According to one estimate, about $30 trillion will be passed down from older Americans to subsequent generations over the next 30 years.[1] That’s a staggering sum.

In contrast to many previous generations, people are now giving inheritance before death more and more frequently. In fact, about $0.71 of every dollar that is given to charity is donated by individuals who are still living – gifting by trust or will accounts for just $0.09 of every dollar.[2] The desire to see your money help the people you love and causes you care about is hard to overstate. This trend towards a “living inheritance” is likely to stick around.

Family Dynamics

This is the biggest stumbling block to seeing your dollars make a meaningful impact. Giving an inheritance before death, even a partial one, presents thorny issues. Each of your children’s needs may be different. Do you believe their inheritance should be different, too?

And how about timing? Some of your children may need the money now. Divorce and unexpected medical events are as common as they are costly. Should you gift some now to one child while leaving out the others who are on better financial footing?

Say nothing of the moral hazard that comes with this, either. Will an early inheritance discourage your children from pursuing meaningful and challenging careers? Will they simply fritter away what you worked so hard to build?

There are no easy answers. In our experience, open communication is the best policy. There may still be fights, disagreements, and hurt feelings; but you have the chance to get out in front of it. You are in control of the narrative when you give an inheritance before death. You have the chance to intervene and ameliorate conflict when gifting while you’re still here. The same can’t be said when you’ve passed on. The benefits of this are hard to overstate.

Seeing is Believing

One of the best reasons to give away funds whiling living is to see the positive impact it creates in the lives of your friends and family members. Your gift could be transformative. You can help your child secure a home or launch a business. A gift could set a grandchild up for college with a 529 plan, or get them interested in saving early with a gift of stock. You can invest in your community and give to local non-profits.

How you gift is entirely up to you, as are the warm and fuzzy feelings you get from doing it. Try it on a small scale. You might be surprised.

Ensuring Your Retirement is Secure

You need to make sure your own financial house is in order prior to giving an inheritance before death. It’s essential to ensure you won’t be giving away money you may need later in life. Retirement may last longer than you think, potentially 30+ years, and healthcare costs increase significantly as we age. Pro tip: review your entire financial plan before you give away the proverbial family farm. Your needs come first.

Mo’ Money Mo’ Problems

You can gift in all kinds of different ways, from cash and appreciated securities to real property, life estates, or even shares in a Family Limited Partnership (FLP). Some gifts feel good, like handing down family heirlooms to people you know will love and cherish them. Other gifts are more strategic and can be done for tax purposes.

Estate Taxes

Generally speaking, gifting property moves it out of your estate. A smaller estate could mean lower estate taxes, but there’s an important footnote. All gifts made above the annual gift exclusion (currently $16k per person) after 1976 get roped back into the estate at the time of your passing for purposes of calculating the size of your estate. This rule exists to keep you from transferring everything on your deathbed just to avoid estate taxes.

But you probably won’t be subject to estate taxes anyway. This is something that only impacts the top 1% of the top 1%. The first $12.06M (2022 figure) of your estate is exempted from estate taxes. Double it if you’re married. Odds are you’ll be able to skip out on paying this without issue at a Federal level, though your state may have a lower exemption limit for estate taxes on the state level.

If you do have a large estate then you need to tread lightly. There are many tools and techniques that can be used in the gifting world to reduce or eliminate estate taxes, but none of them is a silver bullet. You’ll need to use a variety of tools to build your plan. Our opinion here, but a good advisor could be worth their literal weight in gold depending on the size of your estate. Hire out for help on this.

Gift Taxes

There is a separate issue of gift taxes. Gifts made by an individual to another individual in excess of $16,000 (2022 limit) are subject to gift taxes. But you have a lifetime exclusion on this at the Federal level just like you do with estate taxes – currently $12.06M per individual in 2022.

Note – you can make unlimited gifts to your spouse without triggering gift or estate taxes so long as both you and your spouse are US citizens.

You might view that $16k ($32k if married) as the upper limit. Functionally its not. You just use up some of your exemption if you gift above that threshold, which requires you to add form 709 to your tax filing that year. Your CPA might charge you more for this so be aware!

One more thing to note, but the gift and estate tax exemption levels drop down to around $5M after 2025. There are opportunities to gift now that will disappear in just a few short years!

Other Exclusions

Medical expenses and qualified education expenses also get a free pass on estate and gift taxes. And not just college, by the way. Anyone attending an eligible education institution can be a recipient. But the payment must be for tuition and it must be paid directly to the institution. Pocket money and other expenses for books, computers, and general supplies don’t count.

There is a special caveat for 529 plans. The annual gift tax limit of $16k applies. However, you can lump up to five years’ worth of contributions into a single donation. That brings the total to $80k or $160k in a single year if your spouse contributes as well.

Medical expenses aren’t much different. You can directly pay an institution or insurance company to cover the costs of diagnosis, cure, mitigation, treatment or prevention of disease without it impacting your gift or estate tax exemptions.

Charity in Your Lifetime

You may also decide to give money to charity before your passing. Some types of property make great charitable donations while you’re living. Others make great gifts after you’ve passed, and others just aren’t great assets to be donating to charitable beneficiaries at all.

Gifting Appreciated Stock

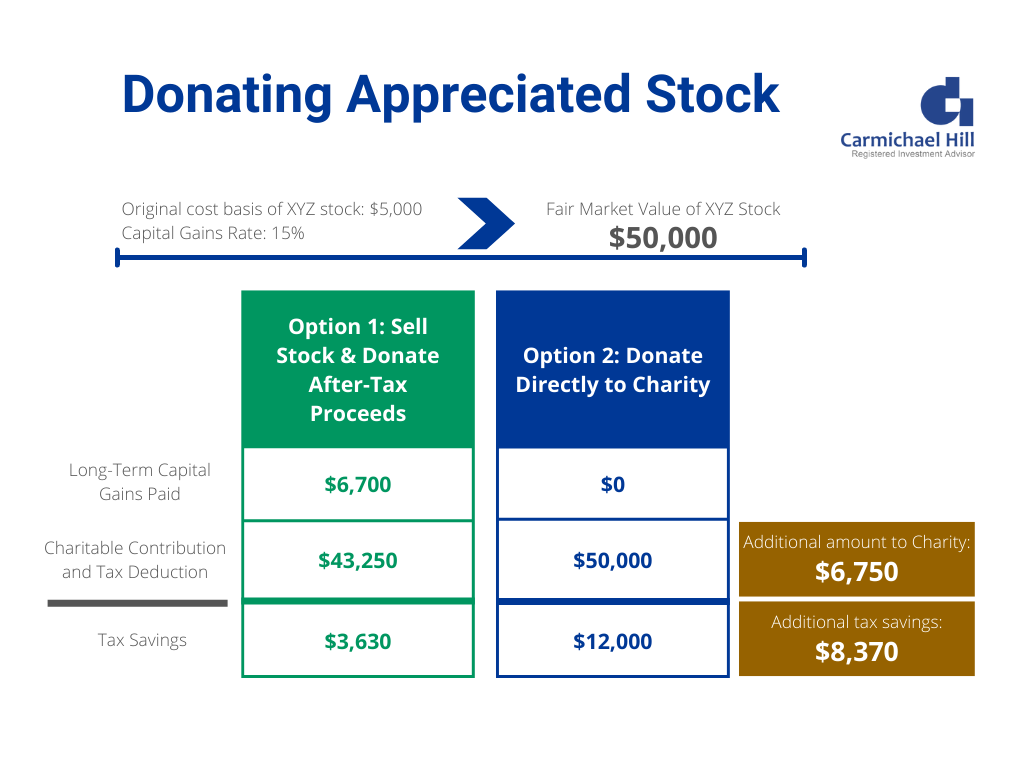

Appreciated securities in taxable accounts come at the top of the list for great assets to donate during your lifetime. You can deduct the full value of the securities you donate while avoiding tax on the appreciation. This makes it more far more favorable than selling the stock, recognizing the tax, and donating whatever cash is leftover. Consider this:

The tax savings and size of the donation are both larger in option two, making it a win-win. The only hiccup to this is that you must itemize your taxes to get the full value of the charitable contribution! This means having enough in miscellaneous deductions to exceed your standard deduction, which is $12,950 per person in 2022.

Donor Advised Funds

You may not be interested in donating that much at once. And don’t worry, it doesn’t make you a bad person. That’s where a Donor Advised Fund (DAF) can help. You can lump several years’ worth of donations into a single year with this vehicle to push you above the $12,950 standard deduction. You can then distribute from the DAF over the next few years to any charity you choose!

QCDs and Other Great Assets for Charities

You can donate all or a portion of your Required Minimum Distribution every year to charity. The act of doing so is known as a Qualified Charitable Distribution, or QCD. Donations made this way don’t need to be claimed as a miscellaneous itemized deduction, which means you can get the full value of the donation without having to exceed your $12,950 standard deduction!

Beyond this, your pre-tax retirement accounts are an excellent asset to leave at death to charity. The charity will pay zero tax on whatever you leave them, and as a pre-tax account you will have paid the IRS zilch as well!

Great Assets for the Next Generation

Roth-type accounts tend to be better left to kids and grandkids. Charities can avoid tax on just about anything you leave them, but your family members will pay tax on almost any asset you leave behind. The glaring exceptions are Roth accounts and life insurance payout outs, which are both received free and clear of income taxes and capital gains taxes. Non-qualified assets that are eligible for a step up in basis, such as a house or non-qualified brokerage accounts, are also largely tax free (or have minimal tax) when sold shortly after the original owner’s passing.

This stands in stark contrast to pre-tax accounts, which are fully taxable to your kids. Moreover, your children may be able to defer taking distributions from an inherited Roth account for up to ten years! How much could that nest egg grow with an extra full decade of tax-free compounding?

Conclusion

Taxes play an important role when giving your children part or all of their inheritance early, but they are not the sole consideration. Take care of yourself first and foremost and make sure you don’t gift too much too soon. Family harmony is also important, depending on how you distribute amongst family members. Open communication is usually best when it comes to preventing squabbles and resentment later. But for most people, it’s that special satisfaction you get from seeing your gifts improve the lives of those around you that becomes so critical.

[1] Accenture. The Greater Wealth Transfer: Capitalizing on the Intergenerational Shift in Wealth. 2016.

[2] Philanthropyroundtable.org. Statistics on US Generosity. 2022