By Matt Bacon – August 12th, 2020

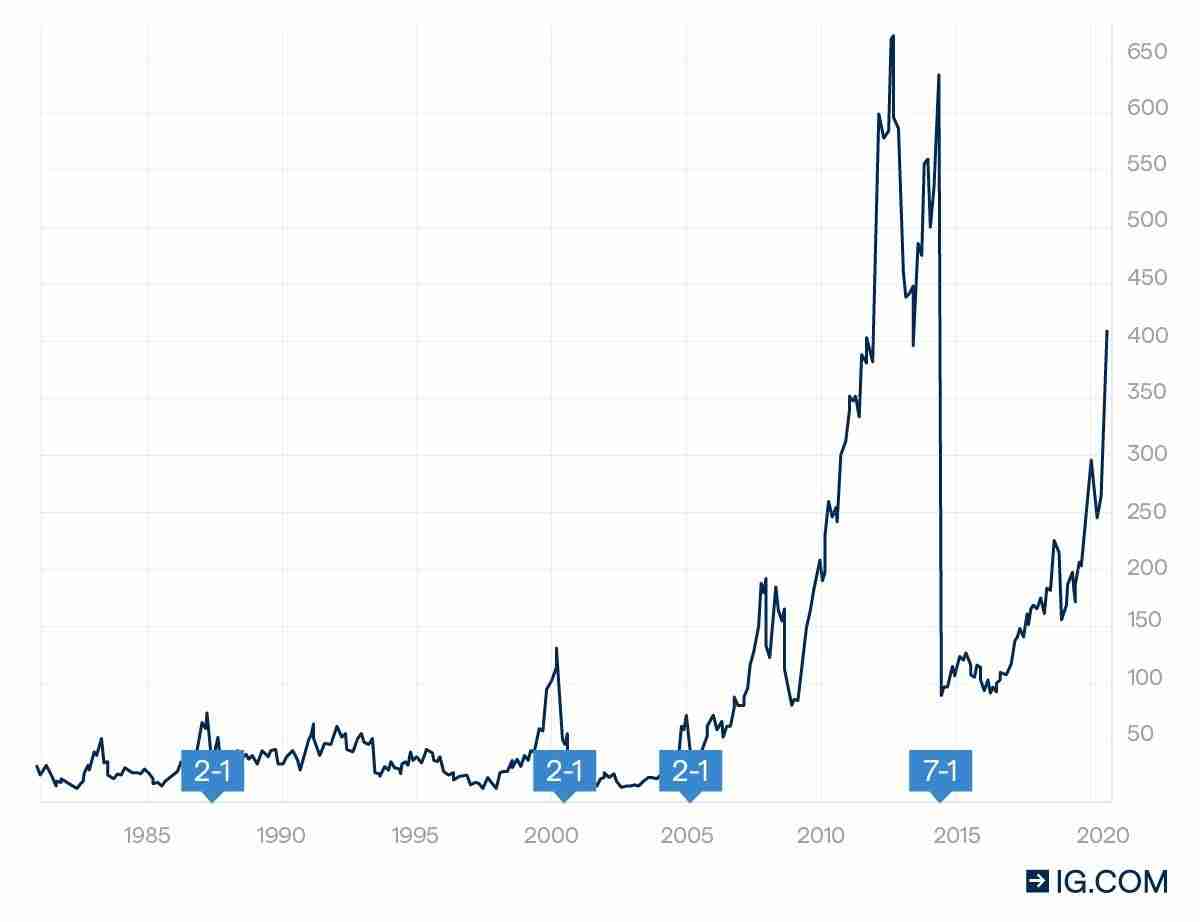

On July 30th, Apple (AAPL) announced a four for one stock split effective 8/31/20. Tesla (TSLA) followed suit a week and a half later with the announcement of a five for one stock split also effective 8/31/20. The intrinsic value of Apple and Tesla won’t change one iota following the splits, but these announcements are still generating quite a lot of buzz. Tesla has never split, while the last time Apple completed a split was in 2014.

A stock split is simply share price manipulation. Nothing fundamentally changes about the company. In the case of a split the price comes down. A reverse split? The stock price goes up. Companies engaging in stock splits frequently tout a rationale about small investors who want to own a few shares but can’t afford the current high price tag. Following a split these people theoretically rush to the stock, which would drive up the price and create value for shareholders. Academic research doesn’t seem to support this, but it doesn’t stop reputable news outlets from propagating the theory.

So why would Apple, with its trillion+ valuation, bother to engage in something like a stock split? Why would Tesla? In Apple’s case we think it has a lot to do with the Dow Jones Industrial Average, colloquially “The Dow”, and historical norms.

Splits are largely a thing of the past. Prior to the rise of technologically robust trading platforms, investors paid commissions on stock trades. Buying ‘round lots’ of 100 shares helped control cost. Buying an ‘odd lot’ amount increased commissions, making it more expensive to trade. Companies manipulated their share price believing it would add marketability to their stock if it were more affordable and could be more easily purchased in round lots, though again the research doesn’t back it up. However, this advantage has disappeared with all major US brokerage houses now offering zero commission stock trading. Compounding this is the rise of fractional share investing. Does it matter how much a share of Apple costs if I can purchase a sliver of it for $20?

The benefit to Apple is about their inclusion in the Dow. Unlike the S&P 500, which is an index, the Dow is an average. The two are often tossed about though they are of the same cloth, but the difference is important. On July 31st, when Apple made the split announcement, it accounted for 3,271 of the Dow’s 26,428 points. Had the split been completed that day, it would have accounted for 788 points. This would have dropped the value of the Dow by about 2,500 points were it not for something known as the “Dow Divisor”, which is a divisor fabricated to keep the index value the same following stock splits and dividend payments. This means that the ~2,500 points Apple “lost” would really just be redistributed amongst the index’ 29 other constituents. In effect, the stock split is reducing the impact Apple has on the Dow.

Does this make sense? Not really. Apple is a gigantic company. If it starts hemorrhaging money at some point in the future it won’t be reflected well in the Dow. Why? Because it’s a price-weighted average. Ignoring market cap means that a smaller company that sees a sharp rise in share price may have more of an impact on the index than Apple, even though Apple may be several orders of magnitude larger! Imagine McDonald’s shares soaring as hamburger consumption doubles in the US. Even though Apple is more than twelve times larger, McDonald’s could have a bigger impact on the Dow due to the price averaging methodology.

Cue the comments about the irrelevance of the Dow. Investors have known it for a long time. There is nearly $4.5 trillion tied to the S&P index and about $28bn tied to the Dow. It doesn’t change the fact that the Dow is still one of the most widely reported metrics of how “the market” is doing on the whole. I manage money for a living and am guilty of falling back on this as well. I can’t help but to reference the Dow when someone asks me how the market is doing. Call it hubris, but perhaps this is why Apple wants to keep its inclusion in the Dow.

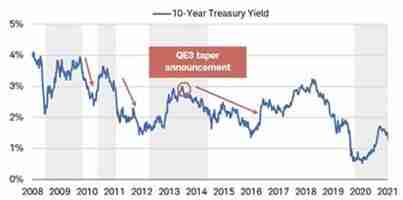

A committee at the S&P Dow Jones Indices company, which maintains and licenses both the Dow average and S&P 500 index, prefer to keep companies in the Dow that trade at similar price levels. The exact criteria for inclusion isn’t publicly disclosed, but its price-weighted methodology has a lot to say about who is in or out. (Note that neither Google nor Amazon, each currently trading at $1,000+/share prices, are Dow components despite their trillion dollar valuations). History comes into play here. Apple last completed a stock split in 2014 when they were trading around $800/share. Then it was a 7 for 1 split. They were added to the Dow the following year.

History of Apple share price during stock splits.

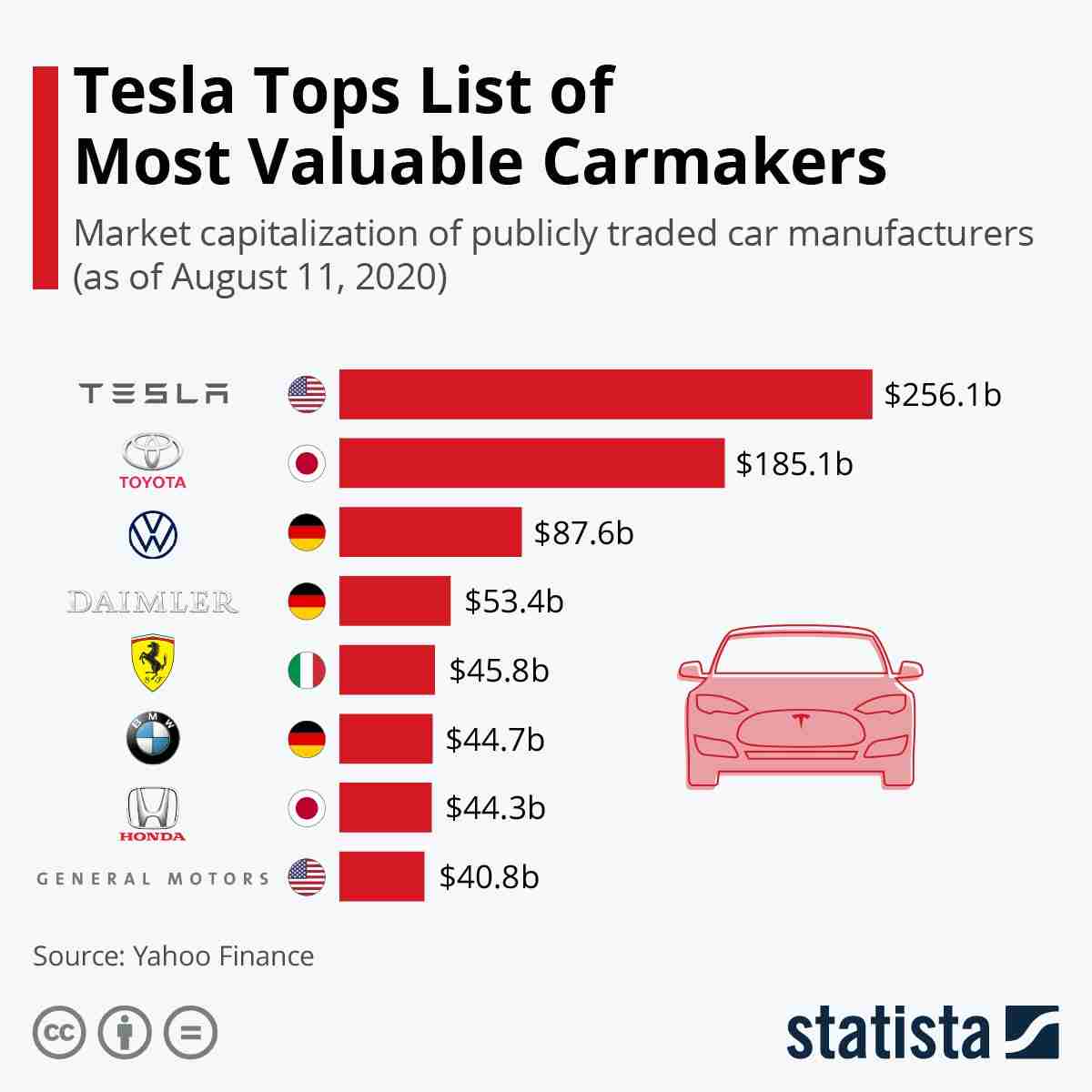

Tesla is a different animal. They have never completed a stock split and are not currently in the Dow. Whether or not the move is designed to get them in, or in Apple’s case to keep them in, is up for debate. Tesla currently has a market cap of about $270bn, making is larger than Daimler, Ferrari, BMW, Honda, and GM combined. This is extraordinary for many reasons, chief among them that they sell far fewer cars than their competitors. GM, with a market cap of around $40bn, delivered just shy of a half million vehicles in Q2 2020. Tesla delivered about 90,000 over the same period, less than a fifth of what GM was able to deliver. And yet Tesla is worth almost seven GMs.

Visual breakdown of Tesla’s market cap compared to competitors

Perhaps this is why Tesla isn’t yet in the S&P 500 index. Similar to the Dow, the S&P 500 selection committee doesn’t make their selection criteria public. However, they have stated that there is a minimum profitability level that must be achieved before a company can be included. Tesla hit that profitability benchmark at the end of Q2 2020. If Tesla does get included in the S&P 500, a share price run up would be all be inevitable. There are trillions of dollars in index funds and ETFs linked to that index. Tesla’s inclusion would mean large bulk purchases from passive managers and a surge in demand that would undoubtedly drive up its price.

For now though, Tesla may be looking to baby-step its way to the S&P 500. Inclusion in the Dow, which would unofficially require a lower stock price, would be a good way to start.

In all, Apple and Tesla’s split means very little for the average investor. Both companies were industry powerhouses before the split and will continue to be such after it.