Jim Stewart October 7, 2020

The news of President Trump and the First Lady contracting COVID-19 late last week along with members of his staff reminded me of the term “October Surprise,” which was coined during Ronald Reagan’s 1980 campaign regarding the Iranian hostage crisis. 2020 has been one for the record books with unprecedented events and sharp market gyrations. When I decided to write this piece on election years and market performance it was hard to know where to start. I decided to use historical data to form a baseline view, but we live in uncertain times. The global pandemic, government induced recession, on again/off again stimulus talks, and now the president’s diagnosis are just a few things that make this year so unquestionably different from any other election year in modern history.

Two of the most frequently asked questions about the election and markets that I field are around a Democratic sweep or a contested election. Your political calculus is about as good as mine; I don’t know what’s going to come to fruition. I do believe that a Democratic sweep could have some significant policy changes around taxes, environment, healthcare, and foreign policy. The most important of these to the market is probably taxes. With such a fragile recovery, I have a hard time believing tax rates would jump right out of the gate. A change in the second half of a Biden presidency seems more likely. Initially, I think a large stimulus bill could be passed which would be market friendly. The tax bill comes due later in 2022-2023.

With regards to a contested election, I personally believe we will see a peaceful transfer of power. However, it may take several weeks to figure it out. The “hanging chads” incident from the 2000 Bush v. Gore election comes to mind. Market volatility spiked then. It may spike again, but we’re already seeing unusually high levels of volatility. A contested election may already be priced in.

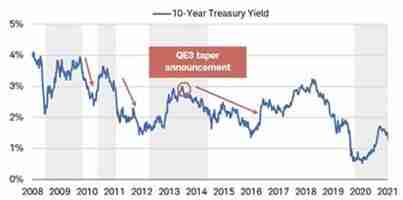

Election years don’t tend to alter the course of markets in meaningful ways, but they do increase volatility. I believe that one of the biggest factors in the recovery year to date is the Federal Reserve. Chairman Powell aggressively cut interest rates and expanded QE, both of which are critical ingredients in staving off the worst impacts of a recession. More fiscal stimulus is needed as well, but the outcome for that is less certain due to Congressional gridlock.

A Historical Perspective

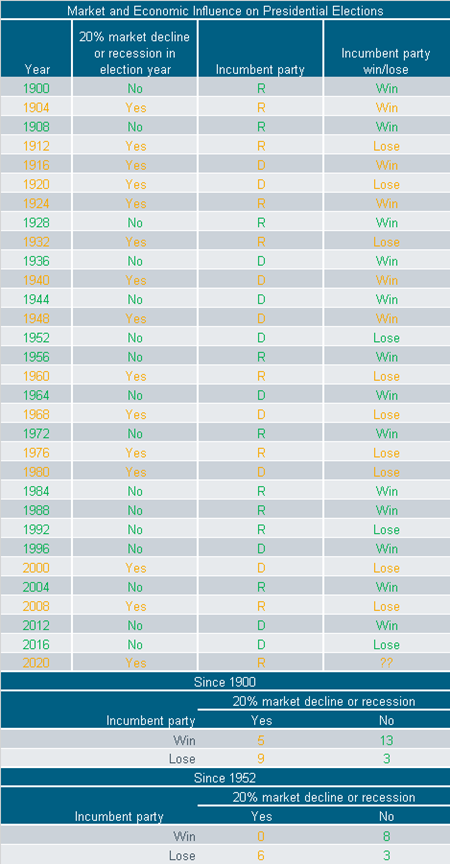

So, who does history say will win the election? In looking at the chart below, it’s clear that the economy and market performance play important parts. We’ve seen fourteen election years since 1900 with a 20%+ stock market decline or economic recession. The incumbent lost nine of the fourteen elections. If we look more recently since 1952, we find that the incumbent has lost all six of the elections in which a bear market or recession occurred.

What happens in a healthy market? The incumbent wins. Of the sixteen elections we’ve had in good economic times, the incumbent won thirteen of them.

Source: Charles Schwab, ©Copyright 2020 Ned Davis Research, Inc. For illustrative purposes only. Past performance is no guarantee of future results.

2020 is a bear market year. In March, the S&P 500 fell more than 30% from its earlier February high. Quick action from the Fed and Congress rescued markets and in September we set new all-time highs. This, however, was amidst the backdrop of an economy with near double digit unemployment. Unlike other election years, the market and the economy seem to be almost divorced of one another. It’s hard to prognosticate on how voters will view this when they head to the polls and history may not be our best guide. Go vote!