Social Security was established in 1935 as part of President Roosevelt’s ‘New Deal’. The program provided relief from poverty for tens of thousands of seniors and continues today as one of the nation’s most significant social insurance programs.

About 96% of all Americans are now covered by Social Security according to figures from the Government Accountability Office. But this wasn’t always the case. Benefits weren’t initially available for state or local government employees who were already covered under their own retirement programs (i.e. pensions). This changed in the 1950s when states were allowed to enter into a voluntary agreement with the Social Security Administration to coordinate state and local benefits.

This created a new problem. The original Social Security legislation did not account for workers who had retirement from both a “non-covered” pension (from the previously non-covered state and local governments) and earnings from employers that paid into social security. On paper, low-income workers with just ten years of covered work history looked identical to non-covered employees with ten years of covered work and thirty years of non-covered work.

The was problematic because Social Security was built with wage replacement in mind. Those who pay into it the least get the most as a percentage of wages replaced. So-called ‘double-dipping’ allowed some people to collect a higher wage replacement rate than they were realistically entitled to given all their years of non-covered work. This was both unfair and a drain on taxpayer resources.

Congress fixed this in the early 1980s with the Social Security Windfall Elimination Provision (WEP), which reduces retirement benefits for those who double-dip.

WEP Defined

You need to meet the following conditions to be ensnared with WEP in the first place:

- Worked at a job where you did not pay into social security (e.g. some Federal, state, and local jobs. Educators commonly fit the mold)

- Qualified for a pension from that job where you didn’t pay into social security

- Worked at yet another job where you not only paid into Social Security, but also worked there long enough to qualify for social security benefits.

Your benefits will be reduced if you fit all three conditions above due to the Social Security Windfall Elimination Provision. But this rule impacts a relatively small number of people. As of December 2021, about 2M people were impacted by WEP.

A clean, linear formula that shows the dollar-for-dollar impact of WEP on your Social Security benefit would be incredible. We could post it right here and be done with it. But this is a gigantic Federal program. Nothing is clean, linear, or tidy. We’ll show you how to calculate it if you’re a nerd like us and want to dive deep. Or you can check out this calculator from the SSA that will do the heavy lifting for you.

Calculating your Social Security benefits

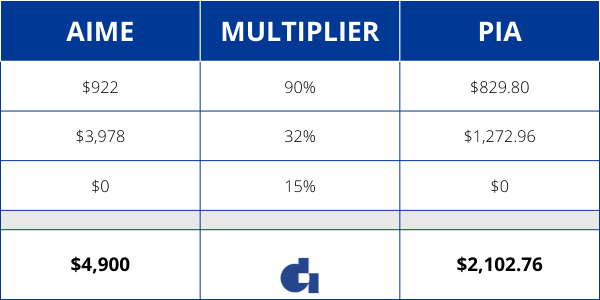

Your retirement benefits are calculated based on your highest 35 years of earnings. Those earnings are adjusted for inflation at your age 60 using the National Average Wage Index. These inflation-adjusted earnings years are then broken down into 12 x 35 = 420 inflation-adjusted earnings months. These months are known as your Average Indexed Monthly Earnings, or AIME for short.

Your AIME will fall into one of three ranges; a 90% replacement rate for low-income workers, a 32% rate for middle-income workers, and 15% rate for high-income workers. The replacement thresholds are separated by “bend points” where the replacement rates are bent downward. (See the cool graph below).

Your AIME amount is multiplied by the replacement rate. The result gives your Primary Insurance Amount (PIA), which is the benefit you would receive at your full retirement age. Take note though that this is bracketed. The first part of AIME is replaced at 90%. The next at 32% and the final at 15%. Your bracket isn’t all or nothing.

For example, say your AIME is $1,900 and we’re using the bend points from the graph above. Your PIA would be calculated as follows:

Applying the Social Security Windfall Elimination Provision to your benefit calculation

Now for the good stuff! WEP reduces the replacement rate of that first AIME tier. What would otherwise be 90% is cut down to as little as 40% for anyone with less than 20 years of earnings history!

But the WEP reduction is a sliding scale. The Social Security Administration built in some mercy. The reduction is lessened if you have more than 20 years of work history outside of a non-covered pension. The penalty is reduced by 5% for every year of “substantial” work between years 21-30. The penalty disappears completely at 30 years.

It helps to see it in context. The penalty is a 50% reduction for anything under 20 years (i.e. 90% – 40% = 50% penalty). Say you work for 23 years in a covered job. You claw back 5% of that penalty for every year worked over 20. That works out to 3 years x 5% = 15% penalty reduction. WEP would therefore cut the AIME replacement rate to 90% – (50%-15%) = 55% for that first AIME tier.

The term “substantial” mentioned above is important. Its not sufficient to wait tables for a single day in years 20+ and call it quits. You need to earn at least a certain minimum amount if you want to work off that WEP penalty. The minimum earnings amount changes every year, but you can find it in the Social Security Windfall Elimination Provision publication.

The Guarantee Rule

There is a rule in place to protect Social Security benefits from a small non-covered pension. The Social Security Administration didn’t want to keep a lifetime of earnings from being materially impacted by a non-covered pension that was never much in the first place. The Guarantee Rule states that a person’s Social Security Benefit cannot be reduced by more than half of their non-covered pension amount.

This is one of those things that’s easier to see and understand through an example.

Example: Jane is 66 and has an AIME of $4,900. She has 20 years of substantial earnings in the private sector as well as a small non-covered pension from her time as a teacher that will provide about $700/month. She will retire this year at her full retirement age with a PIA of $2,105.08.

The WEP penalty will cut her first AIME threshold replacement rate from 90% to 40% because Jane has just twenty years of earnings. This drops her PIA amount to $1,642.08. It’s a difference of $463.

The WEP Guarantee Rule states that Jane’s PIA can’t dip by more than $700 ÷ 2 = $350, or half the non-covered pension amount. Jane’s PIA would therefore dip by $350 to $1,755.08, and not the $1,642.08 as initially calculated.

A note about your statement estimates

Your Social Security estimate doesn’t reflect the WEP calculation. The Social Security Administration isn’t aware of which years, if any, include non-covered earnings. And its because of this that the estimate always reflects the full value of your earnings. It’s not until you go to file for benefits that the impact of WEP will be fully priced in.

Also, you may continue to work after claiming your Social Security retirement benefit. Work in a covered job will help reduce the WEP penalty if you have more than 20 years of covered work. But again, the SSA won’t know how many years you have unless you tell them. You can always request your benefit be recalculated to reflect the lower penalty.

The impact on filing early or late

The short answer is that there isn’t an impact. The Social Security Windfall Elimination Provision is used to determine your PIA. Your PIA is then adjusted up or down based on whether you’re retiring early or late. But this happens after WEP has already been factored in! Its all about the order of operations.

Example: Consider Sue, who has a PIA of $1,463. She has 15 years of covered work and won’t qualify to reduce the WEP penalty. The full WEP reduction is $463, which takes her PIA to $1,000.

Sue will get $1,000/month if she claims at her full retirement age (66). But that WEP-adjusted PIA will be reduced if she claims early. The early filing reduction is 5/9 of 1% for every early month and 5/12 of 1% for the twelve months immediately before her full retirement age. Adding it all up gives…

5/9% x 36 months = 20%

5/12 x 12 months = 5%

…a 25% reduction if she claims on her 62nd birthday. This amounts to $250 of Sue’s WEP-adjusted $1,000 at her full retirement age. Claiming early will give her $750/month.

Impact on Spousal and Family Benefits

Social Security isn’t made up of solely retirement benefits. Spousal benefits, disability benefits, and survivor benefits are also available. These are all based on the worker’s PIA amount. And because WEP impacts that PIA amount, it impacts these other benefits as well!

The calculation for how much a family can receive based on one worker’s earnings record changes depending on whether or not any disability benefits are included. The full calculations are beyond the scope of this article, but the grip of WEP is depressingly tight.

How to avoid WEP

The simple answer is to just keep working. 30 years of covered work will eliminate the WEP penalty and 20+ years will reduce it. But this is easier said than done for many. You may not want to work that long. Medical issues could force a sooner-than-expected retirement. Or given that there are no delayed credits to claiming Social Security after age 70, you may simply decide that its uneconomical to continue accruing time in a covered job.

The lump-sum misnomer

The Social Security Windfall Elimination Provision is based on the idea that you are double-dipping by claiming multiple pension income streams. What if you took the non-covered pension as a lump-sum instead of as an income stream? This would theoretically level the playing field. But the Social Security Administration doesn’t see it quite that way.

Rather, the SSA will use an alternate calculation to determine the WEP penalty when your non-covered pension is rolled as a lump sum. This calculation could reduce the impact of WEP for some but it won’t ever fully eliminate it.

The calculation is used to determine how much you would have received as an income stream based on your age and the date you took the lump sum. It doesn’t matter that the funds come out all at once; the SSA still views it as though you took a normal pension. Most pensions payout over a lifetime. A publicly available table of actuarial values is used to determine how long WEP should be applied in that case.

In some cases the pension will pay over defined period of time, such as ten years. WEP would then be applied solely to that ten year period. But a payout schedule like that isn’t common. And be careful not to confuse that with a 10 year period certain payout option! Period certain still pays over your lifetime. It just does so with a guaranteed minimum number of payments in the event of an early death.

A full lump-sum distribution or rollover could reduce the WEP penalty but only if you live past the expected payout period.

A lump sum pension refund

The only caveat to the above comes when a lump sum distribution of only your contributions happens before you are eligible for the pension in the first place. Then WEP really does become part of a magic vanishing act!

Example: Consider John, who works as a teacher in a non-covered school district from age 25-30. The state, the local school district, and John all contributed to his pension during employment. John never stayed long enough to become eligible for pension benefits. He requests a refund of his pension contributions and the interest they earned.

Josh doesn’t receive any of the money or earnings from the state and school district contributions. The only money he receives is what he put in. He will not be subject to WEP because he did not vest his pension, nor did he receive any employer money.

But the situation would have been different if John worked there longer or if he received the funds his employer set aside. The Social Security Administration has this to say about the matter:

Withdrawals of the employee’s own contributions and interest made before the employee is eligible to receive a pension are not pensions for WEP purposes if the employee forfeits all rights to the pension. This rule applies even if the employer paid the employee contributions.

Withdrawals of the employee’s own contributions and interest made after the employee is eligible to receive a pension are considered a lump-sum pension for WEP purposes.

Any separation payment, withdrawal, or refund consisting of both employer and employee contributions is a pension; for WEP purposes whether made before or after the employee is eligible to receive a pension.

There is a difference between the date you retire and the date you are eligible to claim the pension. Be careful not to confuse them! WEP applies based on when you’re eligible. It is not connected or related to the date you choose to stop working.

The option to avoid WEP entirely ends when you vest your pension. But withdrawing all contributions and earnings prior to that is like letting the tail wag the dog. The penalty from WEP is likely far less than the value of the contributions your employer has set aside for you. Cashing out early simply to avoid WEP almost never makes sense.

What to do about mixed earnings from covered and non-covered employment

Sometimes you may mix earnings from covered and non-covered employers within the same pension. It sounds strange but this is relatively common for teachers who switch school districts during their career and municipal employees who go on to become state employees. When this happens, the amount of Social Security that is subject to WEP is prorated down to the month between covered and non-covered time.

Example: Amanda worked for 18 years in school district A, which paid into social security in addition to its own pension. It constituted covered employment. But she switched to school district B when her partner got a job in a new city. She spent 12 years working in district B, which did not pay into Social Security and was not covered employment.

Amanda’s move was intrastate. She has 30 years of combined time in the state’s teacher pension plan, but only a portion is considered to be covered for purposes of Social Security and WEP.

Her employer has *theoretically* kept great records and can easily tell her how much of her pension payment comes from non-covered work. Or maybe not. The reality is that many pension-paying agencies just haven’t been that detailed in their record keeping. Amanda may need to prorate this herself. Thankfully it’s an easy formula:

Let’s assume that her gross pension benefit is $4,000/month. The portion of this that comes from non-covered work is:

Remember the Guarantee Rule from above? The most the WEP offset could be in Amanda’s case is ½ of the $1,600 non-covered pension, or $800 in total.

How other employer savings plans impact the Social Security Windfall Elimination Provision

Its common for employers to offer more than just a pension plan. Many couple it with a 401(k), a 403(b), a 457, or Optional Retirement Plans (ORPs). Savings from these plans could impact WEP. But most of them do not. The only time these plans get roped in is when they are A) the primary retirement plan or B) funded with employer money.

The plans are rarely ever the primary retirement plan. The whole point of non-covered employment is based on the existence of a state or local government pension plan, which is the primary plan.

These savings plans are most often supplemental and are offered as way for employees to save additional sums above and beyond the amount their employer takes for the pension. They rarely include match money or profit-sharing contributions, which means its not common for WEP to impact them.

ORP, specifically

The major exception to the above is the Optional Retirement Plan offered to certain classes of employees working in higher education. This program allows the worker to opt out of the state’s pension plan in favor of a plan that allows them to make their own contributions and receive a match from their employer. In this case the plan is both primary as well as comingled with employer and employee money. It is subject to WEP.

The key difference lies in when WEP is actually triggered. These plans vary from state to state and may have slightly different rules as a result. The Social Security Administration dedicated a section of their Programs Operations Manual to the Texas ORP plan, which has the following rules:

- The WEP trigger is entitlement

- Entitlement is defined as a distribution, which includes a rollover, lump sum payment, or periodic payments

- Distributions aren’t mandated until Required Minimum Distributions kick in, which is currently at age 72.

This means that the WEP penalty may not take place immediately if you are an ORP worker that also qualifies for a Social Security retirement benefit! You could take your Social Security retirement benefits as early as 62 without being impacted by WEP until age 72.

This obviously won’t be the right choice for everyone – claiming social security early reduces your benefit amount and you may very well need the money from the ORP to fund your living expenses. But for some this is a wonderful option.

Parting thoughts

The main takeaway from this should be that WEP will impact you if you are eligible (or entitled in the case of ORP) for a pension from a non-covered employer. The strategies to mitigate its impact are undesirable in the case of working longer or flat out irresponsible in the case of withdrawing everything just to avoid it!

The best option is usually the simplest. Quantify the impact and work around it! This is not a disastrous penalty that will derail your retirement. Its intent is to level the playing field. Retirement is well within reach even when WEP is in play. You just need to be careful to plan with its impact in mind.