March 10, 2020 By Matt Bacon

Yesterday was a record day in the markets as oil prices fell nearly 30% amidst another day of extreme volatility. On Sunday, March 8th an alliance on oil output between Saudi Arabia and Russia collapsed. The two oil- dependent economies had been restraining supply since 2017 to prop up prices. Russia’s refusal this weekend to maintain production cuts sparked a sharp rebuke from Saudi Arabia, who slashed prices and signaled a ramp up in production beginning in April. Saudi’s move amounts to a price war. Crude had its biggest single day drop yesterday since the first gulf war in 1991.

The gambit by Saudi has two goals: 1) protect current market share and 2) force Russia back to the bargaining table. Crude will likely spike if Saudi can get Russia to agree to more cuts, which would provide global markets with a nice bump northward. However, this isn’t likely to happen overnight. If the strategy works it will be a victory through attrition, as Saudi hopes to bleed Russia into a deal.

This comes at a particularly unfortunate time. The Coronavirus is likely to cause global oil demand to shrink for the first time since 2009. Markets moved sharply lower yesterday with the Dow finishing just over 7% down from its Friday close, making it one of the worst days since the 2008 financial

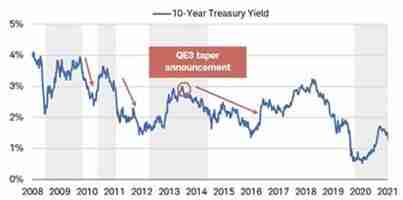

crisis. Meanwhile, treasury yields set record lows as investors flocked to safe haven assets. The entire US yield curve plunged below 1% for the first time in history yesterday. This comes less than a week after an emergency 50 basis point interest rate cut by the Fed.

What will the next few weeks hold? It’s likely to be more volatility before the market bottoms out. We’ll see consolidation in the energy industry as some of the smaller producers with weaker balance sheets get shaken out from the price war. There is a good chance that we’ll see the economy contract in the second quarter as production suffers on Coronavirus quarantine efforts. Indeed, the market appears eager to price in a recession despite record low unemployment, rising wages, and broad job growth in the US economy.

It’s important to keep sight of the cyclical nature of yesterday’s bad news. We’re coming to an end of winter and approaching warmer weather, which is expected to have a significant impact in slowing the spread of the virus. Infection rates in the southern hemisphere seem to support this theory. Italy struggles but China appears to have already turned the tide. Reports of new infections in the country are down significantly, and no new infections are being reported outside of the Hubei province epicenter.

Chinese government figures are understandably unreliable, but pollution reports appear to back this up with a noticeable increase in factory smog. People are going back to work. Factor in several months of pain in the global energy markets and a Russian/Saudi deal could be reached in the months ahead.

Positive news on either of these fronts should send the market higher, but we’re unlikely to see it in the coming weeks. In the interim it’s likely that the global central banks will continue to offer/introduce stimulus. In addition, other government plans could be offered to help businesses and individuals get through this period. We expect a bumpy ride with some good buying opportunities along the way.

Buckle up!