Matt Bacon April 14, 2021

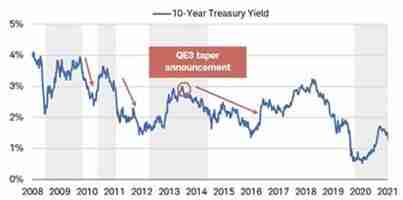

The US is experiencing a hot housing market and the DC area is no exception. Chances are you’ve probably lost an over the asking price bid or two if you’ve been a house hunter the last few months. But signs are starting to suggest that the market may be heading towards a pause. Data from The National Association of Realtors shows that existing home sales are down. So are new home starts (new homes being constructed). The average 30-year fixed mortgage rate is also starting to tick back up as US treasury yields rise.

These facts aren’t an endorsement to buy. Every situation is different. But there are a few things you should consider if you’re looking to make a move soon in what is arguably one of the tightest housing markets in decades.

Housing Inventory Matters

Housing inventory generally confirms a buyers’ or sellers’ market. More inventory is good for buyers – more homes to choose from and more sellers looking to court business. Home prices generally fall as inventory increases. The opposite holds true when inventory is low. Home prices can spiral upwards quickly. Its basic supply and demand in action.

Inventory is typically given in months’ supply, which is the length of time it would take all currently available homes to sell given the current pace of sales. A balanced market is generally 4-6 months’ worth of supply. Less than that and you enter a sellers’ market. More than that and it’s a buyers’ market.

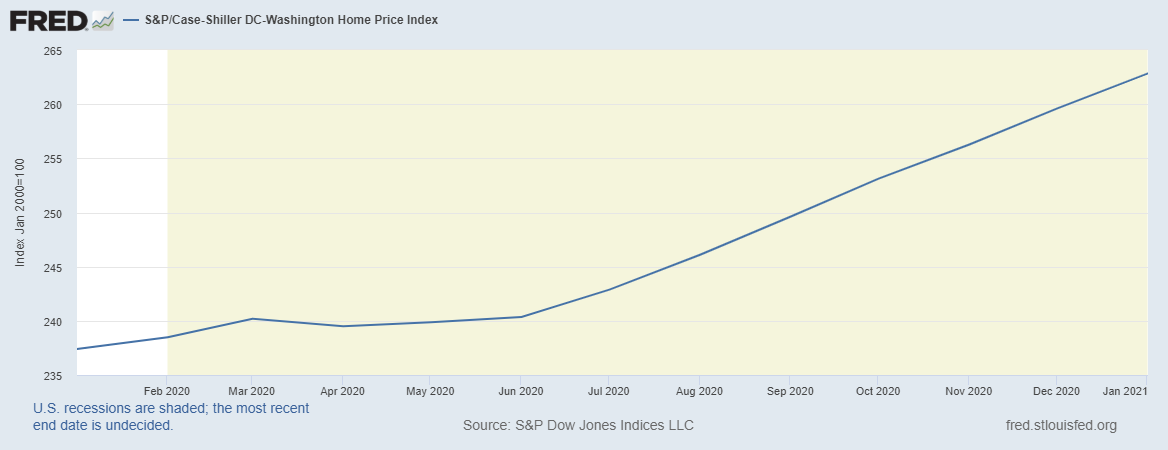

In DC proper there were 2.0 months of supply available in February. Compare this to 1.5 months in Arlington and 0.9 months in Montgomery County and you get a picture of a scorching market. The Montgomery County figure is 52% lower y-o-y according to data compiled by Long and Foster. Further data from the St. Louis Fed confirms a hot housing market with home prices in the region up roughly 10.7% in the last twelve months.

Hot or Overheated?

The market gets hot from time to time but it doesn’t always mean its overheated. You may just be catching the front end of the housing boom. So how can you tell? Overheated markets generally have the following characteristics in addition to the low inventory seen in a hot housing market:

- Comparable sales prices are lower, sometime significantly lower, than active listing prices.

- Median sale prices are rising.

- Real estate ads are vanishing.

- Anecdotally, the for-sale signs you see disappear almost as quickly as they appeared.

Boomtown

There isn’t a definitive way to know you’re buying at the start of the next big housing boom or a cyclical hot housing market. But there are a few things that scholars point to as being critical ingredients for growth. For example, a town needs access to a major interstate. This makes it cheaper and easier for businesses to move goods and tourists to come visit. The DMV has both I-95 and I-66. Airports are the next big upgrade following an interstate and the DMV can boast three.

Raw land or underdeveloped land near the city center also makes an impact. The costs of development are lower which makes profit margins wider. It’s the kind of thing that makes a developer’s eyes water and allows the city to more easily and cheaply attract investment and new infrastructure. Cities like Austin, TX and Nashville, TN are good examples of this.

Favorable business climates and nearby universities are another good proxy of whether your city is primed for future growth. Large employers enjoy business-friendly local governments and are willing to locate large campuses in those environments. This provides the city with a relatively stable new tax base to support growing infrastructure needs, such as investments in higher education. Universities provide a constant stream of talented, skilled, and cheap(er) talent every year to feed those large employers. It’s a virtuous cycle and one that generates economic growth.

The DMV offers many of the ingredients needed for sustained economic growth. The fact that the area is the seat of Federal government, arguably the world’s most stable if not erratic employer, also boasts well. By most any measure this is a good area of the country in which to own property. The trick is to ensure you’re making the right purchase when the time comes.

Plan Ahead and Skip the FOMO

Spend some time window shopping before you get serious. Browse through Zillow and Redfin for a few weeks to get the pulse of the market. Head to a few open houses without any expectations and drive through the local neighborhood afterwards. Make sure you know which neighborhoods feed to the good schools. You may not have kids or plan on it any time soon, but this can be a make or break factor for many would-be buyers when you ultimately look to sell.

Remember, price is what you pay. Value is what you get. Having a good sense of the market will help you avoid knee-jerk reactions if you do find a house that you fall in love with. Great potential isn’t the same as great value.

Find a Good Realtor

Knowing the market is a tremendous advantage, but it doesn’t make you an expert. It’s worthwhile to get a pro to help. They may hear about new listings before you do as well as have access private listings. Crucially, they know how to make an offer stand out in a crowded and hot housing market. You may not. Interview a few realtors, collect references, and go with the one that suits you best.

Decide Where to Compromise

Some houses are old. Really old. Archaic appliances and shag carpet may send you running for the door. It shouldn’t. Cosmetic fixes like new carpet and appliances may only cost a few thousand bucks all together. These are easy to change. The same can’t be said for floor plans, house location, and structural issues.

Buying an outdated property, or on a busy street, or adjacent to a commercial area may allow you to get into a neighborhood you couldn’t otherwise afford. But these probably aren’t top of the list for the dream home you always envisioned. That trade-off may be ok and so might others. Just be sure you’re on the same page with your partner before submitting an offer. You may not mind buying a fixer upper that backs up to a gas station under the right circumstances. Does your spouse?

Get Preapproved and Offer a Quick Close

Sellers want to do business with people they know have the means to buy a house. Getting pre-approved from a bank signals that you can secure the necessary financing and makes your offer significantly more likely to be accepted. The last thing a seller wants is for a deal to fall through due to financing issues.

A quick close can help sweeten the deal. Mortgage debt in the US is hitting new highs. There’s a good chance the seller is paying for two homes while their old house sits empty for sale. That’s a strong motivating force to get the property off of their books. Your deal may be the one accepted if you can offer to close faster than the next guy. Sometimes, using a lender that has an established relationship with your realtor can help ensure a quick close.

Get a Pre-inspection

You’ll want to have an inspector look over the home you’re thinking of buying. Structural problems or other major issues could deter you from purchase. The pre-inspection allows you to make an offer that isn’t subject to any kind of inspection contingency while learning of any major issues with the property. In a hot market the seller is unlikely to fix minor problems and an offer subject to inspection stands little chance.

Waive the Other Details

Home offers can get complicated. Simpler is better in a hot market. Consider waiving other contingencies where you can, such as tendering an offer that is subject to selling another home. Talk with your realtor for help crafting the best offer. Some contingencies exist to protect your rights. You need to carefully consider whether its worthwhile to waive these to secure your dream home.

Good Things Come to Those Who Wait

Be patient. Your dream home may not pop up for sale immediately. Or worse, you may see your dream home snatched out from under you in a competitive situation. Don’t fret. It’s better to wait on the sidelines than to buy a house you don’t like or overpay for one you do. Your home is likely the biggest purchase you will ever make. It shouldn’t come with buyer’s remorse.