The Net Investment Income Tax (NIIT) has been around since 2010, and it applies to investors who have high incomes and healthy investment account balances. It applies regardless of whether you are working or are retired and covers a broad range of assets classes. But since retirees often rely on withdrawals from investments to generate income – which creates a capital gains tax liability – the impact of the NIIT on their total tax liability can be considerable.

Fortunately, the net investment income tax only applies to investment income. Distributions from and conversions of retirement accounts don’t get dinged with this tax. But it’s a little more involved than that. Since the tax is only applied at certain income thresholds (see below), taking money from pre-tax retirement accounts can bump your total income over the threshold line and push you into an NIIT bracket!

Income that isn’t directly subject to the tax can still move the needle by bumping you into a higher bracket, thereby indirectly subjecting you to NIIT. Ouch!

The good news is there are some ways to mitigate it. We break it down.

The Essentials

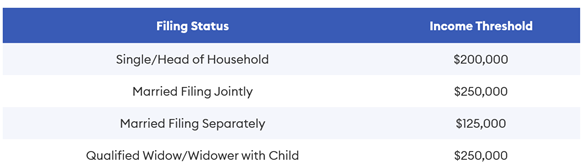

Let’s cover the basics. it only applies if you are above certain Modified Adjusted Gross Income (MAGI) thresholds. The chart below lays it out by filing status and income threshold.

You are subject to the NIIT if your modified adjusted gross income is over one of those thresholds. Wondering how much you’ll owe? Calculate net investment income first. Add up all of the income earned from your investments (interest payments, capital gains, dividends, rental income, etc). Follow this by subtracting any related expenses (that’s the “Net” part).

Commissions on stock sales and tax preparation services usually qualify as an allowable expense in this category, though there are plenty more admissible expenses you could incur.

But there is a wrinkle in the fold. The 3.8% NIIT can be assessed on either the net investment income as we outlined above, or it can be on the amount of total income you have over the NIIT threshold. For once, the IRS takes the lesser amount.

Its easier to see it in action. Consider a married couple making about $300,000 a year. They are over the $250,000 NIIT threshold and will pay tax. In scenario A, the couple has $30,000 of net investment income. Scenario B doubles that to $60,000.

| Scenario | Income Threshold | (a) Amount Over Threshold | (b) Net Investment Income | Taxable Amount: Lesser of (a) or (b) |

| A | $300,000 | $50,000 |

$30,000 |

$30,000 |

| B | $300,000 | $50,000 | $60,000 | $50,000 |

Scenario A would assess the 3.8% NIIT on the net couple’s net investment income (column (b)) since it is less than the level of total income over the $250,000 threshold (column (a)). Scenario B would apply the NIIT to the level of income over the threshold (column (a)) since its less than their net investment income.

If it all sounds Greek to you don’t worry. Just compare column (a) to column (b). The NIIT applies to whichever is less.

Where Retirement Accounts Help and Hurt

It’s important to note that retirement accounts alone won’t subject you to the NIIT. IRC Section 1411(c)(5) carves out and specifically exempts taxable distributions from any retirement accounts from the NIIT. This includes 401(k)s, IRAs, 403(b)s, 457(b)s, and even Roth IRA conversions! You are in the clear if your retirement income consists solely of pensions, social security, and retirement account distributions.

These accounts only become problematic when stacked on top of other investment income like capital gains and interest, both of which are subject to the net investment income surtax. It’s the stacking effect that matters. Even though that retirement account distribution isn’t subject to the NIIT, the face that it indirectly pushes people past the $250,000 threshold can make your capital gains subject to an extra 3.8%.

Managing the Tax Liability – Pulling the Right Lever

Lowering Net Investment Income

Because the ultimate amount of the NIIT depends on two inputs – your Modified Adjusted Gross Income and your net investment income amount, you have some options for minimizing it.

Tax-loss harvesting strategies can work well to lower your investment income. This means selling investments at a loss and buying near-identical securities with the proceeds. Your allocation doesn’t materially change and you’re able to capture a loss for tax purposes. Just be careful to avoid the wash sale rule, which can undo the tax benefits of capturing the loss. Seriously. Be careful with this and read up if you aren’t familiar.

The key is not to let the tail wag the dog. Markets are always moving and you may not be able to completely offset a gain by capturing a loss. This is for the best. You aren’t making any money when losses can fully offset gains.

Charitable giving can also play a role. Donating appreciated stock can help reduce investment income as well as fulfill your charitable intentions. You avoid triggering capital gains and get an additional tax deduction with the donation. But you must itemize your taxes to get the benefit! You can also get a $300 tax deduction for cash gifts made throughout the year without itemizing. This however is unlikely to be large enough to move the needle. Consider a different strategy if your donation won’t be larger than your standard deduction.

Lowering MAGI

QCD

Donations can play a role here as well. Consider using a Qualified Charitable Distribution (QCD) from your retirement account if you are over age 70.5. Remember, distributions from your retirement accounts are excluded from the NIIT. But if they are large enough to bump your MAGI above the applicable NIIT threshold and you have investment income, then avoiding them has some benefits.

A QCD sends money directly from your retirement account to a named charity. The donation counts towards your required minimum distribution amount for the year, which reduces the amount of income you are required to recognize. Additionally, you don’t have to itemize to get the benefit. You get full credit for the donation directly from your retirement account as well as your full standard deduction!

Roth IRA Conversions

Roth IRA conversions can help, too, but need to be approached with caution. This strategy moves money from your pre-tax retirement account to your Roth IRA. The full amount of your conversion is taxable. This increases your income in the year of the conversion, which could bump you above the $250k NIIT threshold. Roth conversions should only be done in years when you know you will be in low tax brackets. The opportune time for Roth conversions tends to be from the year you retire to required minimum distributions at age 72.

When you complete a conversion you are not only reducing the amount of money in your pre-tax accounts, you are also reducing the size of all future required minimum distributions! This tax bracket arbitrage requires a careful consideration. These conversions also impact your Medicare Part B and D premiums as well as phase you out of certain tax credits you may otherwise qualify for. You need to weigh the full current costs of a conversion carefully against the future benefits afforded by lower required minimum distributions.

The Bottom Line

A good retirement plan is of course focused on generating the income you need. But that’s only one side of the story. Setting up a plan that is thoughtful about taxes well in advance can add considerably to your disposable income – both this year and for years to come.