Inherited Roth IRA Rules can be complicated. This is especially true if you inherit an account as a non-spouse beneficiary. Understanding how these accounts work, what the rules are for withdrawing money, and the tax consequences that follow are all critical to maximizing the value of your inheritance. We’ll break down everything you need to know.

General Rules

Roth IRAs generally provide for tax free distributions, but there is a test that must be passed for this to be the case. The test applies to tax, not penalties, from the growth on money that went into the Roth IRA as a contribution. (See IRC Section 408A(d)(2)(b)) To avoid tax on those earnings, the withdrawal must take place after five tax years have passed from the time of the first contribution. The rule isn’t measured per contribution, either, so you’re not stacking five year terms sequentially for every contribution made. Its one and done. The clock starts once the first contribution hits the account, and once the holding period is met it’s met for life.

Notably, this doesn’t address penalties. The account owner must be at least age 59.5 at the time of withdrawal, dead, totally disabled, or using the withdrawal for first-time qualified home buyer expenses up to $10,000 in order to avoid the 10% early distribution penalty.

Inheritors will automatically pass the test to waive penalties – a death has occurred. But the original account owner must also have owned that account for at least five tax years for the beneficiary to make tax-free withdrawals of earnings.

There is a second test that applies to waiving penalties from Roth IRA conversions, but this test it automatically passed when an account is inherited. We put together an in-depth piece on the 5-year rules for Roth IRAs if you want to get technical.

Important Nuances Worth Knowing

This test raises an important question: How do you determine what part of the Roth IRA you’re distributing in the first place when you have to delineate between conversions, earnings, and contributions? Fortunately, the IRS has provided some guidance. Roth IRAs have an ordering for distributions: principal comes out first, then conversions, then earnings. So, you may very well be able to make withdraws within the first five years so long as you don’t completely distribute all principal and converted amounts!

Inheriting as a Spouse (Eligible Designated Beneficiary)

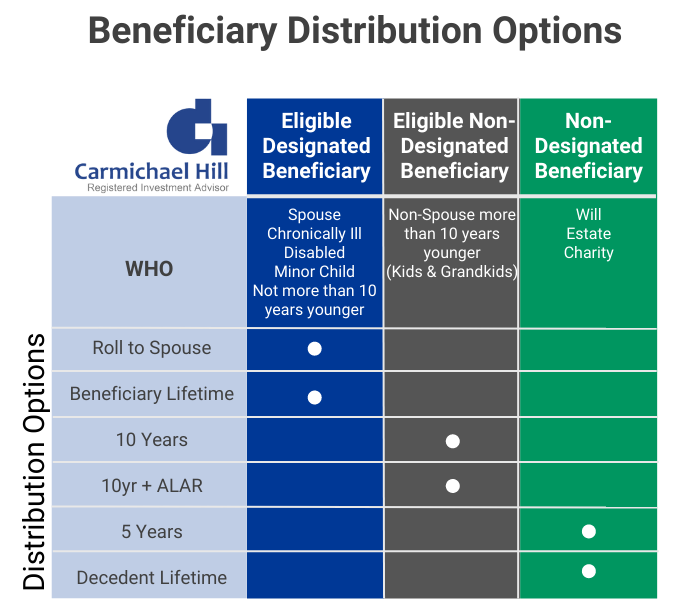

The SECURE act expanded the categories of IRA beneficiaries from two to three. There are now eligible designated beneficiaries, non-eligible designated beneficiaries, and non-designated beneficiaries. Spouses fall into the eligible designated beneficiaries category. So do minor children of the decedent, disabled and chronically ill persons, certain trusts, and individuals not more than 10 years younger than the decedent. The eligible designated beneficiary category gets the best options for inherited Roth IRAs.

Option 1 – Make it your own

These rules are the most favorable. An inheriting spouse has the option to take over their late partner’s account and make it their own, either by retitling the decedent’s account into their name or by rolling it into their own pre-existing IRA. The five-year rule for tax-free withdrawals of earnings still applies here but can be satisfied by rolling the decedent’s account into your own that has already satisfied the holding period requirement!

However, surviving spouses should be mindful of their income needs before completing a rollover. Death satisfies the first test for qualified distributions. The widow(er) can take tax and penalty-free distributions from an inherited IRA if the account has been open for at least five tax years. But this isn’t necessarily so if the account is rolled over – the age 59.5 rule for early distribution penalties applies when the survivor moves their late partner’s account into their own. This means a surviving spouse who is not yet 59.5 years old should think about how much money they may need to pull out of that inherited Roth IRA before they roll it into their own account.

Option 2 – Stretch it over your lifetime

Surviving spouses also have the option to stretch distributions over their lifetime through an inherited Roth IRA. This is also commonly called a “stretch IRA”. Significant changes were made to stretch IRA rules via the SECURE Act, but this option is still alive and well for spouses. (Note that the changes made by the SECURE Act are only applicable to accounts from decedents who passed away on or after January 1st, 2020. Those who passed away prior to that date are grandfathered in under the old rules).

Eligible designated beneficiaries are required to pull an annual minimum distribution from an inherited Roth IRA. The first distribution must come by 1) December 31st of the year following the year of the account owner’s death or 2) when the decedent would have obtained age 72, whichever is later. Waiting for the decedent’s age 72 is a great strategy for an inherited traditional IRA that was obtained from a younger spouse. The older survivor is allowed to wait until their younger spouse would have been 72 before they are forced to distribute funds.

But this is a bit of a moot point for Roth accounts. Unlike traditional IRAs, Roth IRAs DO NOT have required minimum distributions at age 72! The surviving spouse can simply roll proceeds of an inherited Roth, which has RMDs, to their own Roth IRA and eschew distributions entirely. A stretch Roth IRA can make sense if the surviving is under age 59.5, needs the funds, and wants to avoid the early distribution penalty. But it doesn’t generally make a whole lot of sense to maintain a stretch Roth IRA structure after that age.

Option 3 – Take the money and run

Lump sum distributions are always an option. There won’t be any taxes due if the account has been open at least five years when the lump sum is taken. From a planning perspective, this works well if the full balance of the account is needed. But if any portion is to be saved it’s likely best to simply leave that money in the Roth. The benefits of tax-free compounding are hard to overstate.

Caveats for other eligible designated beneficiaries who are not surviving spouses

Only spouses have the option to wait until their late partner’s age 72 before taking distributions from Inherited Roth IRAs. Disabled and chronically ill individuals, minor children, some trusts, and other individuals not more than 10 years younger than the decedent must begin distributions by December 31st of the year following the decedent’s death.

Moreover, only surviving spouses have the option to roll the account into their own Roth IRA. Everyone else is stuck with the inherited Roth IRA that mandates a certain required minimum distribution each and every year. This group can still stretch distributions over their lifetimes, which is a gift given how much the SECURE Act moved the goalposts, but it’s still not as favorable as rolling it into their own Roth IRA.

There is one final exception for minor children of the decedent. This group can continue under the lifetime stretch rule until they reach the age of majority. This is generally either 18 or 21 depending on the state. The child switches categories and moves into a “non-eligible designated beneficiary” status at that point, which has a different set of rules for distributions.

And that brings us to our next topic…..

Inheriting as a Non-Spouse

Non-Eligible Designated Beneficiaries

These are non-spouse beneficiaries who don’t fit into the eligible designated category. These beneficiaries are usually the children and grandchildren of the deceased (i.e. a non-spouse who is more than ten years younger than the decedent) and certain kinds of trusts. These beneficiaries have just two options available to them: 1) distribute according to the ten-year rule, or 2) a full lump sum distribution.

The new ten-year distribution rule

Congress added a new rule for non-eligible designated beneficiaries when they enacted the SECURE Act. Lifetime distributions via a “stretch” provision are no longer an option. Instead, this group must now distribute the full value of the account by the end of the tenth year following the year of death. (i.e. it must be drained within ten years of the beneficiary’s first required minimum distribution). What was once a lifetime stretch is now compressed to no more than a decade.

But the initial legislation left a few things open to interpretation. It wasn’t immediately clear whether and how the At Least As Rapidly (ALAR) rule would be applied. This rule states that a non-eligible designated beneficiary must continue to withdraw from the account at least as rapidly as the original account owner. This means that the beneficiary will have to take required minimum distributions if the original account owner was taking required minimum distributions.

The initial ambiguity around what rule would be applied, ALAR or the new ten-year rule, seems to be settled after an unprecedented amount of flip flopping from the IRS. The ALAR rule and the ten-year rule will apply if the original IRA owner was at least age 72. This means minimal annual distributions plus a requirement to drain the account by the end of the decade.

Only the ten-year rule will apply if the original account owner wasn’t yet 72. This offers greater flexibility. The beneficiary is in complete control over the distributions schedule during that ten-year period.

This leads to an interesting point. There is no required beginning date for Roth IRAs since there are no required minimum distributions for these accounts! This means that the ALAR rule doesn’t apply, and the inheritors of a Roth IRA will only be subject to the new ten year rule! No annual minimum distributions are required.

A special note for Roth 401ks

Not all Roth-type accounts are created equal. Roth 401ks have required minimum distributions and a required beginning date (age 72). Roth IRAs have neither. This means that the ALAR rule applies to Roth 401ks in addition to the ten-year rule. These Roth-type accounts are treated no differently than traditional IRAs from a distribution standpoint.

But seeing this in the real world is somewhat rare. Most everyone out there will run as far as they can from a required minimum distribution. Roth 401ks are frequently rolled over to Roth IRAs to avoid those required minimum distributions during the original account owner’s life. Inheriting one subject to the ALAR rule isn’t common, but possible if poor planning was applied.

Non-Designated Beneficiaries

Leaving an IRA without naming a beneficiary, naming your will/estate, naming a charity, or leaving the account to certain kinds of trusts moves into the non-designated beneficiary category. The SECURE Act didn’t make any direct changes to this group. There distribution options are:

- Distribute all funds over a five-year period if the original account owner had not yet reached their required beginning date (age 72), or

- Distribute funds over the remaining life expectancy of the decedent if the death occurred on or after the required beginning date. This contrasts with the eligible beneficiaries from above who can distribute over their remaining lifetime.

Its worth noting that the IRS doesn’t “look through” a will or estate to locate the end beneficiary and apply their specific set of distribution rules. This is true even if there is nothing more than a simple will leaving everything to a surviving spouse! The IRS will still use one of these two rules, and the surviving spouse will not be able to roll the account into their own Roth IRA. Its worth naming a specific beneficiary to your Roth IRA.

Calculating how much to distribute

So how much do you need to take out in a given year? This is functionally an issue for beneficiaries subject to the ALAR rule with their stretch Roth IRA. Distributions are spread over the beneficiary’s life expectancy.

For a beneficiary utilizing the stretch Roth IRA option, simply take the value of the account as of December 31st of the previous year. Divide this by the factor given for the beneficiary’s age in the IRS Table I. Then, reduce life expectancy by one for each and every year following the year of the initial distribution.

For example, say an eligible non-designated beneficiary inherits an account at their age 62. The decedent’s account was open for 10 years before their passing. The account value was $500,000 at the end of the previous year. The beneficiary will find the factor for their life expectancy using Table I (23.5 in this example) and divide that by last year’s account value. This comes out to $21,276.59 for the first year’s required minimum distribution.

The beneficiary will take the factor they used in the first year (23.5) and subtract one from it to determine the distribution in year two. So, say the account grew to $505,000 by the end of the year following the first distribution. The beneficiary would divide this by (23.5 – 1 = 22.5) to get a required distribution of $22,444.44 for that year.

The Devil is in the details

Remember, a non-spouse beneficiary utilizing the stretch IRA has until December 31st of the year following the year in which the account owner passed away to take the distribution. So, if the decedent passed away on Jan 1st of 2020, the beneficiary has until December 31st of 2021 to take the first RMD. This is just shy of two years before the first distribution must take place. The beneficiary may have seen two birthdays take place over that period.

The beneficiary will use the life expectancy factor for their age at the time of the first distribution when making the initial distribution. They will not use the factor for their age at the time of the decedent’s passing. This is important as using the latter will lead to a smaller and incorrect distribution. The amount that is left in the account that should have been pulled out is subject to a 50% failure to distribute penalty! Getting the age factor correct is mission critical.

Parting Thoughts

The Roth IRA is a great estate planning vehicle due to its tax-free distributions for the beneficiary, but the rules can get messy. Seek out a good financial planner if you aren’t sure about what to do or want a pro to check your work. Here’s our shameless plug – we can help you do this! Give us a call or schedule an appointment on our calendar and we’ll help you sort it out