Jim Stewart September 28, 2020

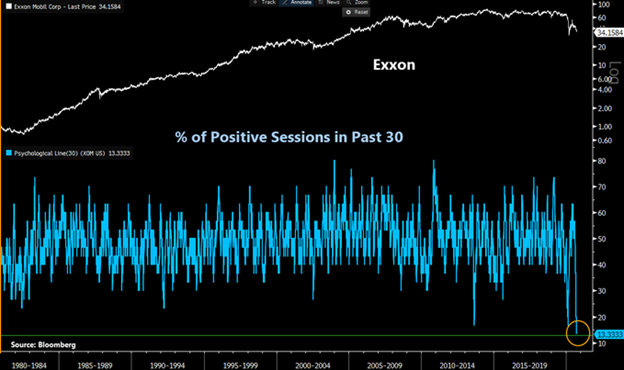

Energy stocks are having a rough time. Just look at Exxon – the last 30 days have been one of its worst in the past 40 years. With the stock’s price decline, Exxon’s dividend yield is now over 10%. This is attractive in the current low yield environment if its sustainable. Unfortunately, we don’t believe it is longer term. It will most likely be reduced in the coming quarters. According to analysts’ forecasts Exxon does not generate sufficient free cash flow to pay its dividend. This means they will need to finance the difference which is only a short-term stopgap. Kind of like holding your breath under water, you can only do it for so long.

Other energy stocks performed poorly last week as well. The S&P 500 Energy Sector Index declined by almost 9% and the Alerian Midstream Energy Index fell by almost 6%. Below are the main reasons why in our opinion.

California Ban of gasoline powered vehicles by 2035

California Governor Gavin Newsom issued an executive order banning the sale of new gasoline-powered cars and pickup trucks by 2035 in his state. Since California is pushing ahead with Electronic Vehicles, it’s safe to say that this will impact the longer-term trends of US gasoline consumption. Right now, California consumes about 14 billion gallons of gasoline (2019 according to the EIA). This equates to slightly less than 1 million barrels per day or 1% of global oil demand. As 2035 approaches, gallons of gasoline will be replaced by kilowatt hours of electricity as the energy source for the transportation sector in California. As other states adopt these same mandates you will see the US consume less gasoline. It’s difficult to project how this will play out. The California Solar & Storage Associations estimates that electricity demand could grow by 25% by 2035 with oil demand dropping off. Currently, the State of California lacks sufficient electricity to maintain reliability. California suffered from rolling blackouts this summer due to high levels of demand during heat waves. To fix this situation and prepare for future demand, a significant amount of renewable and power infrastructure will be needed. This could potentially delay the conversion.

Permian Basin pipeline overcapacity

The WSJ is reporting excess pipeline capacity in the Permian Basin. The story highlighted pipeline capacity transporting oil from the Permian could reach 8.3 million barrels per day while the current Covid-19 induced Permian oil production is around 4 million barrels per day. This points to excess pipeline capacity that could pressure transportation rates and cash flows of several large energy pipeline companies. The Permian Basin is unique as it is considered the world’s best short cycle basin. This means that once shuttered it takes very little time to restart production. This is an advantage over longer cycle projects like offshore drilling. This also makes it difficult to make accurate long-term projections. We expect that if oil demand growth and/or Permian production growth do not materialize, then existing pipelines could be repurposed to transport other in demand commodities such as natural gas liquids or natural gas.

China’s Pledge to become carbon neutral by 2060

China’s President Xi pledged to become carbon neutral by 2060. China is by far the world’s largest carbon dioxide emitter generating more carbon dioxide than the U.S. and Europe combined. After peaking in 2007, the U.S. and Europe have reduced carbon dioxide emissions by 16% and 18%, respectively according to the BP Statistical Review. China’s path toward to lower emissions will likely follow the U.S. and Europe which means replacing coal that generates 58% of China’s current energy supply with natural gas and renewables.

Energy stocks are the worst performing group in the S&P 500 and are down roughly 48% for the year. Until there is a healthcare solution to the pandemic, energy usage is going to recover in line with the economy meaning uneven and slow. While we don’t expect oil prices to go down substantially from the current $40/barrel price, energy share prices will only recover with industry consolidation and a higher price per barrel. This past week provided a few data points that suggest it may take longer than most investors realize.