Making the transition to retirement is a tremendous pleasure for most, but it comes with a few new challenges and headaches, too. Your taxes will be different. There will be new forms, new rules to follow to stay current on your tax bill, and new decisions to make on how much and from where to withhold!

If it feels a little overwhelming, don’t worry. We’ll show you where you’re likely to generate taxable income, how to calculate how much tax to withhold, where to withhold from, and how to ultimately pay those taxes in this article.

Withholding the right amount

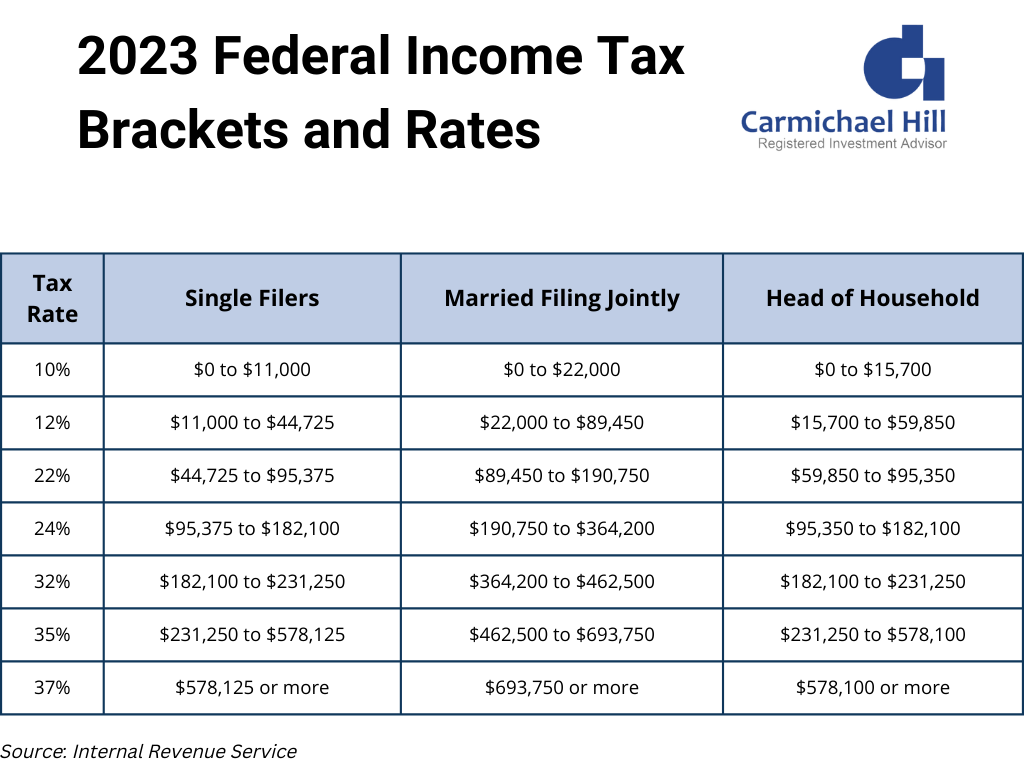

When we think about taxes, most of us think about marginal rates. This is the rate that corresponds to your current tax bracket. Every additional dollar you earn is taxed at the marginal rate. For example, you would be in the 24% bracket if you’re single and earn $100k/year.

But, the US tax system is tiered. Not every dollar you earn is taxed at the marginal rate. The first $11k is taxed at 10%, the next tranche of income is taxed at 12%, and so on. If you added up and weighed each of those tiers you’d get a blended rate that reflects what you’re paying in total. This is the effective rate, and it’s the level you want to target when determining how much tax to withhold in retirement.

Let’s carry that example from earlier forward. Making $100k of taxable income (after all credits and deductions) puts you in the 24% bracket, but your actual effective rate is less at 17.4% due to the tiered brackets.

You can withhold at a rate that is more than the effective rate, and if your income varies from year to year then that’s not necessarily a bad idea to leave some padding. But withholding too much equates to overpaying the IRS. Yes, you will get a refund when you file. But the IRS doesn’t pay any interest on the amount by which you overpaid. This is a classic example of opportunity cost – what could you have done with the extra money you sent to the IRS and how much could you have earned on it in the interim?

Calculating how much to withhold

But before you can calculate your effective bracket, you’ll first need to arrive at a reasonable estimate for annual income. These are the income sources we typically see from most retirees:

- Pension income (reported on Form 1099-R)

- Social Security (reported on Form SSA-1099)

- Interest, dividends, and capital gains/losses from investments (reported on Forms 1099-DIV, 1099-INT, and 1099-B)

- Retirement plan distributions. Includes accounts such as a 401(k), 403(b), IRA, and 401(a) (reported on Form 1099-R)

- Rental Income (you report this on Schedule E)

- Partnership income from certain investments (reported on Schedule K-1)

Tax Deductions

Adding all your income sources together will provide you with your gross income. But gross isn’t the same as taxable. Only part of your Social Security is taxable, for example. You’ll also qualify for deductions and potentially credits as well that can be used to reduce your taxable income or the amount of taxes owed directly. These need to be filtered out to get to a reasonable estimate.

Determining Adjusted Gross Income (AGI)

If you’ve ever heard the term “above the line” or “below the line” deductions, the line that’s being referred to is your Adjusted Gross Income, or line 11 of your Form 1040. And it’s important. Some deductions are taken before line 11 (above the line) while others are taken after (below the line).

Above the line deductions are more powerful than below the line since they help to determine what your AGI is in the first place, and that AGI figure gets plugged into other areas on your tax return to determine whether:

- You qualify for certain deductions and

- How big some of those deductions can be

For example, you can deduct out-of-pocket medical expenses greater than 7.5% of AGI if you itemize deductions. Your AGI is also used to determine how much of your charitable contributions can be deducted (usually limited to 60% of AGI). Another calculation based on your Modified Adjusted Gross Income is used to determine whether you can make Roth IRA contributions and deductible Traditional IRA contributions. Deductions that get you to a smaller AGI number are golden.

Standard or Itemized Deductions

The standard deduction in 2023 is big at $13,850 per person. You can claim an additional $1,500 per person if over age 65, or $1,850 if unmarried, over 65, and not a surviving spouse. You can take either the standard deduction or itemize your deductions when you file your taxes, but you can’t take both! Given the expansive size of the standard deduction, about 90% of taxpayers now choose to take it.

It’s our experience that most retirees who itemize deductions are those who made a large charitable gift for the year or had a major medical event with large out-of-pocket costs. Those must be itemized to receive credit, and if they total more than the standard deduction then it usually makes sense to itemize.

Once you determine which route you’re prepared to take for the year, itemized or standard deduction, you’ll subtract that figure from your AGI to determine your taxable income for the year (line 15 of Form 1040). This is the figure you will use to determine your marginal tax bracket.

Tax Credits

Calculating your taxable income gets you to your marginal bracket, but determining your effective bracket takes an extra step. A tax credit provides a dollar for dollar reduction in the amount of tax you owe. For instance, if you owe $10,000 in taxes and have a $2,000 credit, then you’ll only pay $8,000 to the IRS.

For comparison, a deduction reduces taxable income that in turn reduces the amount of tax owed, but it isn’t a straight dollar for dollar offset. Credits are much more powerful than deductions. Below is a quick side by side comparison of a $2,000 above the line deduction vs. a $2,000 credit for someone with $100,000 of taxable income:

Line 37 of your Form 1040 shows the total amount of tax you must pay after factoring in all credits and deductions. You’ll divide the figure on line 37 by your taxable income on line 15 to determine your effective tax bracket. Boom!

Setting your withholding amounts

Once you know your effective rate and have a decent idea on how much to withhold, you’ll need to set and/or update your withholding elections on your various income sources. This can be done online in most cases, but you could hit a few snags along the way.

401(k)s, 403(b)s, and other qualified employer-sponsored retirement plans

Plan providers are required by law to withhold no less than 20% from any taxable distribution paid to you. The only exception is for Required Minimum Distributions (RMDs) that begin at age 72. These distributions conform to the IRA withholding rules, which default to 10% with most custodians but can be changed or eliminated at any time by you. However, taking more than the RMD will subject any overage to the same 20% mandatory withholding rules that applied before you starting taking RMDs.

This can present a hiccup if your effective rate is less than 20%. An easy workaround is to simply reduce the withholding elections on one of your other income sources. Though depending on the size of your 401k distributions relative to the other income source(s), that may still not be enough.

Rolling assets directly to another plan that allows you to determine the withholding requirements yourself, such as an IRA, could also be an option. Just be sure to carefully think through the other implications of a move like that before pulling the trigger, such as fees and availability of investment options. You are not generally able to roll assets back into an old employer’s plan once you leave the company. Your decision to complete a rollover is therefore a one and done decision that cannot be reversed.

Roth and Non-Roth after-tax balances in employer plans

Mandatory withholding is only required for taxable balances in employer plans. This means that Roth distributions do not require any withholding on the part of your former employer, nor do any non-Roth after-tax contributions that you miraculously failed to convert to a Roth.

Traditional, SEP, and SIMPLE IRAs

The custodian of the IRA (SEP, SIMPLE, or Traditional) generally withholds 10% for Federal taxes by default. (Note – the custodian is the company that holds the investments, such as Schwab or Fidelity). You can update and change the withholding elections on any IRA at any time and for any reason, including slashing withholding all the way down to 0%. A short and simple form is usually all that is required.

Pensions and Annuities

The companies administering over pensions and the insurance companies that issue annuity checks must follow Federal laws regarding withholding. This means that you cannot elect a specific withholding percentage on these accounts. Distributions from pensions and annuities are treated just like wages for tax purposes, and the IRS therefore requires these companies to use the withholding tables in Publication 15 when sending you money. They rely on the information you provide them on Form W-P4 to determine what rate from the table to use for withholding. There is very little flexibility here.

Social Security

Withholding is optional for Social Security payments. But given that up to 85% of your payments could be taxable, it’s not a bad idea to withhold something. You can set up or change your withholding elections with the Social Security Administration by submitting Form W-4V.

Taxable bank and brokerage accounts

Taxes aren’t generally withheld from taxable bank and brokerage accounts. Dividends, interest, capital gains, and any other income that is generated is typically fully taxable to you and must be accounted for in other areas of your planning. This goes back to lines 2 and 3 of your Form 1040 that you used to determine your effective tax bracket.

If you know in advance what your approximate overall tax liability will be, then you can keep a portion of your earnings from your taxable accounts in cash to satisfy your tax bill in April. Though practically speaking, a well-designed asset allocation plan will typically keep a small portion in cash for events like this anyway.

The Bottom Line

Selecting your withholding amounts in a way that keeps you from overpaying the IRS each year isn’t rocket science, but it does require a little bit of leg work to get the math right given your various income sources. Even then it may not be a task you’d like to take on during your leisurely golden years. Tax planning and analysis is something we include with every retirement plan we produce. We can help you determine the right withholding mix for you. Contact us for a complimentary review today!