March 27, 2020

Jeff Grodsky, Matt Bacon, Jim Stewart

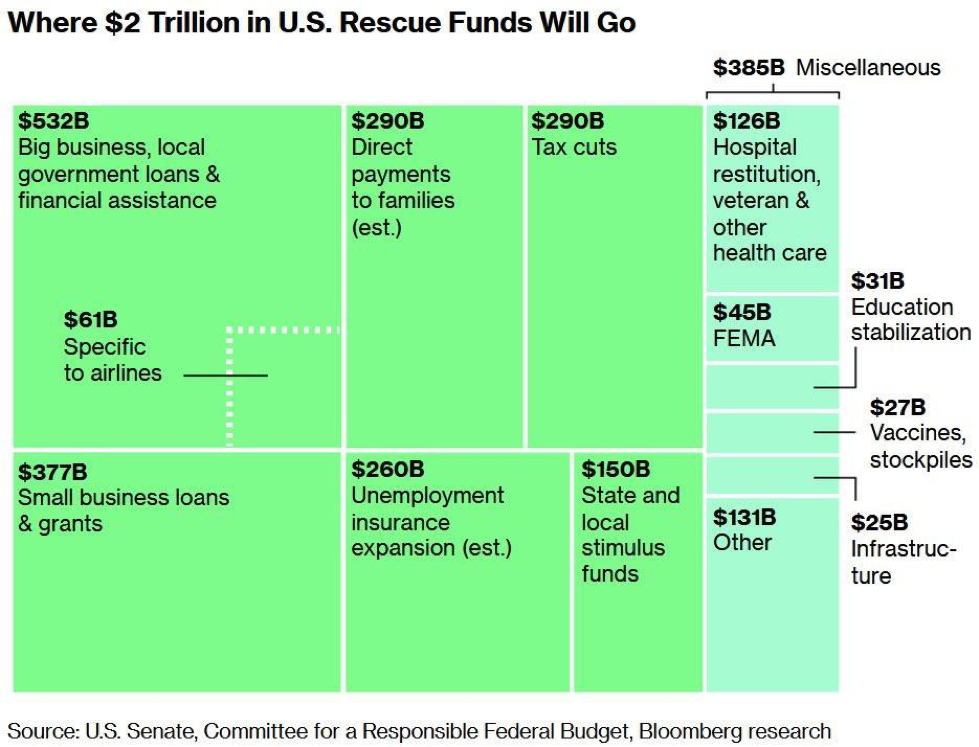

On Wednesday, the Senate unanimously passed a $2 trillion economic rescue plan that will provide relief to the U.S. economy as the Coronavirus rages on. The bill passed the House and was signed by the President this afternoon. This bill is by far the largest stimulus package in U.S. history, and follows two earlier bills aimed at developing a vaccine and greater access to paid sick leave.

The bill is 883 pages and will take some time to fully digest. What follows are the highpoints of the bill that we believe are most likely to impact you.

Keeping Americans Paid

One-time direct payments:

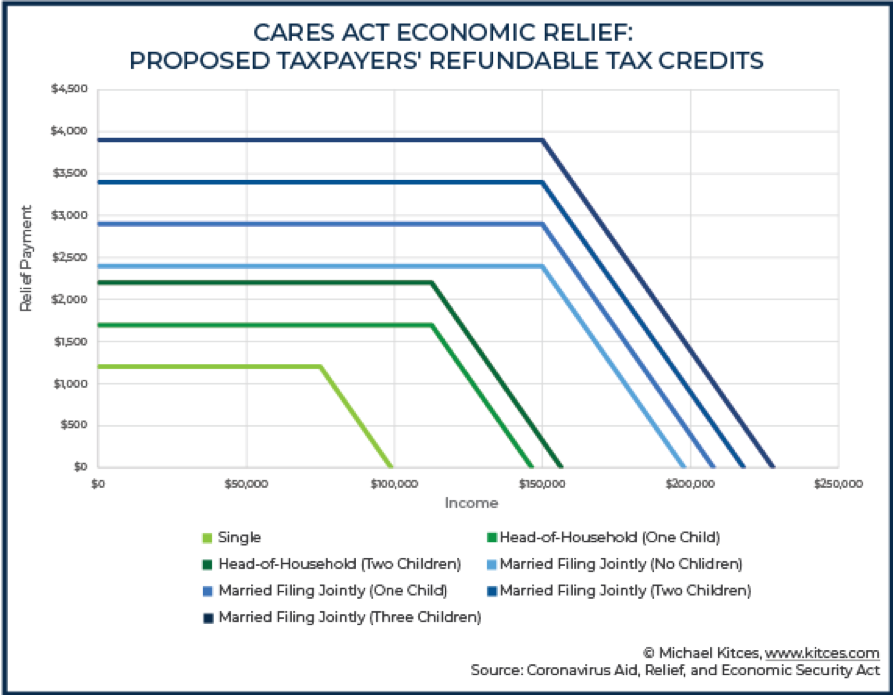

Every adult that has a social security number and is a U.S. resident is potentially eligible to receive a direct cash payment. Benefits will vary based on your tax filing status and income.

- Single Filers with adjusted gross income of ≤$75,000 will receive a payment of $1,200.

- Married Filers with adjusted gross income of ≤$150,000 will receive a payment of $2,400.

- Head of Household Filers with adjusted gross income of ≤$112,500 will receive a payment of $1,200.

- Phaseouts occur for every filing status for amounts earned over the limits listed above. For every $100 earned over the relevant threshold, $5 will be deducted from the stimulus check until the check value hits $0 (i.e. no stimulus check).

- Households with children under age 17 will receive an extra $500 per child. There is no upper limit on the number of qualifying children under age 17, but this amount is still subject to the income phaseouts listed

The IRS is responsible for distributing the checks. They will use the amount listed on line 8b of your Form 1040 from your 2019 return to calculate your check amount. If you haven’t yet filed for 2019, they will use the amount listed in line 7 from your Form 1040 from your 2018 tax return.

To be clear, the payments are for 2020 even though the government is using information from past years. This means that if your 2018/19 income is above the threshold, but your 2020 income is below the payment threshold(s), then you will get a check. You just won’t get it now when you need it. You’ll have to wait until you file your 2020 taxes.The IRS is responsible for distributing the checks. They will use the amount listed on line 8b of your Form 1040 from your 2019 return to calculate your check amount. If you haven’t yet filed for 2019, they will use the amount listed in line 7 from your Form 1040 from your 2018 tax return.

Moreover, there is no claw back if you qualified for the payment in 2018/19 but didn’t in 2020. For example, if you got a stimulus check because you earned $50,000 in 2019 but made $400,000 in 2020 from your BOOMING toilet paper supply business, you don’t have to give any portion of your stimulus check back.

Treasury Secretary Mnuchin says checks will roll out in three weeks. Most experts are skeptical of this. There is incredible logistical complexity to distributing checks/direct deposits to hundreds of millions of people, and experts note that checks took about three months to reach taxpayers in 2008 during the last round of fiscal stimulus.

A direct deposit will be done if you have provided the IRS with bank account information on past returns. If not, you will get a check in the mail.

Unemployment benefits

This bill has expanded unemployment benefits to include self-employed and part-time workers as well as independent contractors and furloughed workers. The maximum length of unemployment benefits has been extended to 39 weeks, up from the current 26 week maximum. While the amount of unemployment benefits varies by state, there will be up to an additional $600 per week for the first 16 weeks as a result of the stimulus package.

If you have not lost a job but are experiencing lost income due to a coronavirus diagnosis or forced self- quarantine, or if you are caring for someone who has been diagnosed, then you will qualify for the expanded unemployment benefits.

Assisting Businesses, families and workers

Retirement plans

First and foremost, required minimum distributions are waived in 2020 (woohoo!) This applies to all retirement account types including inherited IRAs. Moreover, if you turned 70.5 last year but were planning to take your RMD this year, your RMD is also waived!

The IRS is unclear on whether you can put money back into your retirement account if you have already taken an RMD. We see two possible options under current law that may allow you to put the money back:

- Take advantage of the 60-day rollover rule. Treat the funds as though they were an indirect rollover and put the money back into your retirement account. You are limited to one of these per annum, so if you are on a monthly distribution you will only be able to re-contribute one of your distributions. You cannot lump together the three distributions you have taken year to date.

- If you can show that you qualify under the Coronavirus hardship provisions for 2020 (see next paragraph), then you may be able to treat your regular distribution as a hardship distribution. This would give you up to three years to get the funds back inside your retirement

Note – Inherited IRAs are not eligible for rollovers, meaning it isn’t possible to get the funds back into the account if they’ve already been withdrawn.

A Coronavirus hardship provision has been added to the laws governing retirement accounts for 2020. Coronavirus related distributions of up to $100,000 will be exempted from the 10% early distribution penalty, can be rolled back into the account anytime over the next three years and the tax consequence can be spread over three years. However, if you need the hardship distribution you may be in a lower tax bracket in 2020 anyway. Careful tax planning is needed here.

Additionally, loans from employer sponsored retirement plans have been increased from $50,000 or 50% of account value to $100,000 or 100% of the vested account value. Repayments on the loan will also be deferred for up to one year.

As a reminder from our last letter, the tax filing and payment deadline has been moved back to July 15th. The knock-on effect of this is that IRA contributions for 2019 can also be made up to July 15th.

All businesses

The bill creates a fully refundable “employee retention” tax credit of 50% of payroll on the first $10,000

of compensation (including health benefits) for each employee for companies that are closed or

‘distressed’ as a result of the Coronavirus. The company must see a year-on-year quarterly drop in

revenue (not profit) of at least 50% to qualify.

Qualifying companies, including those who are self-employed, can delay paying the 6.2% Social Security tax on employee wages through to the end of 2020. 50% of the balance is due in 2021 and the remainder in 2022.

Small businesses

Low-interest loans (less than 4% interest) will be provided for businesses with 500 or fewer employees. The maximum loan is $10 million or 250% of the of the average monthly payroll costs of the previous year, excluding folks that earn more than $100,000. These loans are potentially forgivable if they are to retain workers, pay rent/utilities or mortgage interest. The bill also provides emergency grants of up to

$10,000 for small businesses that need to cover immediate expenses. Furthermore, there is a $17 billion fund to cover relief from existing loans for small businesses already using Small Business Administration (SBA) Loans.

Big Corporations

The Treasury will extend $500 billion in loans to struggling publicly traded corporations. A committee to include the Inspector General will oversee the distribution of the funds and uses of these taxpayer dollars. Companies will be prevented from buying back their stock until a year after the loan is paid back.

Student loans

Payments on federal student loans are now suspended without penalty through September 30, 2020. Interest will not be charged during this period and it will still count towards any and every loan forgiveness program. Employers can also provide up to $5,250 in tax-free student loan repayment benefits, meaning the employer can make loan payments up to this amount without the worker including this in their 2020 income.

Charitable Contributions

There is a new above-the-line deduction for the first $300 of qualified charitable contributions for taxpayers that do not itemize. ($300 total regardless of whether you file single or jointly with a spouse)**. This works out to actual tax bill savings of $111 f you are in the highest 37% tax bracket and less if you are in a lower bracket. We don’t expect this to have a material impact but for those of you who are regularly donating to charity, consider this new provision as you decide how to give this year.

Supporting the Healthcare System

Heath Care Providers:

Hospitals and healthcare providers will receive hundreds of billions in aid. Additionally, several key provisions have been rolled out that will impact individuals directly:

- Medicare beneficiaries will get the COVID-19 vaccine (when available) at no

- During the COVID-19 emergency period, Medicare Part D recipients must be given the ability to have, upon request, up to a 90-day supply of medication prescribed and

- For 2020, over-the-counter medication is included as a qualified medical expense for all HSAs, MSAs and

Stabilizing the Economy

Airlines

There is $61 billion allocated to help keep the airlines flying. Approximately half of this total is in the form of grants and the other half are loans. There is also relief from the federal excise taxes that apply to transporting passengers and cargo and the purchase of jet fuel.

Delta, United, American and Southwest share prices were all down on the passage of the bill as it is thought the stimulus provided may not be enough. Industrial titan Boeing was also down on the news as Treasury Secretary Mnuchin said the company had not approached the government for any assistance.

Travel and Hospitality

No dollars have been earmarked for these industries. Several cruise lines have approached the government for money; however, the major cruise lines are all domiciled overseas in an apparent effort to avoid/minimize U.S. taxes. The government has declined to provide assistance or “bail them out” on that basis.

**Based on our current understanding of the CARES Act. Please consult your tax advisor for additional clarification on comment.