Investing undergoes a few changes when you retire. This of course is expected. You no longer add money to your accounts – you drain them. This paradigm shift requires a new approach to managing money, and its one that runs against the last 30 to 40 years of hard-won habits you’ve established.

Your portfolio must support your lifestyle. This includes both planned and unplanned expenses in good years and bad. And that’s the greatest change and biggest challenge. You can’t simply skip distributions and wait for your portfolio to recover when a bear market inevitably arrives. The income needs to continue no matter what.

This translates to lowering the amount of risk you take in your portfolio. You will be force to trade the outrageously good years to avoid the ruinously bad years as you enter retirement. That’s widely known. You’ll also need to develop and stick to a rebalancing plan, keep ample cash reserves, watch your spending, avoid emotionally charged and bone-headed investment decision, and keeping costs to a minimum

It all starts with the basics.

Determine your expenses

You can’t build a portfolio or even reasonably retire if you don’t know how much you’re spending. Budgets help but aren’t a silver bullet. Unexpected expenses are hard to predict and even more challenging to forecast. It’s more helpful to work backwards in our experience.

Check your paycheck and determine how much money flows to your bank account each month. Don’t use the gross figure. Go with the amount that’s leftover after taxes, savings, insurance, and all other deductions. This is the monthly income you’re used to living on.

Next, pull your bank statements from the last six months. Did you steadily build up cash in your accounts? Your approximate monthly expenses are the difference between the average monthly build up and the net amount from your paycheck. You’re spending what you’re making if your bank balance stays about level. Use your net take home pay as your approximate monthly expense figure in that case.

Why six months? Because that’s generally a good barometer to factor in some of those unplanned expenses. You can also backtrack to look at the last 12 or 24 months or even longer if you prefer. Just be sure you’re looking backwards and averaging out those monthly expenses. You need a budget that can handle regular and irregular expenses.

Whatever the number you arrive at, gross it up by 10%. You need cushion for 1) errors in your calculation and 2) big, unplanned expenses that go far beyond the pale.

Maintain your emergency fund

You need a pile of cash to cover your expenses when bad stuff happens. This could be a new car, needed home repairs, unreimbursed medical costs, a family member that needs help, or anything that may come up. Most advisors recommend at least 3-6 months of expenses for your emergency reserve, but this number is fungible. You may decide that the number needs to be higher, and that is ok.

The only upper bound limit that exists is in relation to your total portfolio. Your cash reserve can’t occupy an inordinate amount of your liquid net worth. Too much in cash will limit your ability to stay retired (can’t get the growth on assets required) or severely restrict your future upside (opportunity cost). How much is too much varies by portfolio size and expense level. Reach out to a planner if you aren’t sure.

Rebalance Regularly

Its not about what you make; it’s about what you keep. Rebalancing is the systematic process of selling the winners and reinvesting the proceeds into the losers. This can be done based frequency (monthly, quarterly, annually), by some trigger (such as a certain percentage deviation away from a target stock/bond allocation), or some combo thereof.

Which method is best? It doesn’t really matter so long as it gets done. Many studies were done over the years to try and find the secret sauce in rebalancing: there isn’t one. Some methods were weakly better than others over certain periods, but no method has been proven to hold a sustainable advantage over the long term.

Sequence risk and the perils of ‘letting it ride’

Without rebalancing, the winners in your portfolio will comprise a greater and greater share of your assets over time as they continue to accrue greater and greater gains. This skews your portfolio towards the high risk/high return assets in what is known as ‘drift’.

That will work until it doesn’t. You could very well average out to a higher return over time with a riskier portfolio, but it greatly increases your chances of exhausting your assets early. This is because of sequence risk, which is the risk that you run out of money due to the timing of your withdrawals. Consider the example below:

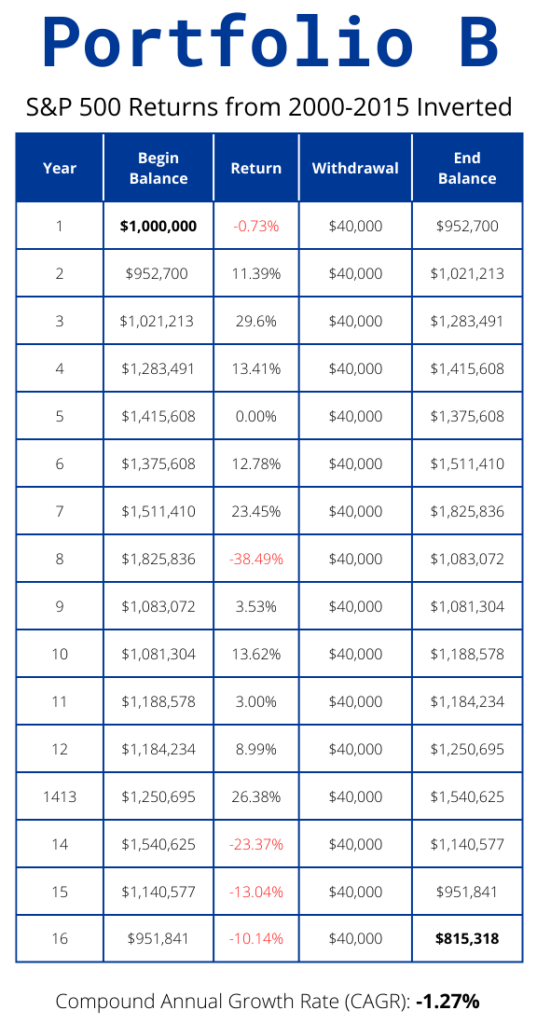

But what if we flipped the order of returns for Portfolio B? The large losses from the dot com bust take place at the end of the period as opposed to the beginning. The compound annual growth rate is -1.27% over the same period and the ending balance is $815,318.

The difference between portfolio A and portfolio B after sixteen years is a whopping $445,348.

Sadly, nobody has control over the timing of returns. And there are some periods in which it is far better to retire than others. But you can help limit the impact of these market losses by setting a more conservative asset allocation and sticking to a rebalancing program.

There are other strategies you can employ to limit the potential devastation from sequence risk, such as beefing up your cash reserve to be able to skip withdrawals or simply taking a pay cut and adjusting your withdrawal rate downward, but these too have drawbacks. Setting an appropriate asset allocation and sticking to a rebalancing plan is the low hanging fruit.

Avoid FOMO and bad ideas

There will always be opportunities to chase bad ideas up and sell on the way down. The last two years offered plenty of opportunities to purchase speculative crypto assets and near-valueless SPACs. There will always be something to throw your hard-won retirement dollars at. Friends and family members may even encourage you to do it. But many if not most won’t work out in the short run, and you may not want to stick around in the long run to recoup your losses.

Some of these things, like the recent Luna cryptocurrency token that just collapsed, will be a total loss. Others will be good purchases but may take much longer than you’d like to yield value. Microsoft took fourteen years to get back to their pre dot com crash price, for example.

Optimizing your investing in retirement is as much about doing the right things (allocation and rebalancing, see above) as it is about avoiding the wrong things. Keep it simple and don’t chase returns. Boring is good when it comes to your retirement portfolio.

Cheaper is Better

Costs and fees are one of the biggest drivers to your overall investment performance. It’s important to minimize them where you can. This means looking for lower cost share classes within your mutual fund holdings or swapping them out entirely for a comparable exchange-traded fund (ETF). Limiting trading costs is also important, though most major custodial platforms have moved to zero cost trading for equities and ETF orders.

Evaluating old employer retirement plans is also important. Many plans are exorbitantly cheap but some carry high fees. You can check the annual 404(a)(5) Participant Fee Disclosure to get the full run down on what you’re paying. And a final word of caution – employers have the legal authority to charge all plan fees to a specific class of employees, such as those who have separated from service. This isn’t a common practice but is worth exploring if you notice high costs eating into your account.

Its all about balance

With a little planning and strategy, and an ongoing dialogue with your investment professional, spending and investing in retirement can be a happy balance that keeps you engaging in all the things you love to do while continuing to meet your own personal goals.