Analyzing Portfolio Performance with your financial planner

Ever wondered how to make sense of the complex maze that is your investment portfolio? You’re not alone. Many investors feel like they’ve been dropped into a foreign city without a map when it comes to understanding their investments.

This post acts as your investment GPS, guiding you through the twists and turns of analyzing portfolio performance with your financial planner. We’ll dive into asset allocation, explore global diversification strategies, and shine a light on fixed income quality & maturity.

Analyzing portfolio performance with your financial planner isn’t just about numbers – it’s about aligning those numbers with your personal finance goals. It’s an art as much as it is science; each brush stroke paints a picture of where you stand financially today…and where you could be tomorrow.

Remember, life isn’t always a smooth ride – it’s the bumps along the way that help us grow and become stronger. That’s just part of life. But it’s those challenges that help us grow and become stronger.

Table of Contents:

- How do you analyze portfolio performance?

- How do you evaluate the performance of a portfolio manager?

- What 5 steps should you take when evaluating your portfolio?

- How do you calculate portfolio performance?

Understanding Portfolio Performance Analysis

Analyzing portfolio performance with your financial planner can seem like a daunting task. But, it’s crucial for making informed investment decisions and effective performance evaluation.

A key part of this process is an investment portfolio review. This review helps to assess if your investments align with your financial goals, risk tolerance, and tax efficiency objectives. It involves scrutinizing various factors such as asset allocation, diversification, risk exposure along with management expenses and ownership costs.

By focusing on these areas, you’ll get a clear picture of how well or poorly the investments are performing against benchmarks in different market conditions.

The objective here isn’t just about achieving higher returns but also managing potential risks effectively. It lets you evaluate if any adjustments need to be made to maintain alignment between the portfolio’s performance and investment objectives. Contact Carmichael Hill & Associates today for a free portfolio checkup and review.

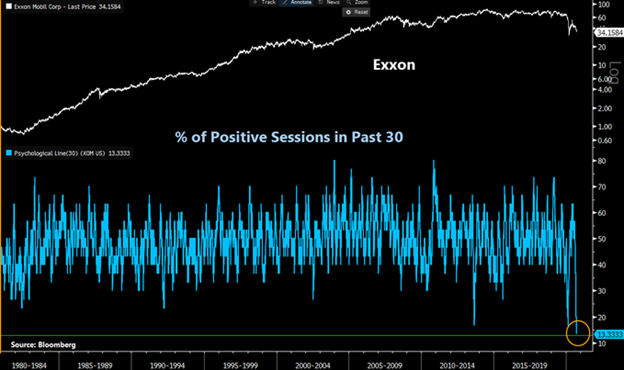

The Importance of Regular Reviews

Your portfolio requires regular reviews due to the dynamic nature of markets. Markets change constantly due to various reasons ranging from economic indicators to geopolitical events. Therefore, reviewing investments frequently ensures that your portfolio stays relevant under changing scenarios.

What Should You Expect From A Review?

In each review session with your advisor, look forward to discussing both macroeconomic trends affecting broad markets as well as specific developments related directly to individual holdings within the portfolios. Remember that understanding why certain assets performed better than others provides valuable insights into what changes may need implementing going forward.

The Role of Asset Allocation in Portfolio Performance

Asset allocation plays a critical role in your portfolio’s performance. It’s like the conductor leading an orchestra, coordinating different instruments (or assets) to create harmonious music (returns). This strategy helps balance risk and reward by dividing your investments among various asset classes such as stocks, bonds, and cash equivalents.

A compelling statistic highlights the importance of this approach: asset allocation can account for up to 90% of portfolio returns over the long term. So why does it matter so much?

Well, each type of investment performs differently under market conditions. Some are more volatile than others. Stocks may offer higher potential returns but also carry more risk. Bonds provide steady income but have lower growth potential compared to stocks.

Diversifying across these asset types means you’re not putting all your eggs into one basket – which reduces risk while still aiming for solid returns based on your personal financial goals and time horizon.

Balancing Risk with Reward through Proper Asset Allocation

In other words, getting asset allocation right is key because it lets you align your investment decisions with both your short-term needs (like paying bills or saving for vacation) and longer-term ambitions such as retirement planning or funding college education for children.

This delicate balancing act isn’t something that happens once and then is forgotten about. Regular reviews help ensure that changes in market conditions or life circumstances still allow for harmony between different components within our ‘investment orchestra’.

Reach out today if you’d like some guidance on how best to allocate assets within YOUR own unique financial situation.

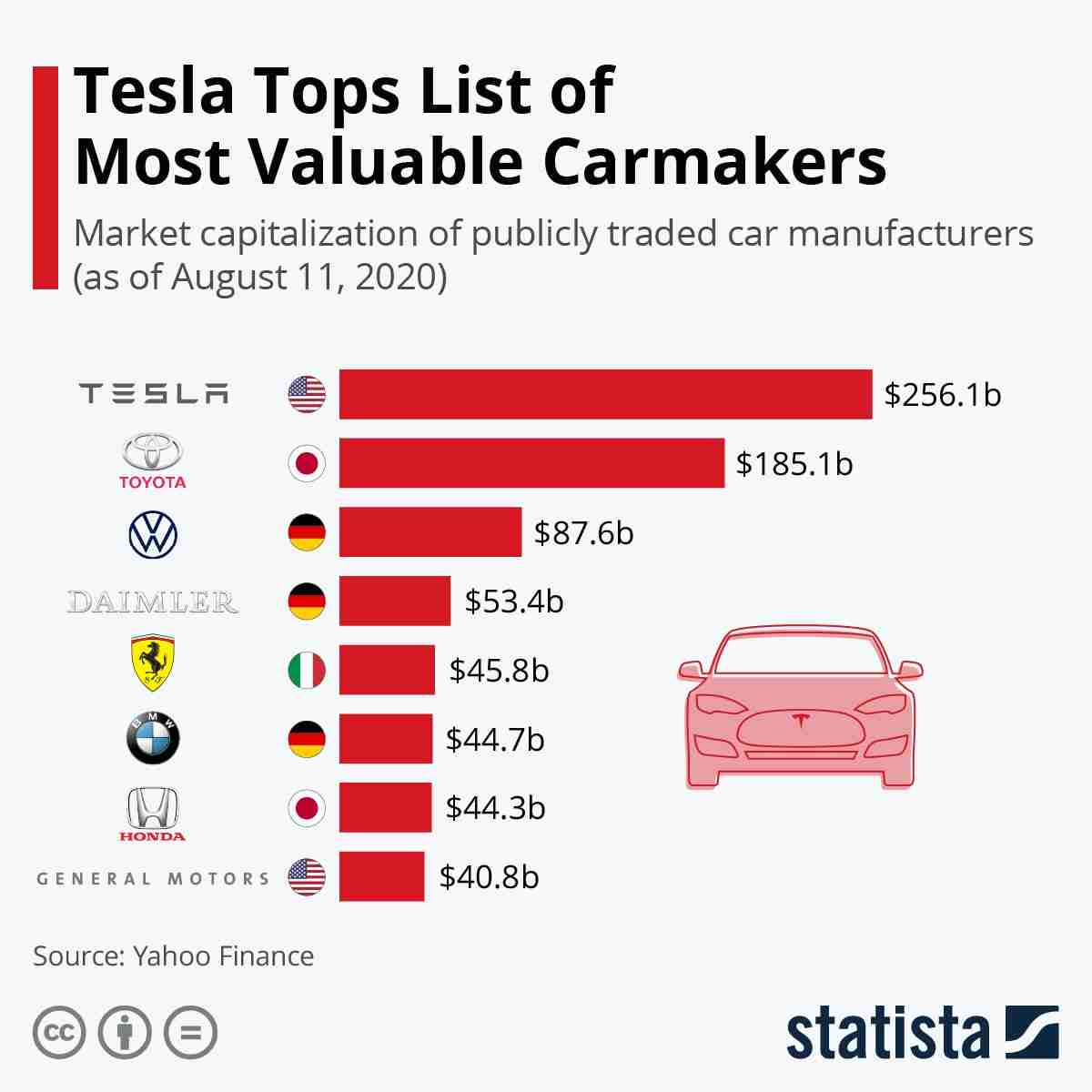

Global Diversification as a Strategy

Diversifying your investments across various asset classes and regions can lead to higher returns. This strategy reduces exposure to domestic market risk while providing growth potential in developed and emerging markets.

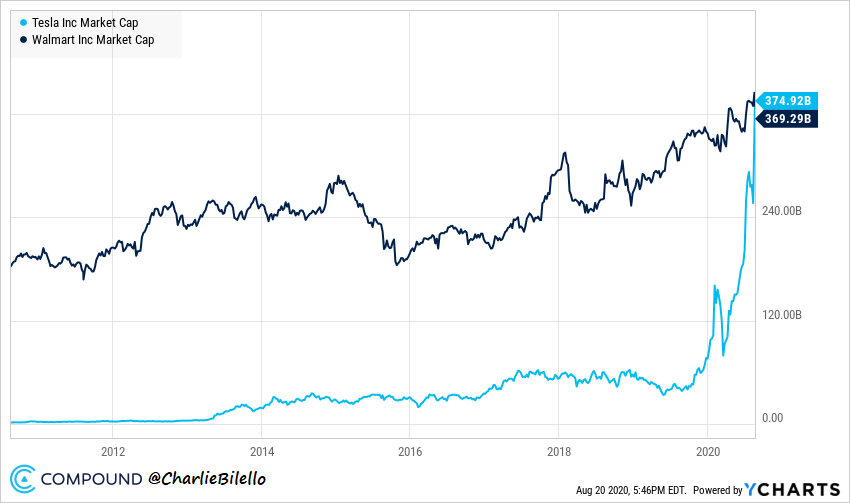

Managing Stock Concentration Risk

A significant part of diversification involves managing stock concentration risk. Having too much money concentrated in one company or a small group of companies can significantly increase portfolio risk. Spreading investments across multiple securities globally helps to reduce that danger.

The beauty of global diversification is in the ability to absorb shocks from individual stocks or sectors. For instance, if technology stocks are performing poorly in the U.S., manufacturing shares may be booming somewhere else.

Equity Factor Analysis

Besides geographical distribution, it’s important to look at other characteristics influencing portfolio performance such as company size, value, and profitability. These characteristics are known collectively as equity factors.

In essence, these are traits which have historically shown an impact on security selection and ultimately portfolio turnover. In short: they help us understand how well our diversified stock investments perform over time.

Note:

“Key Stats: Global diversification reduces exposure to domestic market risk by up 50%, while potentially enhancing growth prospects within developed & emerging markets.”

Understanding Fixed Income Quality & Maturity

The world of fixed income can seem like a dense forest filled with treasury bills and bonds. Don’t fret – we’ll guide you through the thicket of fixed income investments.

Fixed income quality refers to the credit rating of bonds. Think of it as a way to rate debt payment quality over time. In financial lingo, fixed income quality is an indicator of how likely the bond issuer is going to repay their debt.

If you’re excited by thrill-seeking adventures, then riskier investments with lower ratings might be more appealing as they typically offer higher returns due to increased risk exposure.

Bond Maturity: A Countdown Clock

A bond’s maturity date is a confirmed date including principal plus interest. This date affects both yields and sensitivity towards changes in interest rates.

Take note, if interest rates increase while you’re holding onto a long-term bond that pays low-interest rate, you may see changes in returns.

With proper understanding and careful analysis it’s possible to understand bond maturity factors over time. The next time you’re considering an investment in fixed income securities or portfolio analysis, remember to check the credit rating and maturity date. Look for the best quality and timing to maximize gains.

Key Takeaway:

Cracking the fixed income code is all about understanding quality and maturity. Just like a trustworthy borrower who always pays credits on time, high-quality bonds are more likely to repay their debt. The maturity date is when the bond promises full repayment. Remember, timing matters when it comes to maximizing earrings on bonds.

Evaluating Investment Costs

Understanding the impact of fees and expenses on your investment returns is crucial. It’s not just about the gains you make, but also how much of those returns remain in your pocket.

Investment outlay may include fees, levies, and costs associated with obtaining, possessing, and disposing of investments. These fees can significantly erode your overall return if not kept in check.

The Real Cost of Fees

Fees might seem small when viewed as a percentage. But consider this: If Warren Buffett had set up Berkshire Hathaway as a hedge fund and charged 2%/year and 20% of profits, then a $1,000 investment at the get go would have turned into $396,000 by 2009. With no fees this would have netted $4.3M. You may receive great value for the fees you pay, but like anything it’s important to keep an eye on costs as you manage your portfolioCommissions – A Hidden Drain?

Commissions are charges by brokers or advisors for executing trades or offering advice. While they may seem insignificant per transaction, these costs add up over time especially with frequent trading activity. Commissions may come in the form of ticket charges, which are costs that may be incurred to buy and sell securities in a brokerage account. They may also be baked into the cost structure of the financial products you buy, such as mutual funds and annuities. This dynamic may lead to reduced net profits.

Beware The Expense Ratios

If mutual funds or ETFs form part of your investment portfolio, be aware that these come with expense ratios in an annual charge that’s deducted from the fund’s assets. This impacts the return delivered to investors because lower expenses mean more money stays invested towards growth.

Keep tabs on every cost aspect tied to investing. This will help increase long-term gains while ensuring financial goals remain within reach.

However, remember that low-cost does not equate better value. Factors like asset allocation strategies should align well with personal risk tolerance levels.

Importance of Tax Efficiency

One may think of taxes as a necessary annoyance, but they can have an immense effect on the return from investments. Focus on tax efficiency measures to maximize after-tax returns.

Tax efficiency involves strategies that aim to minimize tax liability and maximize after-tax returns. How can one go about reducing their tax liability and maximizing returns? Let’s dive into the details.

Assessing Risk Tolerance

Assessing your risk tolerance is not only crucial for deciding what kind of investments suit you best; it’s also important in managing your tax burden. Higher-risk assets typically come with higher potential rewards – but often mean more significant taxable events too.

A savvy financial advisor will work to understand your personal risk tolerance. They can help align these factors and guide you towards decisions tailored for optimum tax efficiency. Your advisor will help ensure that every dollar in your investment portfolio works as hard as possible.

A solid grasp on risk tolerance can significantly improve after-tax returns for investors. As the saying goes: “It’s not what you earn; it’s what you keep.”

Finding Your Balance Point

Since no two investors are alike, there isn’t a one-size-fits-all approach to a financial strategy. You’ll need to consider various factors such as current income level, expected future earnings, retirement age, and family situation before determining which strategies work best in terms of both growth and taxation.

Collaborating with a Financial Planner for Portfolio Analysis

Working closely with a financial advisor can bring significant benefits to your investment portfolio. Their expertise aids in the understanding of complex market conditions, which is crucial when analyzing portfolio performance.

Choosing a Registered Investment Advisor

A registered investment advisor isn’t just another suit on Wall Street. They’re someone who understands your financial goals and guides you towards achieving them. Picking the right partner means considering their approach to asset allocation, how they handle risk exposure, and whether their style aligns with yours.

In our experience, we’ve found that clients appreciate advisors who use scenario analysis as part of their strategy – this allows for a “sneak peek” into potential futures.

Reviewing Investments with a Financial Planner

The world doesn’t stop spinning, and neither does the stock market. Regular portfolio review sessions keep us informed about short-term fluctuations and long-term trends alike.

An effective performance evaluation includes everything from individual stocks to mutual funds while taking note of factors such as time horizon or treasury bills’ impact on fixed income assets.

We believe reviews are opportunities not only for making adjustments but also reaffirming commitment to established strategies even when markets seem chaotic. And remember, chaos often brings opportunity.

Best Practices for Analyzing Portfolio Performance

Analyzing your portfolio performance doesn’t have to be daunting. The first step is setting realistic investment goals. Keep track of how your investments are performing and whether they align with your goals over time.

Monitoring and adjusting investment strategies will help you craft an informed approach. This is crucial as stock markets fluctuate and your personal finance needs change over time.

A key component in evaluating the health of an investment portfolio involves considering market conditions as well as short-term fluctuations. Technology can be a useful tool in understanding potential risks and identifying chances that could affect one’s financial future.

The Role of Technology

In today’s digital age, technology plays a pivotal role in managing our finances. Various portfolio analysis tools and software services can help investors get comprehensive views on their assets’ performance.

These tools allow individual investors to monitor everything from asset allocation trends, risk exposure, scenario analysis results down to regular portfolio checkups – all at the click of a button.

Making Investment Decisions Wisely

By taking calculated steps towards higher returns, keeping tabs on reducing risk, and monitoring performance overtime, you can make wise investment decisions.

Keep in mind that chasing after every financial trend may result in more turnover than necessary. This can harm both long-term growth and short term stability.

Routine reviews of your portfolio ensure that your investment strategy aligns with your goals. So, are you ready for a portfolio checkup?

Key Takeaway:

Don’t be intimidated by portfolio performance analysis. Start with realistic investment goals and regularly review your strategies, adjusting for market fluctuations and personal finance changes. Use technology to get a detailed view of asset performance, make wise investment decisions considering risk vs returns balance, and don’t forget regular checkups to stay on track.

Case Studies on Portfolio Performance Analysis

Analyzing portfolio performance can be a complex task. Ensuring your investment approach is consistent with your income goals and risk tolerance is critical. Let’s examine two hypothetical scenarios.

Jane’s Diversified Asset Allocation Strategy

Jane diversified her investment portfolio to include stocks, bonds, and mutual funds in order to reduce risk exposure while still having the potential for higher returns. This approach helped Jane reduce risk exposure while ensuring potential for higher returns despite market fluctuations.

In this scenario, Jane’s stock market assets experienced short-term volatility but achieved average annual returns of 7% over the long term. Her bond investments acted as a buffer during periods of stock market downturns by providing stable income through interest payments.

John’s Concentrated Security Selection Approach

Contrastingly, John focused on security selection within the U.S equity markets only – specifically in technology companies expecting significant growth due to digital transformation trends globally.

This approach led him towards potentially higher returns than diversified portfolios (like Jane’s) in bull markets. However, his concentrated approach also meant he faced greater risk exposure during bearish phases when tech stocks underperformed compared to other sectors or developed markets abroad.

Note: Every investor is unique – you might find yourself somewhere between Jane and John in terms of investment strategies depending upon personal situations or timeline considerations.

To get insights into your own portfolio performance based on past data or scenario analysis, consider seeking help from professional financial advisors. They can provide personalized advice on asset allocation, portfolio risk management, and investment goals in line with market conditions.

FAQs in Relation to Analyzing Portfolio Performance With Your Financial Planner

How do you analyze portfolio performance?

Portfolio performance is analyzed by reviewing asset allocation, diversification strategies, and returns. Assess how investments align with your financial goals and risk tolerance.

How do you evaluate the performance of a portfolio manager?

Evaluate their effectiveness based on investment results compared to benchmarks, strategy execution, communication skills, and understanding of your financial needs.

What 5 steps should you take when evaluating your portfolio?

First, review asset allocation. Second, check for diversification. Next, compare returns against relevant benchmarks. Then review tax efficiency and tax strategy. Finally, take a close look at costs related to investing.

How do you calculate portfolio performance?

To figure out how well an investment is doing over time, you can use formulas like Time-Weighted Return or Money-Weighted Return. These formulas measure gains relative to initial investment.

Conclusion

We’ve explored the vast landscape of analyzing portfolio performance with your financial planner. We discussed the role of asset allocation in shaping returns and mitigated risk exposure through global diversification.

This article explored the impact of fixed income quality & maturity on bond yields and sensitivities. In addition, we touched on investment costs that can eat away at profits.

We stressed tax efficiency for improved after-tax returns and highlighted personal risk tolerance assessment as a way to balance growth and safety. Finally, we underscored the importance of working with a trusted advisor in reviewing investments regularly.

In essence, every step you take towards understanding your portfolio can help shape your future wealth journey more accurately. Taking an informed approach can allow you to navigate market conditions confidently and realize higher returns without losing sleep over short-term fluctuations or sudden market risks.