Welcome to Carmichael Hill

Registered Investment Advisors

We are a SEC registered investment advisor helping high achieving couples plan and prepare for retirement.

Retirement planning starts while you’re still working – and continues after the transition.

Managing wealth across decades is hard. Laws change, taxes change, and so will your life. Keeping your finances in top shape through all of it requires comprehensive expertise across multiple disciplines.

We’ve spent more than thirty years practicing our craft and building a process that brings together all the components of your financial world. We want to share it with you.

AS SEEN IN

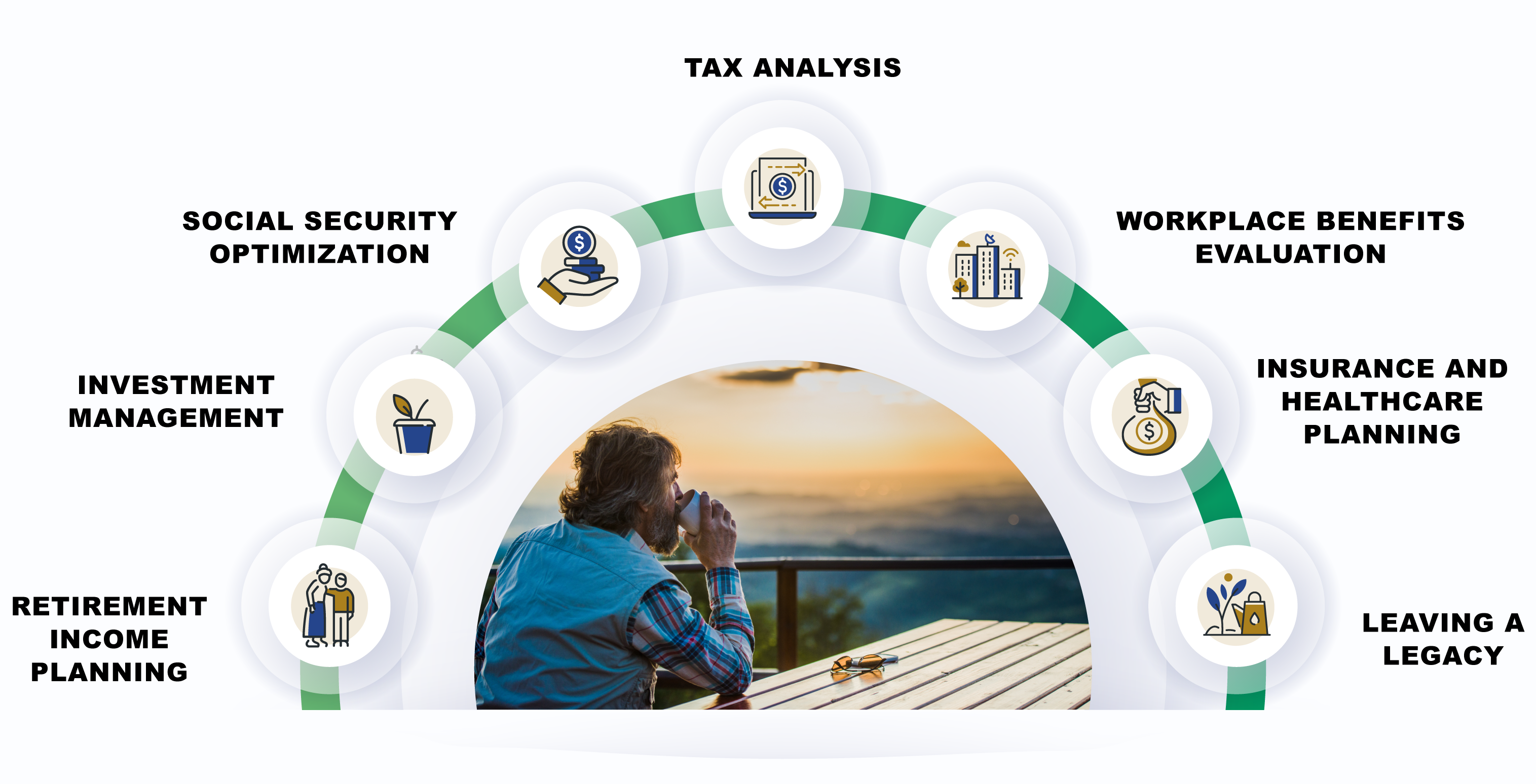

Our Process

Ongoing Financial Planning and Investment Management

At Carmichael Hill, we focus on you. We’ll help you define your vision and design a strategy to achieve it. As a fiduciary, we work for you and your family’s best interest. We understand what feels like to embark on a new path, and we’re here to help you navigate it.

Investment Philosophy

Investing wisely doesn’t have to be complicated

We focus on doing the basics well when we put together portfolios for our clients, and it’s that simple architecture that allows us to construct customized portfolios for everyone we work with. There are no cookie-cutter solutions here, but there are principles and core beliefs we apply to every account: