By Matt Bacon

Aug 19, 2020

Note: Carmichael Hill maintains a position in Tesla

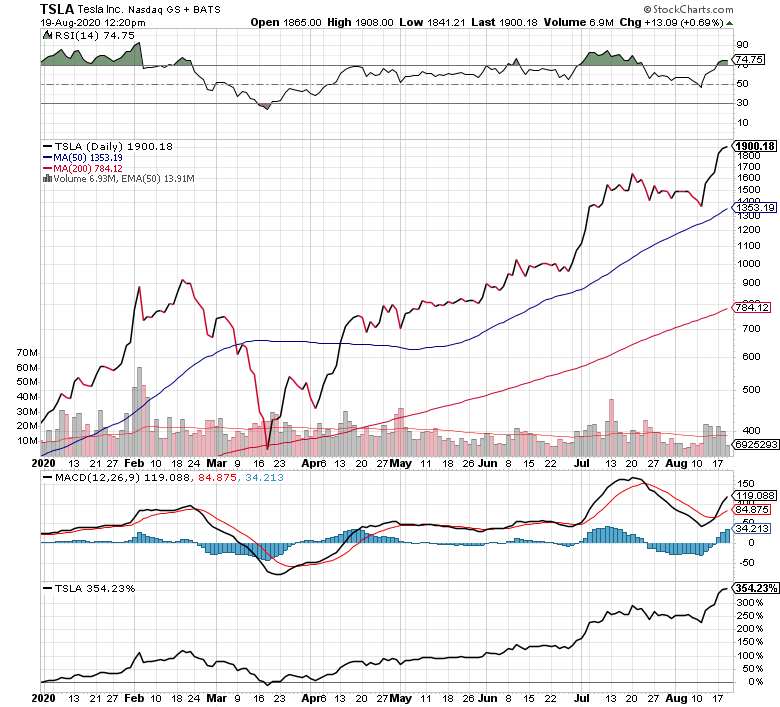

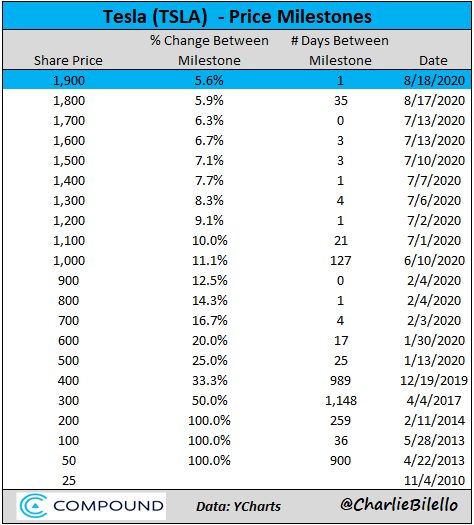

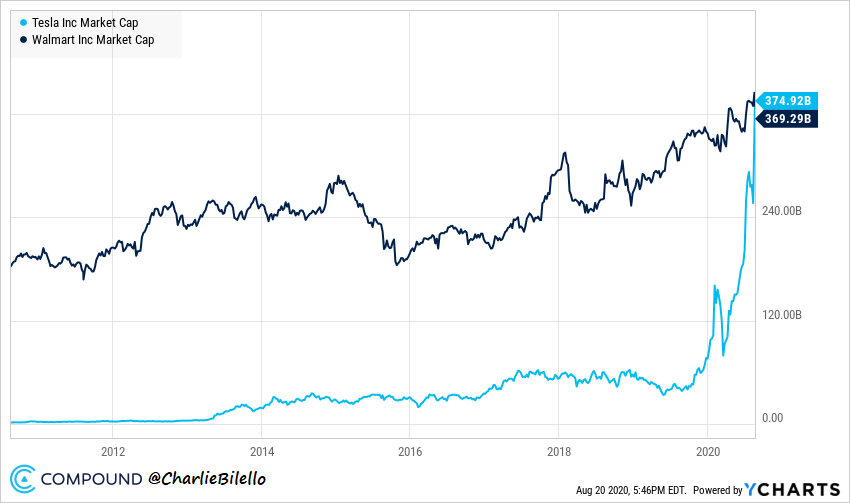

Telsa is arguably the hottest stock of the year having climbed nearly 330% in the first eight months alone. Few stocks can match its performance. None can match the hype. Despite this, our Tesla stock prediction is bearish over the long term. We’re not loading up on Tesla in 2020 or increasing our position in any meaningful way.

What’s Tesla actually worth?

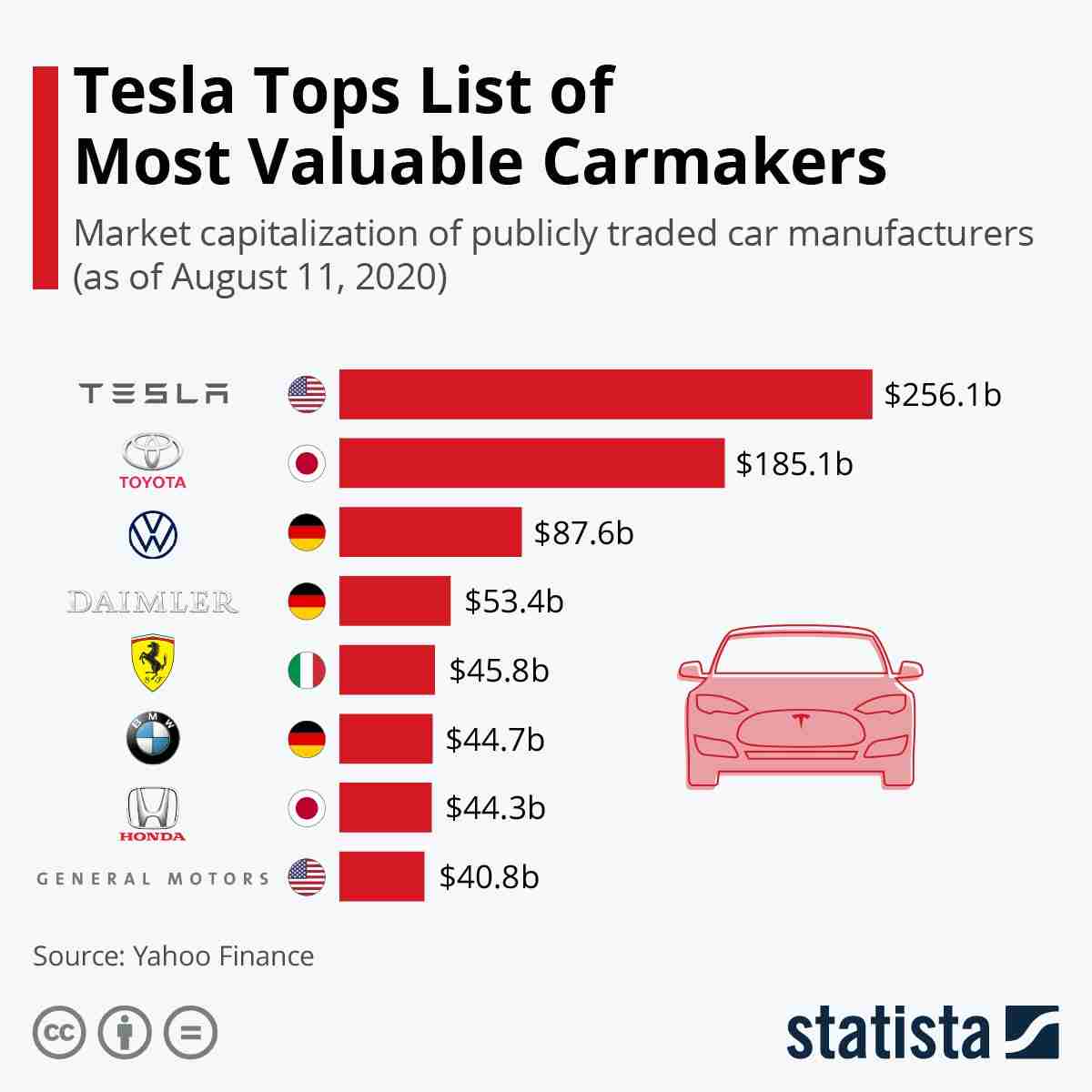

About $351bn by market cap, but this is disturbingly high for a company that produces and sells fewer cars than any other major auto manufacturer.

Visual breakdown of Tesla’s market cap compared to competitors

At the most recent quarter’s end, Telsa delivered a little over 90,000 vehicles. GM, Honda, BMW, Ferrari, and Daimler, whose combined market cap is still $27bn shy of Tesla as of Aug 11th, delivered just shy of 900,000 vehicles. I know what you’re thinking and no, Tesla does not have an average profit margin that’s 10x that of the competition. The valuation is just too high, and our Tesla prediction is that at some point the price will have to come back down to earth.

Moreover, Tesla’s biggest profit driver last quarter wasn’t even cars. It was carbon credits. Regulations adopted by California and nine other states require manufacturers of internal combustion engine based vehicles to earn a certain number of zero-emission vehicle (ZEV) credits each year. Companies earn these credits by selling electric vehicles. The problem for legacy auto makers such as GM and Toyota is that consumer demand for electric vehicles hasn’t kept pace with the number of vehicles the law says they should be selling to avoid penalties. This misalignment means that many manufacturers are short of credits. Enter Tesla, a company with a surplus of credits that is willing to sell.

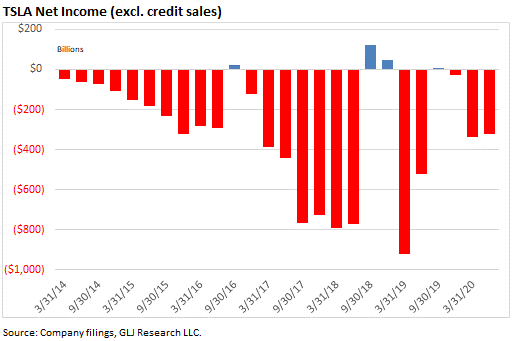

About 7% of Tesla’s net revenue came from these credits in its most recent quarter. As the company incurs no real direct cost to earn these credits, its easily their most profitable business segment. Without these the company would not have achieved four consecutive quarters of profitability, which is a requirement to enter the S&P 500 index. Here’s a peak of what net income looks like without the credits:

Tesla has a significant amount of regulatory risk here. This law makes them gobs of money. When it changes, or when the competition finally learns how to sell more electric vehicles, Tesla is going to have some uncomfortable earnings calls.

Beyond this, there is an existential question no analyst can seem to confidently answer: Is Telsa a battery company that sells cars? Or is it a car company with a fancy battery? The company doesn’t seem confident it knows either. The first two sentences on the company about page say it was founded in 2003 by engineers that wanted to make electric cars, but that their mission is to transition the world to sustainable energy. These are obviously related but by no means the same thing. Here’s what the company currently does:

Batteries

Tesla has the best battery on the market. Most electric vehicle (EV) manufacturers use large individual battery cells, but tesla uses thousands of small lithium-ion commodity cells similar to what’s used in your phone or tablet. This gives the battery more energy density than the other guys, allowing Tesla cars to go far further on a single charge. Essentially, its better fuel economy. The competition is likely two years away from catching up in this regard, maybe even longer. This adds to the Tesla bull case.

The company also manufactures home devices, including a solar roof and energy storage devices. These aren’t major profit drivers for the company and don’t fit neatly with Tesla’s auto manufacturing capabilities. It’s unclear what the future of these products is.

Glass and Motors

Tesla produces its own motors and some of its glass. The glass produced contains an embedded solar collector and may have applications outside of auto production. Motors, however, are strictly for the vehicles.

Autopilot

Not wanting to be left out of the self-driving race, Tesla is also designing autopilot driving technology. You may remember this from the crash, death, and subsequent lawsuit related to their self-driving tech in 2018. CEO Elon Musk has provided numerous timelines for completion of this project, all of which have been pushed back. Most recently, Musk stated that Tesla’s self-driving technology would be feature complete by the end of 2020 but that “doesn’t mean features are working well”. Why even bother then?

There is fierce competition in this space, namely from Google’s Waymo, and the first to market wins. Tesla just announced a new Gigafactory site in Austin, TX, which won’t come cheaply. Their cash is going toward increasing vehicle production, which is the right move if you’re a car company looking increase market share and sell more vehicles. This begs the question of how much time, energy, and capital will continue to flow towards complex software products like a suite of self-driving tools. Arguably not much, or at least not in the near term.

Hardware Company Priced like a Software Company

So Tesla is beefing up its manufacturing capabilities, expanding plant and production facilities, and working to increase its vehicle production output. Its technology, by Musk’s own admission, isn’t great. We believe it should be priced like an auto company. CARZ, a global auto index fund, trades with a price to earnings ratio of about 11.70x. Toyota, the world’s second largest automaker by market cap after Tesla, trades at around 10x. Tesla, however, trades at about 973x. For reference, Amazon is currently trading at about 126x, Microsoft is at 37x, and Apple is at about 35x.

This does not make any sense to us. Tesla, as an auto manufacturer, is overvalued. Car companies generally trade at lower valuations than software companies due to how they scale. For Tesla to ramp up and sell more cars they need to build more plants, purchase more steel and raw materials, hire more workers, and physically deliver more cars. This is expensive. Tesla has to burn through a lot of cash to grow.

By contrast, software companies find scale by adding users or selling digital products. Neither of these is especially capital intensive. Raw materials aren’t required. Physical delivery is non-existent. More staff and a bigger office is required at some point, but the incremental cost of this per worker required and sq ft needed still tends to be relatively low. When Facebook bought WhatsApp in 2014, the company had a $19bn valuation and just 55 employees! Software companies can operate like this. Auto manufacturers cannot.

Yet, investors seem to feel Tesla is worth a software like multiple. This is short sighted, but market forces look like they’ll prevail in the near term. There are a few things driving its valuation.

Cash on the Sidelines

Tesla went public in the summer of 2010. It climbed prolifically in 2013 on great production and delivery numbers. It’s posting strong deliveries again, but we believe record levels of cash and investor speculation is driving more of the run up this year.

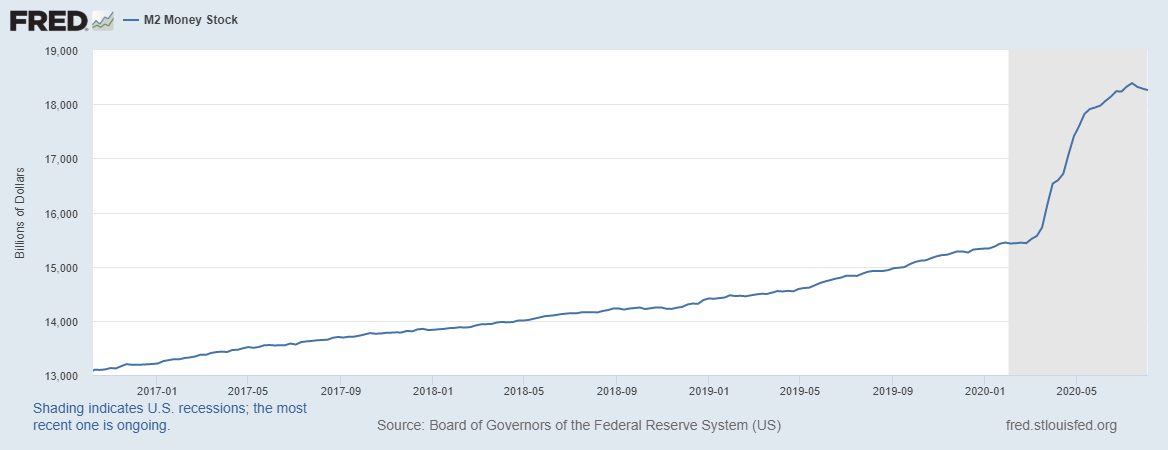

The Fed’s pandemic response has led to record levels of money printing. M2, a measure of money supply consisting of cash and checking deposits, savings, and money market funds, has increased by nearly $3.5 trillion dollars this year.

Cash on this sidelines now sits at over $5 trillion dollars. This is about trillion dollars more than in February, just before the dramatic market pullback. Investors have been slowly moving back into equities since but are still sitting on record levels of cash.

With all this cash there is a desire for opportunities to put capital to work. For some this means Tesla. Data from RobinTrack, a data aggregator providing information on the trading habits of the RobinHood app user base, showed 40,000 users adding Tesla to their account in a single day in July. Obviously the stock has momentum, but strangely the trading volume looks normal year to date.

There have been brief periods of the stock looking overbought or oversold, but on the whole this looks to be a case of investors gradually piling in on Tesla’s momentum after getting spooked in March.

A Stock Split to Remedy the Affordability Crisis

Earlier this month, Tesla announced that it would complete a five for one stock split. This will reduce Tesla’s stock price by 1/5 of it’s current value, thereby making it “more affordable” for the average investor. Functionally splits do nothing to alter the intrinsic value of the company – it’s just a tool used to manipulate share price. Despite academic evidence that these maneuvers don’t add long-term value for the shareholder, investors still love to gobble up shares of a company completing a split. Tesla is no different. The stock is up almost 40% since the split announcement on Aug 11th. Little else has been announced that would suggest this is anything other than investors wanting to get in on the split.

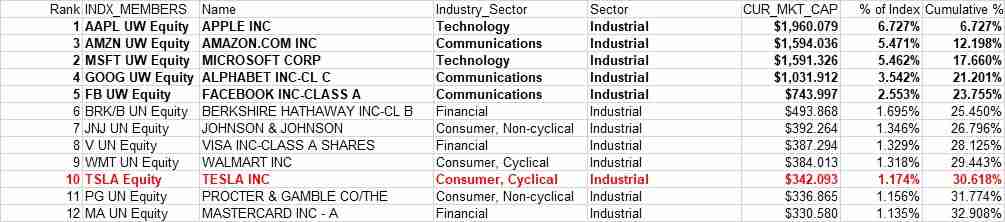

S&P 500 Inclusion and Passive Buying

What’s interesting in Tesla’s case regarding its split is its possible inclusion in the S&P 500 index. A selection committee using unpublished guidelines will have to determine whether or not Tesla can join, but many signs are pointing to yes. It’s now the 10th largest company in the US by market cap. The only other company to crack the top 10 and not make it into the S&P 500 was Berkshire Hathaway. They were added after a 50-1 stock split of their class B shares in 2010. If history is any kind of guide, then Tesla should also be added soon.

Inclusion in the S&P is a big deal. There is nearly $4.6 trillion tied to the index in passive strategies. Tesla’s inclusion would mean index funds and ETFs tracking the S&P would suddenly need to purchase Tesla shares or suffer a wide tracking error. The purchases by these funds would be substantial. Given this, our Tesla stock prediction in the short run is an appreciable rise in price.

This could be undone if Tesla uses the increased demand as an opportunity to raise capital through the issue of new shares. This would create dilution, which would water down the share price and offset some of the appreciation from the flood of passive buying.

Chasing Returns and Why Valuations Matter

We’ve all seen a hot stock before. A company posts better than expected numbers, investors get excited, the company PR machine goes to work, and in the right conditions the stock can vault higher on little more than optimism and mild good news. Not to say there aren’t things to get excited about with Tesla, there are, but not to the tune of 973x earnings. Investors are moving cash into the stock hoping to capture some of the recent momentum and ride the wave up.

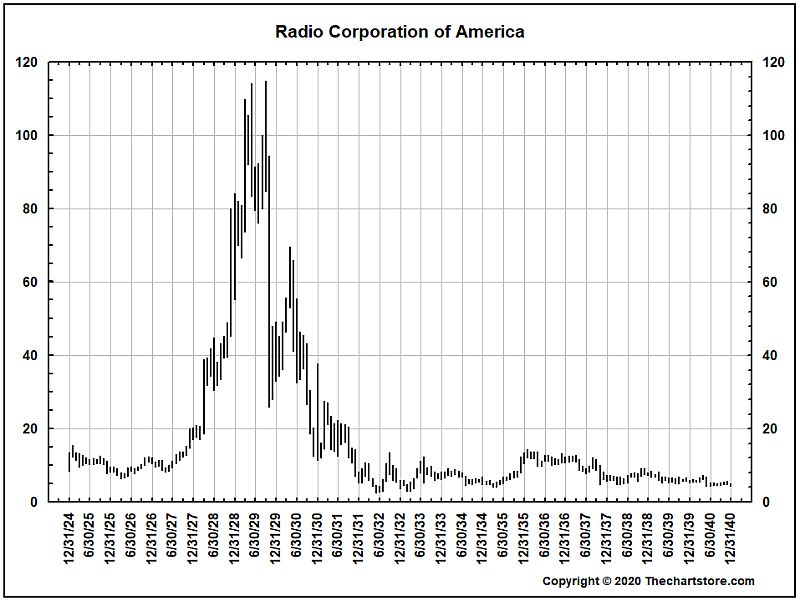

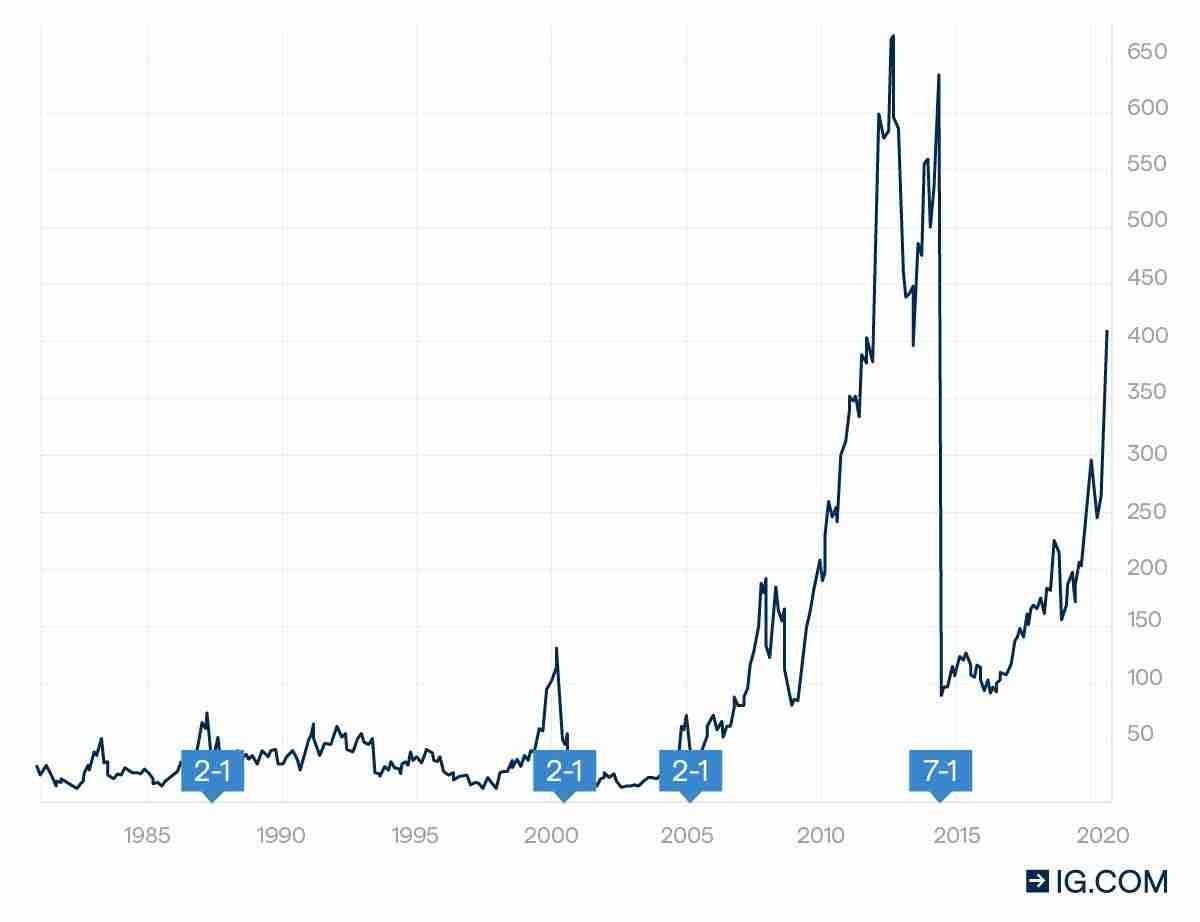

This is going to work, especially if/when Tesla joins the S&P 500, but only over the short run. There just isn’t enough there at the moment for a car company like Tesla to trade where it is. Consider the case of the Radio Company of America, or RCA. They produce consumer electronics and odds are you’ve probably watched a show on one of their TVs at some point in your life. The company has a long history dating back to its founding in 1919, and in the roaring 20s this was THE stock to own.

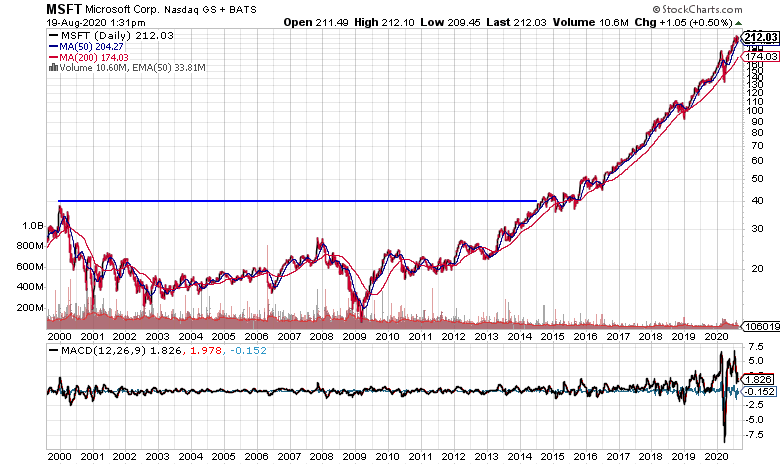

Notice that mountain shaped pattern? The stock was hot for a few years but cooled off quickly. This happens when investors forget about/choose to ignore valuations. Something similar happened to tech stocks during the dot com boom. It would take Microsoft over 14 years to recoup what they lost during the dot com crash.

What’s it actually worth?

Most car companies trade in a range that’s around 10x-15x earnings. If Tesla were to fit this model, it would trade at somewhere around $22-33/share. However this would be an unfairly low figure for them. It fails to account for the IP they’ve built up in the development of their battery and the tangential businesses they have in solar and energy storage, nor does it capture the premium that should be afforded to a dynamic CEO such as Musk.

Of the 30 Wall Street analysts currently providing a 12-month forecast for Tesla, the median price target is $1,425. This represents a 25% downside from its current price. Roughly a month ago, Tesla earned a dubious distinction that no other company has achieved before: the volume of shorts against the stock (i.e. people betting Tesla will drop in value) exceeded $20bn. There are few institutional investors willing to make a bull case for Tesla to climb higher, but the few that did have been proven right thus far.

A Barclays analyst has maintained his $300 price target since February, but he’s in the minority and the lowest estimate on Wall Street. Nevertheless, the broad consensus is that Tesla is overvalued and has been overvalued for nearly all of 2020. We hold this viewpoint as well.

Tesla is positioned to perform well through the end of the year. It’s racked up momentum, there’s cash on the sidelines looking for a play, and the ultra-low interest rate environment means the company has access to capital at near zero rates. All this bodes well in the short-term. Longer term the outlook is less rosy. Valuations will at some point have to come back down to earth. It’s difficult to guess what the catalyst for this may be, but we expect it will come from competition. An announcement of a battery breakthrough from an EV competitor is all it takes. Will people still be as excited about Tesla when they can get an amazing electric car from BMW? We don’t think so, and we’re not loading up on Tesla or adding any more at the current price as a result.