Matt Bacon

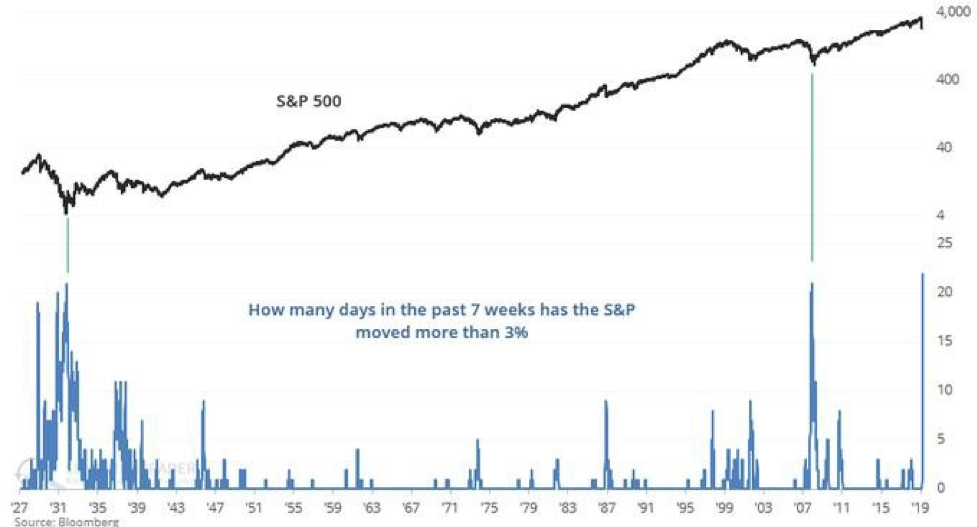

The S&P 500 is up nearly 10% this week and has regained about 50% of its decline in just eleven trading days. This makes it one of the fastest rallies in history. The stock market is rallying while most every business in America has either shut its doors or scaled back operations significantly. If you read that and thought “this doesn’t make sense,” you’re on the right track. Volatility records are being SHATTERED: 22 days in the past 7 weeks have seen the S&P move more than +/- 3%. The previous records were in Oct 1932 and Nov 2008.

The reasons for the rally include:

- Fauci, the Director of the National Institute of Allergy and Infectious Diseases, stated that New York is likely seeing the flattening of the curve in its Coronavirus infections, hospitalizations, and deaths. There is some hope that the U.S. is in the peak area for infections.

- We have seen greenshoots from the healthcare sector on improved accurate testing, alternative treatments (plasma) and vaccines, all of which could lessen the impact of the

- Oil has been in freefall the past month but recently stabilized and rallied on hopes of an OPEC+ deal to reduce supply.

- Unprecedented global stimulus from the U.S. and other major

Technical indicators suggest that we are in the middle of what’s known as a relief rally, which is a reprieve from selling pressure that lifts securities prices. Recent actions by the Federal Reserve and governmental responses to slowing the pandemic have been well received by Wall Street. Round one of the bear market has passed but it remains to be seen just how investors will quantify and price the economic fallout expected from COVID-19.

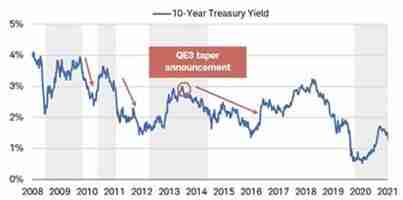

The Federal Reserve (the Fed) announced a bevy of new moves today that will inject up to another $2.3 trillion into businesses and revenue-pinched local governments. Chief among these is a plan to include high yield (junk) bonds in its bond purchasing program. Globally, this puts us at the head of the pack in terms of how much money we’re prepared to pump out. The chart above is telling but doesn’t include today’s announcement.

Stimulus works, but it takes time. What we’re seeing play out now is a tug-of-war between Fed and Treasury/Government stimulus measures and the economic reality brought about by the Coronavirus. In the near-term, the stimulus is likely to provide a floor for the market. If there is money flowing through an economy, be it from economic activity or stimulus, the market will only be able to sink so low. Determining where the low should be is challenging.

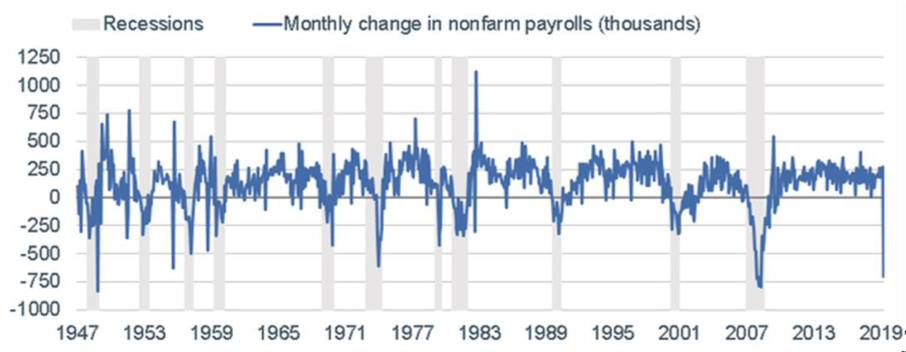

When initial unemployment claims were released on March 26, it was reported that 3.3 million Americans filed for unemployment insurance. Last week topped that in a significant way, with an additional 6.6 million filers. That brought the two-week total to nearly 10 million workers having lost their jobs. You can see how unprecedented this is in the chart below.

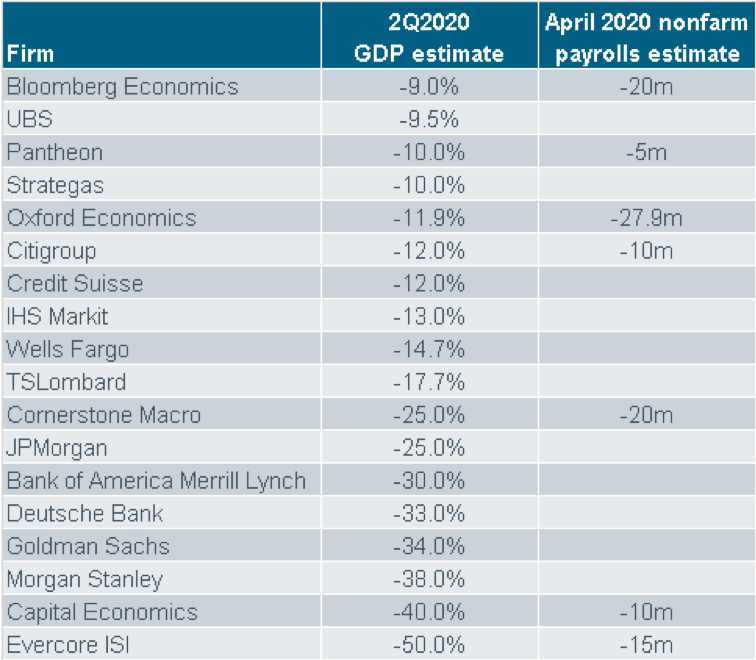

Forecasts from leading analysts on the upcoming state of the economy diverge by more than 40% for the 2nd quarter. An economic contraction of 50%, the most bearish on the list, would be the single worst quarter in history.

Herein lies the struggle: is the tsunami of stimulus enough or is the Coronavirus economic damage going to outweigh it? We don’t have a clear answer. We don’t think anyone else does either. We will have to wait and see if the economic damage of the shutdown is structural and lasting or merely temporal. The historic stimulus should ultimately prevail, but the path to recovery is highly uncertain. In all, we’re not yet out of the woods.

History suggests the market should retest its March lows in the coming weeks/months before we can count a rally as a recovery. We recommend you stay the course, stick to your plan and portfolio allocation target, and rebalance as and where appropriate. As always, we’re here to help.