Matt Bacon March 12, 2021

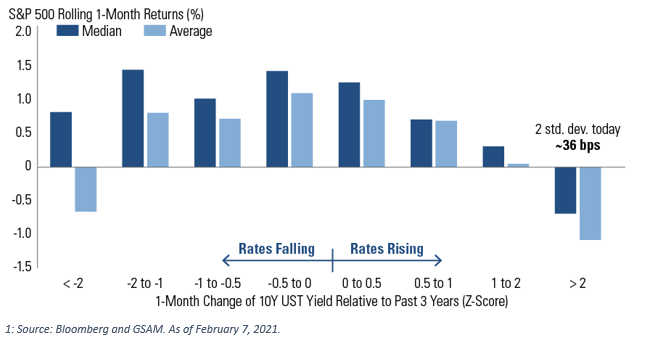

Executive Summary – Bond yields moved more than two standard deviations since January 1st. Equity markets can’t handle that much movement that quickly. This led to volatility with a sell-off in long dated bonds and growth stocks with high multiples (mostly tech). Interest rates look like they have stabilized. Certain sectors of the equity markets now look attractive but multiples will continue to compress in aggregate.

The first quarter of 2021 has been marked by a dovish Fed, positive vaccine news, gradual economic reopening, and rapidly rising yields in the bond market. The last of that list has many worried lately. Rising yields means that bond prices are falling. This in and of itself isn’t all bad. The reason bond prices are falling is because investors are gaining confidence in the economy and selling out of bonds (i.e. the safe stuff). More and more capital is tracking over into equities (the risky stuff). The bullish, risk-on stance is healthy and should bode well long term. But it does pose some structural challenges in the near term.

Why do yields and interest rates impact stock prices?

The full and unabridged primer is best explained by Howard Marks of Oaktree Capital, which you can find here. Fair warning, it’s long. The short version is best laid out as follows:

Low interest rates have a stimulative effect

Mortgages, car loans, and personal loans all get cheaper. Required payments decrease and consumers have more money to spend. The opposite is true when rates rise.

High rates also decrease the present value of future cash flows

It helps to be a finance nerd to wrap your head around this one, but an investment is essentially worth the sum of its expected future cash flows discounted back to the present day. The term “discount” is used because a dollar today is worth more than a dollar five years from now and even more than a dollar ten years from now. Money invested today should bring back more in the future.

The rate that is used to discount those cash flows depends on the risk involved in waiting for them. Part of what makes up the level of risk is the prevailing interest rate environment and the returns we can get from buying something else entirely (opportunity cost). When those are high the discount rate is high as well. The higher the discount rate the lower the present value, which can weigh on stock prices.

Higher rates bring about higher demanded returns throughout all asset classes

The 30-day treasury bill is considered to be risk-free. It’s too short a time period to lose purchasing power or see the government go belly up. If this increases, then returns on literally EVERYTHING ELSE must increase as well. Why else take the risk? This leads money to move from one asset class to the next in search of a new bargain given a higher risk-free rate. The musical chairs stops when a kind of equilibrium is reached, but higher rates have the capacity to reset the prices on everything.

Higher rates lead to lower valuations

This seems crazy but consider a risk-free rate of 3%. As an investor, you might buy an S&P 500 index fund expecting to get 6.5% to compensate you for taking the extra risk. The companies in that index hit that figure when their earnings represent 6.5% of their price, or 6.5/100. Think of this as an “earnings yield”, or the ratio of a company’s earnings to its price. The inverse of this is the company’s stock price to its earnings (aka p/e ratio). This would be 100/6.5 or 15.4 in this example.

The difference between the risk-free rate and expected return in the example above is 3.5%. If the risk-free rate rises by a full percentage point to 4%, the earnings yield will have to increase to 7.5/100 to get the same 3.5% return. This implies a p/e ratio of 100/7.5 or 13.33 and is a drop of about 13.5% from the previous example. The higher risk-free rate leads to lower p/e ratios and therefore lower prices.

The Fed can goose yields, too

The power of the print money cannot be overstated. The Fed can manipulate yields when it buys and sells treasury bonds. It’s currently in an accommodative mode and is buying up bonds. Buying bonds puts money in the hands of the bondholders who sold. This injects extra cash into the economy that is either loaned/spent (good for economy) or reinvested (good for asset prices).

Buying the bonds also drives down the yields. (Bond prices and bond yields are inversely correlated). Other asset classes can therefore attract dollars without having to offer as much return as they used to. This drives up asset prices across the board.

What’s happening today?

The Fed is still hoovering up bonds but they aren’t the world’s sole buyer. Yields have been ticking up since January as more and more investors move into risk assets. Historically, stocks are able to digest a move in yields of about two standard deviations or less in a single month. That works out to about 36 basis points (.0036) today.

That isn’t a big move in the grand scheme of things. But it’s the speed and underlying drivers of the move that matter most. Asset classes are playing a feverish game of musical chairs to figure out what the right equilibrium price should be given that bonds are steadily paying more via higher yields. Last year’s high flying tech stocks are selling off hard. Dollars are rotating into value names that were crushed last year when interest rates dropped and the economy closed. P/E multiples will ultimately compress in aggregate though not necessarily across every sector. Some sectors will compress more than others rise, which will lead to a lower overall multiple in the index but a few pleasant bright spots. (i.e. Dow rising while Nasdaq falling).

Where does it go from here?

We think the pause button was hit this week. Famed investor David Tepper of Appaloosa Capital provided a succinct yet esoteric rationale, which you can find here. The Bank of Japan (BoJ) has been a net seller of US Treasuries for the last few years. BoJ Governor Kuroda made an announcement last Friday that the bank wouldn’t be increasing the band for its yield target. It was widely expected to do so. Yields on Japanese treasuries dropped on the news.

Japanese treasuries are now looking less attractive relative to US treasuries, which is likely to make the BoJ a net buyer of US treasuries. This will put downward pressure on US bond yields and should provide some stability to offset the level of selling we’re seeing from other investors. This isn’t to say that yields will stagnate exactly where they are but we’re probably going to see range-bound activity over the next few months with ~1.6% (about where we are now) being the higher end of the range.

Couple temporarily stabilizing rates with a new $1.9tr fiscal stimulus package and the case to be bullish on asset prices starts to look good over the next few months.