President Biden signed the Inflation Reduction Act into law last week. The $450B piece of legislation is the final version of a dramatically scaled back $2T Build Back Better Act, which passed the House last year before dying in the Senate. The bill is packed with new policies that are sure to impact American life for years to come, but surprisingly few of them have any real personal financial planning consequences. Other than the abbreviation for the bill itself that is, which ironically condenses down to the “IRA” act despite making zero changes to IRAs.

Here’s what’s in the bill and how you can expect it to impact you going forward.

No changes to personal income taxes or inflation

Thousands of hours of political horse trading went into this bill, with previous iterations including a myriad of changes to personal income taxes. But none of these came to fruition in the final version. Personal income tax rates are unchanged, including for the top tax bracket and top 1% of earners. There are no changes to the 3.8% net investment income surtax applicable to pass-through S-Corporations, either. Critically, there are no changes to the so-called “backdoor” Roth IRA.

Previous versions of the bill had killed the backdoor Roth, which is a technique in which an individual earning too much to directly contribute to a Roth IRA will make a non-deductible contribution to a traditional IRA followed by an immediate Roth conversion. This technique is still 100% Kosher.

Despite the name, the bill is also unlikely to do anything to materially impact inflation. The Penn Wharton Budget Model (PWBM) suggests there is a low likelihood the bill does anything to change the trajectory of inflation. The Congressional Budget Office (CBO) agrees, saying that the bill will barely make a dent on inflation in the near-term. (PWBM is a non-partisan research organization in the University of Pennsylvania that creates economic analysis of public policy’s fiscal impact. CBO is a federal agency that provides budget and economic information to Congress to aid in decision-making). The name is just branding. Don’t expect it to work as advertised. The provisions of the bill address an entirely different set of policy priorities.

Big corporations will pay more

AMT and the carried interest loophole

Tax hikes on individuals weren’t popular, so revenue is going to come from big corporations instead. The Inflation Reduction act applies a 15% corporate minimum tax on book income for any corporation that has income of +$1B in any three consecutive years preceding the current tax year. It will also apply to any foreign corporation earnings more than $100M of book income in the US.

This makes it something of a corporate version of the Alternative Minimum Tax (AMT) currently applicable to individual taxpayers. The non-partisan Joint Committee on Taxation estimates that the measures will impact about 150 of the largest companies in America and will add around $222B to government coffers over the next decade. There are some finer points about what can be expensed and how the tax will be applied, but we’re not getting that granular.

The technicality making headlines from all this comes from the carried interest loophole, which was preserved by Senator Sinema of Arizona in the 11th hour. This is the fee that private equity fund managers deduct from the profits earned by their investors on their investor’s own capital. It is a performance fee, and by definition is given to the manager for their presumed skill and expertise in earning those profits. It logically follows that this should be taxed as ordinary income. After all, it’s the manager’s “sweat equity” that is being rewarded. But it’s treated under the much more favorable capital gains rates instead.

The Inflation Reduction Act tried to kill this absolute boon of policymaking to a group of individuals that arguably don’t need it. But it failed. What we’re getting is a tax on stock buybacks instead.

New 1% tax applied to all stock buybacks

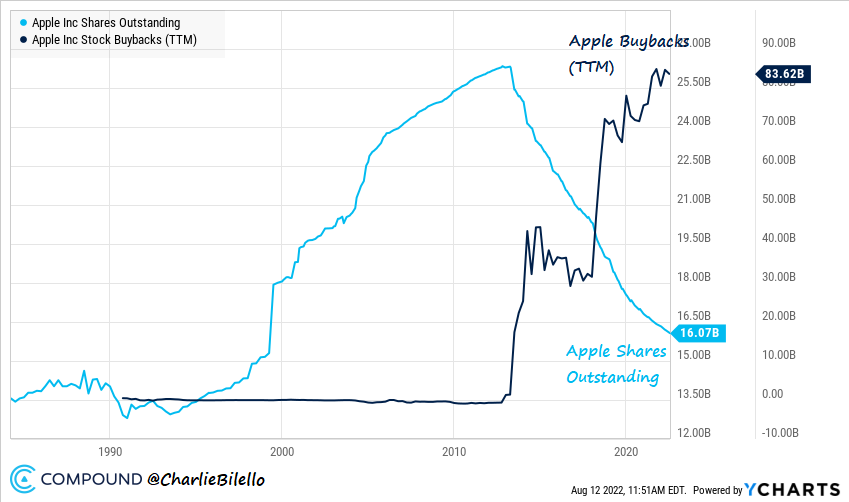

A new excise tax will be levied on all stock buybacks. For those of us that don’t live and breathe stock market jargon, a stock buyback is when a company uses its own money to repurchase its shares from the open market or through a tender offer. It then retires those shares and takes them out of circulation. All other things equal, the fewer the number of shares in existence the higher the share price must go.

Source: Charlie Bilello, Compound Advisor

Take Apple. They bought back about $522B worth of stock over the last decade taking the number of shares currently outstanding down to about 2/3 of what it was in 2012. Their stock price rose more than 1,700% over the same period, or about 34%/year when annualized. This doesn’t mean the buybacks are directly responsible for 1/3 of all of Apple’s share price movement. Performance attribution is more complicated than that. But it’s fair to say the impact is large.

You could argue that the tax is as much about raising revenue as it is about limiting buybacks. The policy will certainly discourage the behavior. Prominent opponents say that that the practice encourages corporations to return capital to shareholders rather than reinvesting profits in growth opportunities, thereby starving markets of capital. Or that using buybacks reduces liquidity that is needed when markets enter downturns and corporate credit dries up. Others argue that without buybacks corporations would merely sit on otherwise productive capital, which also starves the market of needed investment.

Regardless of the camp you’re in, corporations will be less likely to do this going forward given the increased cost. The Tax Policy Center estimates that a 1% tax on buybacks will lead to a 1.5% increase on corporate dividend payouts. That’s not necessarily bad. But dividends are immediately taxable to the investor, whereas buybacks do not incur capital gains until shares are sold (which is potentially never if you die with them.) This makes it all the more important to ensure high dividend paying stocks are in tax deferred accounts – those taxable dividends may increase further yet!

But these provisions won’t take hold until 2023. It wouldn’t surprise us if companies choose to accelerate “tax-free” buybacks from now to the end of the year.

The IRS is more bite and less bark

The Inflation Reduction Act re-arms the IRS. Approximately $80B of new funding will go to the cash-strapped agency over the next 10 years. About $45.6B of this will go towards enforcement. Most of the remainder is earmarked for needed upgrades of technology and new operational processes.

Such a large chunk toward enforcement invariably means more audits. But it also means improved technology to aid in IRS investigations and additional legal support for the agency. About $150M is earmarked for tax courts, for example. The ultimate goal is to narrow an estimated $600B “tax gap,” which the difference between what people owe and what the IRS actually collects. The agency plans to focus on high-income earners, corporations, and complex partnerships, but its yet to be seen where the bulk of new audits will be concentrated.

For what its worth, policymakers and pundits have being throwing around a figure of 87,000 new IRS agents that will be hired as a result of this bill. That number appears to be from a 2021 Treasury Department estimate of the level of IRS funding needed to maintain efficiency. The IRS is not planning to hire at that level, but the memes about it are still worth a laugh.

Another $4.8B will go towards modernizing systems, which means you may actually get routed to a human being when you call in with a tax issue. It could also mean that the IRS avoids ending tax season with millions of unprocessed returns.

Major changes to climate policy and green incentives

Electric vehicles are cheaper, but few qualify for the incentives

The Bill also includes big incentives for green vehicles. There will be up to $7,500 in credits for buying a new EV or $4,000 if you purchase a used one. But getting these credits is a little complicated. The legislation is riddled with caveats that are ultimately meant to make EVs more affordable while bringing more of the supply chain production back to the US.

For starters, only single filing taxpayers with up to $150,000 of income or married filers with up to $300,000 of income qualify for the credits. The car must also be assembled in the US. Seems fair, but only 12 EVs currently make the cut. The credits will also only apply to sedans under $55,000 while SUVs, trucks, and vans will only qualify if the price is under $80,000. The average price of a new EV in the US is currently $66,000.

The price caps for used EVs is just $25,000, but the made in America stuff doesn’t apply to those vehicles for the credit.

Beyond that, specific percentages for the precious minerals used in EV batteries must come from North America or a country that has a free trade agreement with the US. Never mind the logistical nightmare car companies will have trying to prove this to eager consumers, North America doesn’t have the mining capacity and some cases the known mineral reserves to meet current demand. And that’s to say nothing of the exploding expected future demand, or the fact that roughly 90% of current refining is done in China.

No electric vehicle on the market will qualify for the full credit when they take effect in 2023, according to the Alliance for Automotive Innovation. But some may qualify for a partial credit of $3,750 if 40% of battery materials meet the sourcing requirements. Others can get the other $3,750 credit if 50% of the battery components meet the production requirements.

The long and short of this is to wait on buying an EV if you want the best deal. Prices will come down over time as manufacturing capacity and the availability of EVs increases. It will also be easier to qualify for the tax incentives as automakers rework their supply chains, but both of these things take time.

The transition to clean energy is likely to accelerate

Decarbonizing transportation will do wonders for reducing CO2 levels, but the Inflation Reduction Act targets a raft of other climate provisions as well. There are new production credits for hydrogen, advanced manufacturing, nuclear power, and renewable electricity in addition to new investment credits for each of the above-named sources, too. Carbon capture technologies, although incredibly expensive in real life, will get a credit as well as low-carbon fuels used in transportation.

Credits for improvements in residential energy efficiency have been extended and/or increased. New research into energy innovation will also get funding, and clean energy financing will get a boost too. The legislation hits on many fronts and is likely to accelerate the transition to cleaner energy sources, though it won’t happen overnight.

Healthcare gets cheaper (hopefully)

The biggest changes this bill brings is in healthcare. Affordable Care Act (ACA) subsidies will be extended and prescription drug pricing gets a major overhaul.

Medicare can finally haggle

Medicare will finally be able to negotiate the price of certain prescription drugs. This is something that large, private companies and health insurers have been doing for decades. Medicare is just now joining the party with the expected outcome of lower prescription drug costs for millions.

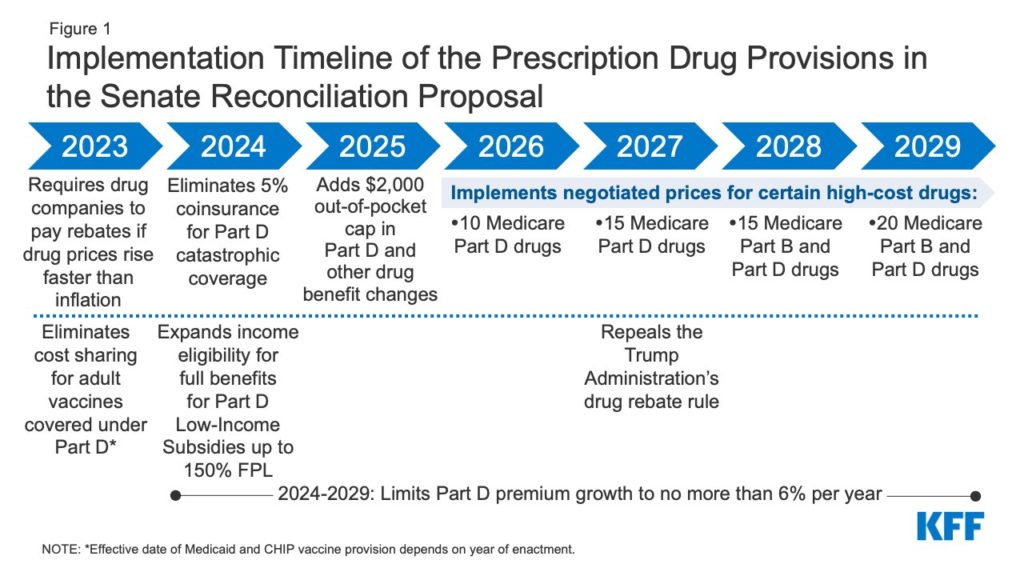

Medicare Part B and Part D spending is heavily concentrated in a few choice drugs that don’t have generic/biosimilar drugs also covered under Part B and D. The Bill lets Medicare negotiate for pricing with up to 10 drugs in 2026, another 15 in 2027, an additional 15 in 2028, and 20 in 2029 and later years. But that doesn’t do much in the here and now.

So, the Bill also caps Medicare beneficiaries’ out-of-pocket spending under Part D by eliminating coinsurance above the catastrophic threshold in 2024 and capping out-of-pocket costs to no more than $2,000 in 2025. The Kaiser Family Foundation put out a fantastic piece that gets to the grisly details of this if you’re interested.

Source: Kaiser Family Foundation. “Understanding the Health Provisions in the Inflation Reduction Act”. August 2022.

The Affordable Care Act remains affordable (for a limited time)

The enhanced Affordable Care Act (ACA) credits made available in 2021 and 2022 by the American Rescue Act are extended to 2025. This means lower out of pocket costs for people with more modest incomes, as well as an elimination of the “cliff” provision for those with incomes above 400% of the Federal Poverty Line. This is welcome relief for many, but its still subject to the whims of Congress in 2025. Substantial regulatory risk remains here.

Source: Michael Kitces, https://kitces.com

Conclusion

The legislation is big and broad enough that there is something in here for everyone to get excited about. The biggest immediate change is likely to be around stock buybacks, which we expect to accelerate in 2022 in anticipation of the new 1% tax. Medicare changes will be a big deal starting next year, but only if you’re currently enrolled in Parts B and D. The EV tax credits are laudable but are currently (and nearly entirely) ineffective. Other climate initiatives for producers and financiers will bear immediate fruit, but you as a consumer may not genuinely feel those effects for another few years.

Perhaps best of all is the do-nothing approach to individual income tax rates and the failure to dismantle the backdoor Roth IRA. The status quo work well for most of us here, as income tax rates are at historic lows and the backdoor Roth has been under legislative fire for years. We can have our cake and eat it, too, when it comes to these for now.

Have questions? Let’s talk. Schedule a time to speak with us directly on our calendar.