There is a period that acts as something of a Goldilocks zone in in determining when to do Roth conversions: the interval between the point that you retire and your first required minimum distribution at age 72. Income is generally lower than it was during your working years, withdrawals from pre-tax retirement accounts aren’t mandatory, and living expenses can be pulled from taxable accounts with favorable capital gains rates (potentially 0%)! There are different schools of thought as to where in this zone is best, but it largely comes down to individual preferences and circumstances.

But simply being in the prime time for conversions doesn’t make it a slam dunk. There are plenty of complicating factors such as hidden tax traps, increased healthcare costs, and even your children’s tax brackets. Here’s how to plan for this, why, and what to look out for along the way.

Tax Normalization

Tax Normalization is the process of accelerating income from high-income years into low-income years to smooth the tax hit you’ll take over time. A Roth conversion is usually the most popular way to do this but there are multiple methods.

Say you retire at age 63 with money in a Roth IRA, a pre-tax 401k, and a taxable brokerage account. The money in your pre-tax account will be treated just like income from a job for tax purposes, which means you may be disinclined to take withdrawals. Maintaining the tax-free compounding in your Roth IRA may keep you from withdrawing from that account, too. But your taxable account? That’s attractive. That qualifies for favorable capital gains rates, which start at 0% if you can keep your income below $41,675 in 2022 (or double that if you’re married). Even if you can’t, the next bracket is a mere 15%.

At 63, you have another nine years before distributions must be made from that pre-tax 401k at age 72. The size of your 401k will double if you’re able to average a 7% return over that period. Your first Required Minimum Distribution (RMD) will double as well if you don’t take any distributions along the way. (Note – Roth 401ks also have required minimum distributions, though they are not taxable. Only Roth IRAs are exempt from required minimum distributions).

That could be painful. RMDs are calculated using a standardized table based on your age. Your first one will be a little shy of $40,000 for every million dollars you have saved. Even if you don’t change your spending pre and post age 72, the fact that you are now required to recognize so much extra income can push you into a higher bracket.

Tax normalization can remedy this when doing a roth conversion.

Leveraging tax brackets

You can opt to accelerate income into your low earning years through Roth conversions to balance out what would otherwise be a whopping RMD at 72.

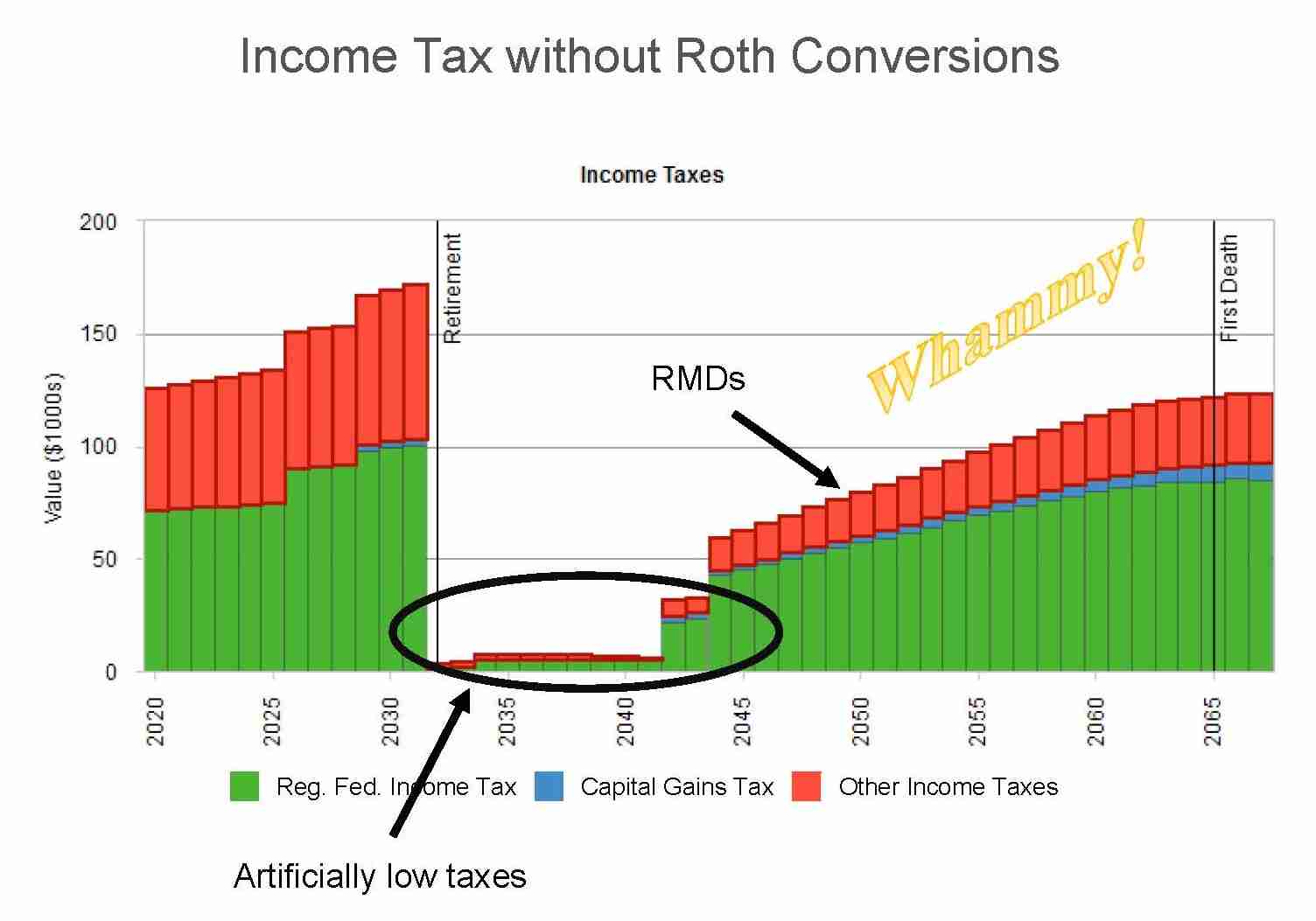

Notice how low taxes are between retirement and RMDs? Dividends, interest, and some small capital gains from rebalancing and/or liquidating low-basis holdings may be the only income you’re required to recognize following retirement. There is a slight bump up at age 70 when social security begins, but the real tax bite comes after when RMDs are stacked on top. This is like going from 0 to 60mph in just a few seconds.

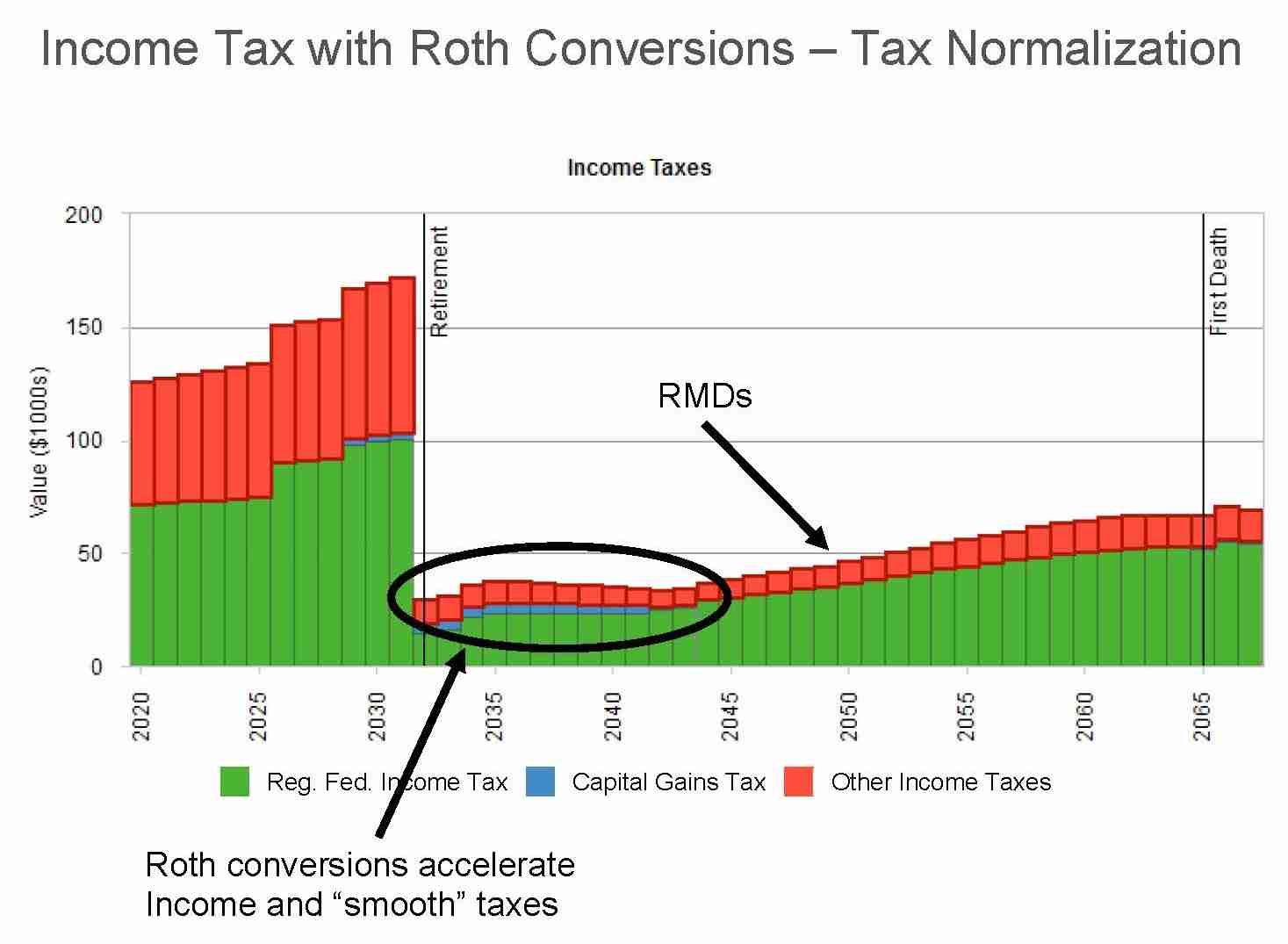

But add in Roth conversions and the picture looks remarkably different.

Notice how your taxes look more, well, normal? That’s tax normalization at work. Performing Roth conversions increases your income during what are otherwise low income years so that the change you see at age 72 is moot. The way we’ve illustrated this shows little variation, but you can get fancy with it.

How much to actually convert

Smoothing adds a nice rhythm and flow to your retirement. Budgeting on a fixed income gets easier and you can avoid most tax traps by doing the same thing year in and year out. But that doesn’t strictly mean it’s optimal. Tax smoothing could bump you into a higher bracket, for example. Or you may have designs to convert large amounts in order to leave a tax-free legacy for your kids and grandkids. It can also make sense to convert additional sums if you have a much younger spouse who could benefit from the additional years of tax-free compounding. Or maybe you just want to max out the “headroom” in your bracket.

While much of this is subjective, planning around tax brackets is quantifiable. Consider a couple who retires with moderate expenses, healthy Federal pensions, savings, and their IRAs. They live on about $6k/month with the mortgage paid off but recognize about $110k/year in combined income due to those pensions. This puts them in the 22% income tax bracket and 15% capital gains bracket while being net savers each month. But their IRAs are expected to be around $2m by the time they hit age 72, which will generate an RMD of a little under $80k. That RMD will only go up over time, too. This will bump them just out of the 22% income tax bracket and into the 24% bracket.

A case study in conversions

This couple is a great candidate for Roth conversions and has two choices ahead of them. The first is to adopt a tax smoothing strategy. They can convert about $50k each and every year until they hit age 72 while staying in the 22% bracket. This will moderate their RMD and keep them in the 22% bracket until their early 80s, when the RMD withdrawal factor gets so large that it bumps them into the next bracket regardless of the conversions. In some cases, smoothing may be enough to keep you from ever entering a higher bracket. In others, it simply pushes back the tax bump to somewhere further down the road.

Or, the couple could decide that the jump from the 22% bracket to the next bracket at 24% isn’t painful. Their kids are doctors and entrepreneurs and in far higher brackets, which makes any conversions the couple does during their lifetimes even more impactful. They decide to embark on a program of substantial Roth conversions with the intent of leaving a legacy. Their $110k of income can go as high as about $329k before they move out of the 24% bracket. They elect to convert $200k/year every year until their IRAs are fully converted.

But this has some extra hurdles to implementation as well as some unintended consequences.

How to pay the tax?

The couple in the example above will have a hefty tax bill on that $200k converted. They are fortunate to have pensions that pay more than they need to cover their bills, but that isn’t going to be enough cash flow for a conversion of that size. So, from where should they pull the money to cover taxes?

The best answer is generally cash savings, but this isn’t realistic in this example or in any situation where Roth conversions are substantial. They’re looking at a tax bill of $200k x 24% = $48k for every conversion. Three to four conversions at this level requires a cash pile of $150k-$200k. That’s more cash than most advisors would recommend the average couple keep on hand.

Taxable brokerage accounts are the next best place to draw from when cash is insufficient. Long-term capital gains rates are more favorable than income tax rates and come in at either 0%, 15%, or 20% depending on total income earned for the year. The couple in this example above will be in the 15% capital gains bracket for either Roth conversion strategy outlined.

Investments in these accounts can be sold to pay tax from the Roth conversion, though these sales will also trigger tax. Not to worry though – this doesn’t lead to a never ending upward spiral of tax upon tax upon tax. Liquidate enough to cover the conversion, then liquidate slightly more to cover the extra tax due.

Here’s the equation to calculate precisely how much to sell from your taxable account to cover Roth taxes:

Est Roth Taxes = (X*Share Price) – (Share Price – Basis per share)*Est Capital Gains Rate

Where X = the number of shares to sell

Pay close attention to your asset allocation

Its best to liquidate from high basis holdings in your taxable accounts first when trying to minimize your tax hit. This usually means selling bonds. Liquidating bonds means that stocks will become a greater share of your portfolio by default. This may not be much of an issue if you’re doing small conversions. But large ones can move the needle substantially.

Increased equity exposure means increased volatility in your portfolio, which can wreak havoc for retirees. You need to be careful to make changes in other accounts, such as your pre-tax accounts or Roth accounts, to offset the increasing equity allocation in your taxable accounts. But this isn’t foolproof either.

Remember the couple from the example above? They are trying to convert the full balance of their IRAs to Roth IRAs. The best assets to hold in Roth IRAs are high-growth assets due to the tax-free compounding that taxes place in that vehicle. But if you convert all of your pre-tax money you may not have any choice but to hold bonds in your Roth IRA. There’s just nowhere else to put them!

Roth IRAs have no RMD

The bond problem can be ameliorated over time. If you’re able to convert your full pre-tax balance or enough of it to substantially reduce your RMD, then you may be in a low enough bracket during your 70s that systematic rebalancing in your taxable account has minimal tax consequences. This is in part due to the fact that Roth IRAs have no required minimum distributions! Whatever goes in can stay in.

Your income could be just social security, pensions, and whatever you pull from your taxable account. If your living expenses are small enough you may be able to stay in the 0% capital gains bracket, which would give you some headroom to liquidate stocks in your taxable account with little to no tax consequence. You could use the stock proceeds to buy bonds and rebalance your taxable account. Even with a minimal 15% capital gains bracket it still makes sense to do.

You can then make a mirrored change in your Roth. Sell the same amount of bonds to what you just purchased in the taxable account and use the proceeds to buy stocks. Your overall allocation doesn’t change with this two-step maneuver. You still have the same proportion of stocks to bonds in your portfolio, but you’ve managed to move a greater portion of those stocks to your Roth IRA for the tax-free compounding!

Your intent should guide your decisions

A word of caution here – its always best to begin with the end in mind. If your reason for Roth conversions is to leave an inheritance, then it may be best to leave your taxable account alone and keep those bonds in your Roth IRA. The taxable account will receive a step up in basis at your death. This effectively eliminates any capital gains taxes due when it passes to the next generation.

If your kids liquidate your accounts immediately or almost immediately after your passing, then there won’t be a difference between the Roth and the taxable account in their eyes. Both pass income-tax free! If a quick liquidation is the likely case, then why bother with rebalancing between those accounts during your lifetime? All that’s likely to do is trigger capital gains tax on your behalf. You’d be better off keeping bonds in your Roth, not touching your taxable account, and letting both ride until the end. Your kids receive both income tax-free (or nearly tax free) and you don’t get dinged with capital gains during your lifetime, either!

Its only if your kids are able to hold onto the Roth for another decade that they’ll see a difference from any rebalancing moves you make. This is because that Roth can continue to grow and compound for up to ten years tax free before they’re required to take any distributions. This makes it advantageous to leave as large a Roth account at your passing as possible, which is going to require equities. A $1.5m Roth that doubles over the next decade will yield an extra $1m tax free over an account that starts with $1m.

Your children’s decisions matter

Yes, your kids could just liquidate the taxable account only at your passing and let the Roth IRA grow. That’s a good middle ground. You don’t rebalance the taxable account during your lifetime and avoid the capital gains, then avoid capital gains again at your death, and let your kids reallocate the Roth at the time the inherit to make it very aggressive. That’s not bad, but its still likely to leave them with a smaller Roth balance than if you had made trades and moved bonds out of the Roth over your lifetime.

Your kids will need strong incomes and financial discipline not to touch the Roth. If you don’t have confidence in them not to take the money and run, then leaving bonds in your Roth and avoiding capital gains during your lifetime may be the smarter move.

This makes communication paramount. A well-executed Roth conversion strategy takes years, ongoing commitment, and a big financial outlay on your part. Will your kids understand the lengths you went through if you don’t communicate it to them? You don’t need to jump into the nitty-gritty of account values and tax dollars paid but letting them know the broad strokes of what you’re doing and why could be helpful here. Your kids don’t know what they don’t know!

Should you withhold tax from the converted amounts?

It’s perfectly legal to withhold taxes from converted amounts. But you shouldn’t. Withholding reduces the amount you can sock away in this shelter with tax-free growth. If you’re in a 22% marginal bracket and withhold taxes, then just $0.78 of every dollar converted actually makes it into the Roth IRA. That account will need to earn a 28% return to get back to where it was before you did the withholding. That may take years.

Moreover, Congress eliminated Roth recharacterizations with the Tax Cuts and Jobs Act of 2017. This allowed you to undo a Roth conversion and recharacterize it back to a traditional IRA if you got cold feet. The feature was a godsend to hedge against unlucky timing.

You’d have a $78,000 if you converted $100,000 in a 22% marginal bracket and did full tax withholding. Your account would dip to a little over $62,000 If the market crashed the day after you converted and slid 20%. This marks a full 38% slide on your original $100,000. You’d be able to recharacterize and take that ~$62,000 up to $84,000 under the old rules (add back your withholding). Under the current rules you’d be forced to stay at $62,000.

It’s better to keep your Roth intact and pay taxes from another account. And yes, bad markets would send those other accounts sliding downward as well. But taxable brokerage accounts fall under the more favorable capital gains rates. Liquidating from there would cost you 15% if you’re in the 22% Federal income tax bracket. That extra 7% could be big.

Pro tip: remember to pay estimated taxes quarterly. Failure to do so could result in late payment penalties. This means sending a big chunk to the IRS in the quarter you complete your conversion.

Best practices if you do withhold

Withholding tax from the Roth conversion can still make sense under certain circumstances if you don’t have the funds in an outside account from which to pay taxes. We went through an example above that included withholding taxes at your marginal tax rate. That’s perfectly fine. In fact it’s the best strategy if you prefer to be safe instead of sorry. But you’re generally better off withholding at your effective tax rate.

Why? Because money withheld can’t be put back in later. Once its out, its out. You’ll just get a tax refund if you end up withholding too much. And there is no current provision under law that allows you to contribute part of your tax refund back to an IRA, be it Roth or Traditional. Every extra dollar withheld is therefore a dollar that won’t compound tax free in a Roth IRA.

Remember, conversions are done on a calendar year basis but taxes aren’t paid until April (or October with extensions) of the following year. You could convert in December and do some light withholding, realize in January that you didn’t withhold enough to cover taxes, and take a subsequent distribution from your pre-tax account to cover the shortfall. This distribution itself will also be taxed and must be paid in the following year, but it keeps as much money as possible in your Roth IRA.

The unintended consequences of a well-meaning conversion

Income taxes and capital gains taxes tend to dominate the discussion around conversions, but these aren’t the only factors in the mix. Medicare premiums, Affordable Care Act subsidies, and the Net Investment Income Surtax all come into the mix as well when you begin your Roth conversions. This adds a migraine-inducing level of complexity to your retirement years.

Medicare is impacted by your conversions, too

Medicare has four parts: A, B, C, and D. Part A covers hospital insurance and is premium free. Part C has been rebranded as Medicare Advantage and is the privately insured arm of Medicare. But part B covering physicians expenses and part D covering prescription drugs are both means tested. Converting significant amounts doesn’t just drive you into new tax brackets, it also impacts your healthcare costs.

Lets revisit the example we had above with the couple making $110k in retirement that was choosing between conversions at $50k/year or $200k/year. Sticking with the lower end would recognize $160k of income for the year.

This wouldn’t change their part B premium. But converting $200k would bump them from $170.10/month to $442.30/month in part B premiums! It’s a similar story for their Part D premiums, which would jump by an extra $51.70/month when converting the $200k.

These upward adjustments in premiums are also called IRMAA, or Income Related Monthly Adjustment Amounts.

Those IRMAA amounts work out to an extra $3,900/year on top of the taxes due from the conversion itself! The couple’s only saving grace is the lookback period. Medicare assess premiums based on your income from two years ago. This gives the couple an opportunity to knock out two large consecutive conversions and stop just before their Medicare premiums jump! They’d have increased taxes over the first two years from the conversions followed by increased Medicare premiums beginning in the third year. This makes things easier on their cash flow.

But it works a little differently when completing conversions prior to age 65.

The impact on Affordable Care Act (ACA) Subsidies

The thresholds for Part B and D premiums are far higher than the thresholds for ACA subsidies if you’re buying a standalone policy on an exchange. This is because ACA subsidies are based on Federal Poverty Level (FPL) guidelines, which as you can imagine are quite low. You must be within 100% to 400% of the FPL to qualify for subsidies.

Pro tip: You won’t be able to get an ACA plan if your income slips below 100% of the FPL. That’s because you will be under a state run Medicaid program at that point, which is a healthcare program for the indigent.

The FPL is based on the number of people in your household. This makes it a bit of a moving benchmark. Assuming its just you and your spouse in your household, the 2022 FPL subsidy is available for incomes between $36,620 and $146,480. Any decently sized Roth conversion is likely going to push you out of receiving subsidies. And unlike Medicare, the subsidies are based on your current year income! There is no lookback.

The cost of an ACA plan can be high, and subsidies could be worth tens of thousands of dollars. This can make Roth conversions a non-starter for some under age 65. Others who still have a working spouse or who are above the subsidy level anyway due to excellent retirement income streams may give Roth conversions a harder look.

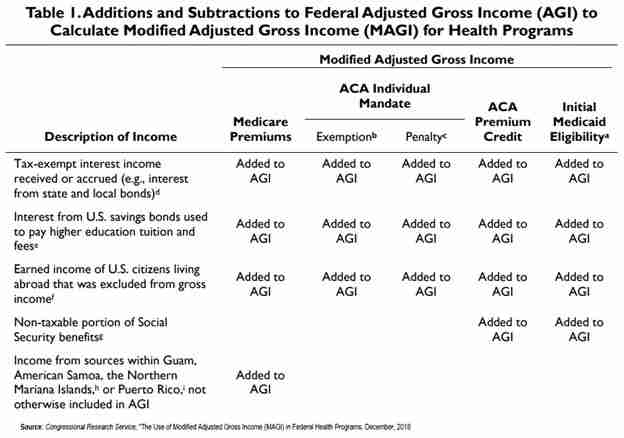

What income is included?

The means-tested Medicare parts B & D and ACA premiums are based on your Modified Adjusted Gross Income, or MAGI for short. This is essentially anything the IRS wants it to be. The term is used in different places in the tax code and the definition of MAGI changes depending on where its used. Somewhat ironically, Roth distributions are one of the few things that don’t get roped back into MAGI when calculating your income for Federal health benefits.

Note the main difference between MAGI definitions for ACA premiums and Medicare: the non-taxable portion of your social security is not included in the Medicare definition. We generally believe its best to wait on claiming your social security, but as part of a Roth conversion strategy it makes a boatload of sense to push this out to at least age 65. Claiming sooner could 1) rule you out of ACA subsidies, 2) reduce your subsidies, or 3) eat up what little room you have for Roth conversions while still remaining subsidy eligible.

The Net Investment Income Tax (NIIT)

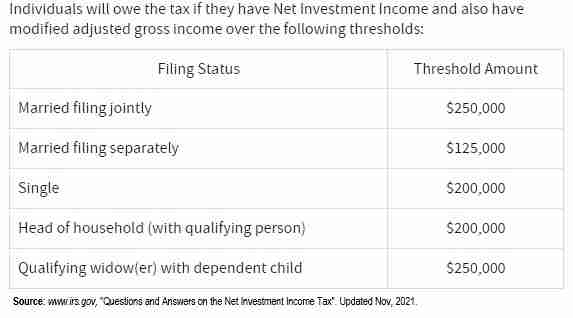

If you’ve decided to bite the bullet on healthcare costs and go for big conversions, then you may get stung with the Net Investment Income Tax (NIIT). This is triggered when you hit $250,000 of income if married or $200,000 if single and tacks on an extra 3.8% tax to investment income. This is important for Roth conversions because you may (read on: will) need to liquidate funds from a taxable brokerage account to pay the tax due on your conversion.

The NIIT threshold is a cliff as well. There is no phase in zone where the tax ratchets up as you near the upper end of the threshold. The difference between $249,999 of income and $250,000 is an extra 3.8%. Full stop.

This means that hefty Roth conversions could take your long-term capital gains tax rate from 15% up to 18.3%. Consider the example we keep coming back to with a couple converting $200k on top of an income that’s already $110,000. They’ll pay an 18.3% tax on anything they liquidate from their brokerage account. They’ll also pay higher Medicare premiums if they are Medicare eligible and will be priced out of ACA subsidies if they’re not.

The cost of a Roth conversion is not linear and its this aspect of it all that makes calculating an optimal conversion amount so challenging!

What’s it all mean for me?

There is a definite sweet spot for Roth conversions that exists in the space between your retirement date and your required beginning date for distributions from your retirement accounts (i.e. age 72). A bonified conversion strategy will look to optimize the amount of income you accelerate into that space in light of the variables we outlined above.

Tax smoothing is certainly attractive, but for many is likely to be suboptimal. The costs to complete Roth conversions jump at different intervals, which means that the amount you convert is likely to jump at different intervals, too. Nothing about conversions moves smoothly along a predestined curve. Creeping up into a higher bracket, be it for Medicare or Federal income taxes, means you‘ll likely convert even more just to max out that bracket.

Those under 65 who are or who can make themselves ACA subsidy eligible should look closely at the tradeoffs between the potential benefits of a Roth and the cost savings provided by subsidies. The ideal amount to convert during these years is likely to be low if anything. Conversions can increase significantly after age 65, especially since the non-taxable portion of your social security doesn’t get roped back into the MAGI when determining Federal health benefits. Whew!

This is complicated stuff at the end of the day and there isn’t ever one strategy that’s a surefire winner. It’s an intricate balancing act between what this is going to cost you today vs. the benefits you or your beneficiaries will recoup down the road. Settle on what’s most important to you first, then think ahead, and plan well to enjoy the rewards that come further down the line.