Tax-efficient investing tips

Ever felt like your hard-earned investments are being eaten away by an invisible force? That’s often the unexpected result of taxes. But what if I told you there’s a way to safely prevent these losses?

Welcome to the world of tax-efficient investing tips.

This isn’t about cheating Uncle Sam. It’s all about knowing how different investment strategies can help minimize your tax burden while boosting after-tax returns.

We’re going on a deep dive into account types with their own unique tax advantages and disadvantages. We will discuss how choosing wisely could give you more bang for your buck. You’ll also get an inside scoop on maximizing contributions to retirement accounts like IRAs and 401(k)s for significant tax benefits.

Stay tuned! We’ve got more to share about optimizing tax through effective asset allocation.

Table of Contents:

- Tax-efficient Investments for Your Accounts

- Navigating Retirement Accounts for Tax Benefits

- Making the Most Out of Contribution Limits

- Understanding the Tax Advantages of Traditional and Roth IRAs

- Beyond Contribution Limits: Uncovering More Opportunities

- Tax Advantages of Municipal Bonds Over Corporate Bonds

- The Trade-off Between Risk and Reward

- A Note About Local Income Taxes

- The Potential for Lower Capital Gains Taxes

- Picking The Right Kind Of Fund For Your Needs

- Navigating Through Actively Managed And Index Funds

- What is the best way to invest to reduce taxes?

- What is a tax-efficient way of investing?

- Which investment is best for tax saving?

- What is a tax-efficient investment strategy?

Understanding Tax-Efficient Investing Strategies

Taxes can take a big bite out of your investment returns. That’s why it’s crucial to understand tax-efficient investing strategies. What does this entail? Let’s explore the details.

Tax-efficient investing is all about minimizing taxes and increasing after-tax returns. It involves strategizing to reduce taxes and increase post-tax returns by deciding on the right place, time, and way to invest.

This strategy becomes even more important as you climb up the income ladder because higher earners tend to fall into higher tax brackets. This means they have potentially more at stake if they’re not careful with their investments.

The Importance of Considering Tax Implications in Investments

Taxes vary between investments, making it essential to consider the tax implications of each option before selecting your strategy. Different types of investments carry different kinds of tax implications which can impact your overall financial health over time.

Some assets attract capital gain taxes while others might incur ordinary income rates – or sometimes both. Understanding these differences helps make sure that Uncle Sam isn’t taking an unnecessarily large cut from your hard-earned money.

Different Types Of Taxes On Investments:

- Capital Gains: Profits made from selling stocks or other assets held for over a year usually face long-term capital gains rates ranging between 0% and 20%, depending on one’s taxable income bracket.

- Ordinary Income: Shorter term trades (less than a year) typically pay ordinary income rates which could go up to 37%.

- Mutual Fund Distributions: Income from mutual funds can be subject to both capital gains and ordinary income taxes, depending on the type of income received.

But that’s not all – other factors such as account types, contribution limits and more can also impact your taxes. You also have to consider your account types (taxable vs tax-advantaged), contribution limits, and other factors that could affect your overall tax burden.

Feeling overwhelmed? No need to fret; we are here to guide you through this maze.

Key Takeaway:

Grasping tax-efficient investing strategies can boost your after-tax returns. It’s about smart planning to minimize taxes and optimize where, when, and how you invest. Remember that different investments have unique tax implications – knowing these helps protect your earnings from unnecessary taxation. Finally, account types and contribution limits also matter in managing your overall tax burden.

Choosing the Right Account Types for Tax Efficiency

To enhance your tax efficiency, it’s crucial to select suitable account types. Let’s explore.

Taxable accounts and tax-advantaged accounts serve different purposes in a balanced investment strategy. Each has its unique benefits that can either reduce or defer your tax obligations.

A taxable account allows you to make contributions with post-tax dollars. Any interest, dividends, or capital gains realized are subject to taxes in the year they occur. Despite this, such an account offers flexibility as there aren’t any restrictions on withdrawals nor contribution limits like some retirement plans have.

Tax-efficient Investments for Your Accounts

You’ll find it beneficial if you place investments that are more tax-efficient into these taxable accounts – think long-term holdings where capital gain is likely rather than ordinary income-producing assets.

In contrast, tax-deferred and tax-exempt accounts offer significant advantages when dealing with less efficient investments prone to generating substantial short-term returns taxed at higher rates compared to long-term ones.

Navigating Retirement Accounts for Tax Benefits

When it comes to retirement planning, Traditional IRAs (Individual Retirement Arrangements) and Roth IRAs offer distinct yet complementary features that contribute towards managing your overall financial picture effectively.

Roth IRA distributions grow tax-free while a Traditional IRA provides immediate deductions against income. This reduces current-year taxation however future withdrawals will be treated as ordinary income by the Internal Revenue Service (IRS).

In essence, this means that traditional IRA contributions include pre-tax and Roth IRA’s have a post-tax nature. Be mindful of these categories while planning your retirement investment strategy.

Making the Most Out of Contribution Limits

Both traditional IRA’s and Roth IRA’s have contribution limits. Both of these accounts have seen increases. The 401K limit has jumped to $23,000 for 2024 and the IRA limit is now at $7,000 for those under age 50.

Key Takeaway:

Boost your tax efficiency by picking the right account types. Use taxable accounts for flexibility and place long-term, capital gain focused investments in them. Opt for tax-deferred or tax-exempt accounts when dealing with short-term return assets taxed at higher rates. For retirement planning, consider both Traditional and Roth IRAs – they offer different but complementary benefits that help manage your financial health effectively. Also, keep an eye on contribution limits which have recently increased.

Maximizing Contributions to Retirement Accounts for Tax Benefits

Squeezing every last drop of tax benefit from your retirement accounts can be a game-changer in personal finance. But how do you go about it? Let’s discuss some approaches.

Understanding the Tax Advantages of Traditional and Roth IRAs

The IRS isn’t as frightening once you become acquainted with them. In fact, they offer some fantastic tax advantages with retirement plans like Traditional and Roth IRAs.

A traditional IRA gives an upfront income tax break. The money invested is pre-tax, reducing your taxable income now but taxes are paid upon withdrawal later on. It’s like ordering dessert before dinner.

In contrast, a Roth IRA takes after-tax contributions now so withdrawals during retirement are generally free from federal income taxes. It’s more akin to eating your vegetables first so you can enjoy dessert guilt-free later. Both types come with annual contribution limits which keep things fair and balanced – think of this as portion control for our food analogy.

According to IRS guidelines, the limit for total contributions to all traditional and Roth IRAs combined is $6,000 ($7,000 if age 50 or older) in 2023.

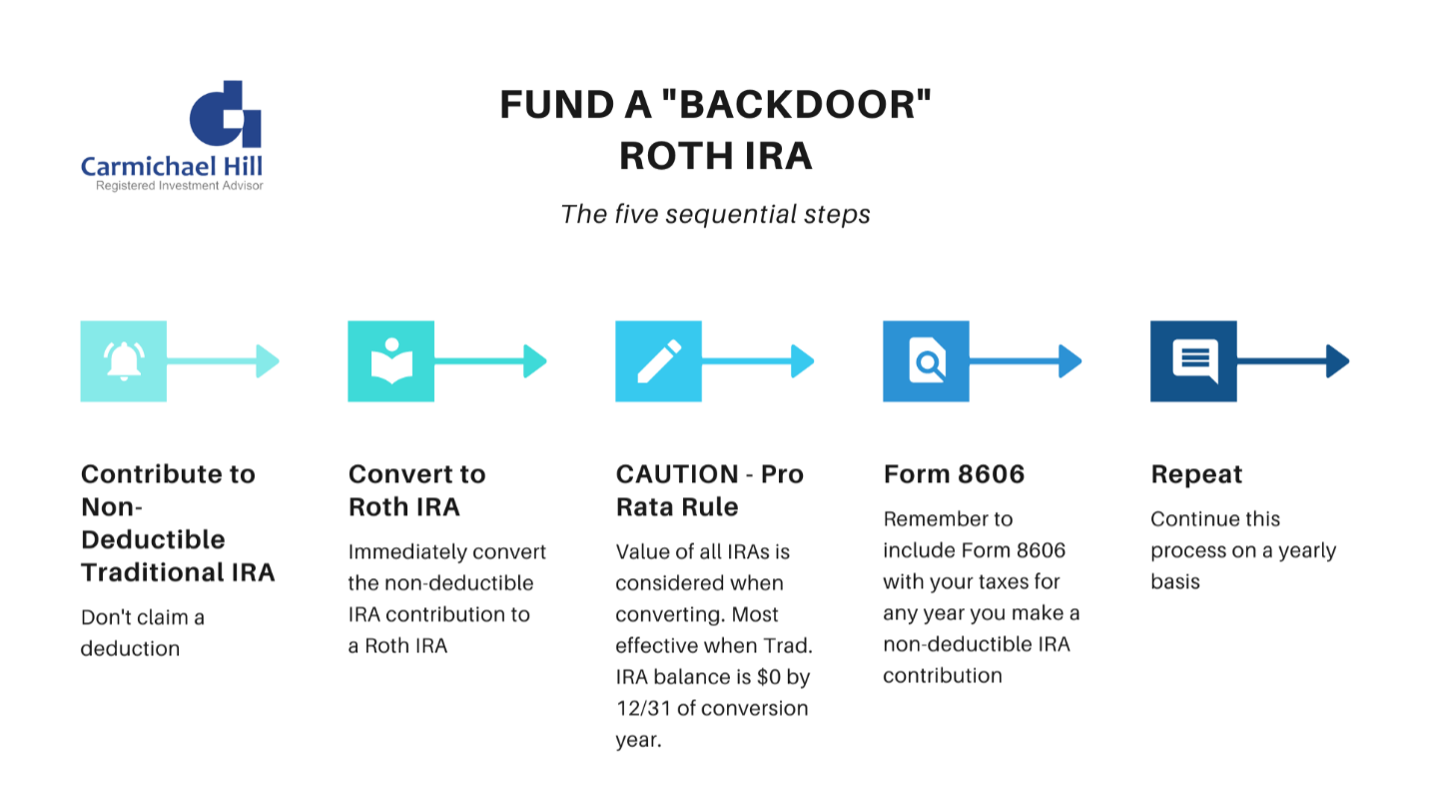

Beyond Contribution Limits: Uncovering More Opportunities

So we’ve discussed the basics; max out those annual contribution limits whenever possible because it reduces today’s taxable income or secures future tax-free earnings – just remember whether you’re opting for ‘dessert-first’ (Traditional) or ‘veggies-first’ (Roth).

Are you curious as to what comes after maxing out contribution limits? Maximize your employer’s 401(k) matching funds by contributing enough to qualify. This is an extra perk that is too good to pass up.

Lastly, don’t forget to think about tax-smart investing strategies for these accounts. It’s a good idea to pick investments that create long-term capital gains or qualified dividends in taxable accounts and keep them.

Key Takeaway:

Max out your retirement contributions: Boost your personal finance game by maxing out tax-advantaged accounts like Traditional and Roth IRAs. Understand the ‘dessert-first’ (Traditional) vs ‘veggies-first’ (Roth) approach to grasp their different tax implications.

Unlock employer matches & smart investing: Don’t leave free money on the table – contribute enough to snag any 401(k) matching funds from your employer. Also, use savvy strategies for long-term capital gains or qualified dividends in taxable accounts.

Implementing Asset Allocation for Tax Efficiency

The art of tax-efficient investing involves more than just picking the right investments. It’s also about choosing where to hold those investments. This strategy is known as asset location.

A common misconception is that all types of income are taxed equally, but that’s not always the case. Long-term capital gains can be a real game-changer in your investment strategy due to their favorable tax rates compared to ordinary income.

You’ll want to put assets expected to generate long-term capital gains into taxable accounts whenever possible. The reason? These gains are typically taxed at lower rates than other forms of income, especially if you’re in a high tax bracket (Topic No 409 Capital Gains and Losses). That’s why smart investors often favor buy-and-hold strategies with these accounts.

Putting it All Together: A Strategy Example

To illustrate how this might work, let’s consider two hypothetical assets held across different account types- ABC Corp stock versus XYZ Mutual Fund shares:

- Your traditional IRA holds ABC Corp stock because its dividends get reinvested and grow without immediate taxation until withdrawal (at which point they’re treated as ordinary income).

- In contrast, you place XYZ Mutual Fund shares into your brokerage account since any long-term capital gain distributions may qualify for lower taxes outside retirement plans.

Taking Advantage of Tax-Advantaged Accounts

Mindfully managing contributions between various retirement plan options like Traditional or Roth IRAs can yield significant tax benefits by reducing your overall taxable income now or securing tax-free withdrawals later on during retirement.

For instance, maximizing your contributions to a traditional IRA can lower your taxable income today. But remember, you’ll have to pay taxes when you withdraw the money during retirement.

Key Takeaway:

Master the art of tax-efficient investing not just by choosing the right investments, but also determining the best ways to hold them. Use asset location strategy and take advantage of long-term capital gains’ favorable tax rates in taxable accounts. Manage your retirement plan contributions mindfully for significant tax benefits.

Utilizing Tax-Loss Harvesting to Offset Gains

If you’ve ever felt the burden of capital gains taxes, tax-loss harvesting may provide some relief. This strategy lets investors sell securities that have experienced a loss to offset capital gains from winning investments.

Sometimes, our investments don’t pan out as we’d hoped. Sometimes our investments strike out and lose value. But rather than sulk over these underperformers, savvy investors use them as opportunities for tax efficiency.

Tax-loss harvesting, in essence, is like making lemonade out of investment lemons – selling losing positions can help minimize your overall taxable income.

The Mechanics of Tax-Loss Harvesting

To put it simply: you sell an investment at a loss and then buy a similar one right back again. The sold security’s loss offsets other capital gains in your portfolio which helps reduce your tax burden on those profits.

This method is particularly useful if you have short-term gains taxed at higher rates because losses are first used to offset short-term profits before they’re applied against long-term ones.

A Real-World Example

Say you bought shares in Company A for $10k but their worth dropped down to $7k since purchase time. You could sell these shares and realize a $3k loss. Here’s where the magic happens:

- Your portfolio also has stocks from Company B with unrealized gain amounting to $5k;

- You decide it’s high time for profit-taking so you cash-in by selling Company B stocks;

- In doing so, the $3k loss from Company A offsets your taxable income. So instead of paying taxes on a $5k gain, you only owe tax for $2k.

Not bad, right? It’s like using a coupon at checkout to get that much-needed discount.

Considering Municipal Bonds for Tax-Advantaged Income

Municipal bonds offer an enticing way to earn income while minimizing your tax burden.These investments are often exempt from local and federal income taxes, which makes them a top choice for tax-efficient investing.

The beauty of municipal bonds lies in their ability to provide regular, tax-exempt income. While corporate bonds can also give steady returns, they lack the potential for significant tax advantages.

To paint a clearer picture: let’s say you’re in the 24% federal tax bracket. If you invest $10,000 into a taxable corporate bond yielding 3%, your after-tax return would be only about $228 due to ordinary income taxes.

Tax Advantages of Municipal Bonds Over Corporate Bonds

Now imagine if instead you bought a municipal bond with the same yield – your take-home pay would still be around $300. Why? Because this investment wouldn’t trigger any local or federal income taxes. It’s like having an extra slice of cake without adding calories.

The Trade-off Between Risk and Reward

When investing, it is important to consider the associated risks that come with potential rewards. That said, despite offering lower yields than corporate bonds on paper (due mainly to their non-taxable status), muni-bonds tend more towards safety because they’re backed by government entities.

A Note About Local Income Taxes

An added perk here is exemption from state and local income taxes too – but only if the investor resides within that specific jurisdiction. If you live in Maryland, investing in a municipal bond issued by the state of Maryland can be an attractive tax-free option.

In conclusion, while they may not make headlines like stocks or real estate do, muni-bonds deserve more credit. Not only can they give steady income streams but also offer attractive tax benefits – particularly to those in higher federal tax brackets. Plus who wouldn’t want that extra slice of cake?

Key Takeaway:

Municipal bonds can be a sweet deal for tax-efficient investing, offering regular income exempt from local and federal taxes. Even if they offer lower yields than corporate bonds on paper, the significant tax benefits make your take-home pay higher. Just remember, in order to enjoy state and local income tax exemption, you need to invest in muni-bonds within your residence jurisdiction.

Seeking Tax Efficiency with Mutual Funds and ETFs

Mutual funds and ETFs can be integral components of a tax-savvy investment strategy. But it’s not just about choosing any fund, the way they’re managed matters too.

Actively managed funds often buy and sell stocks frequently, which may result in higher capital gains taxes. Conversely, stock index mutual funds and ETFs often feature lower turnover of securities, thus potentially resulting in reduced capital gains taxes.

The Potential for Lower Capital Gains Taxes

Mutual funds and ETFs may be more tax-efficient than other investments due to their structure, potentially allowing for lower capital gains taxes. This is because when you hold these types of assets over time, you mainly face long-term capital gains taxes – which generally have lower rates compared to short-term ones.

If your goal is minimizing taxable income through investment strategies, considering such factors might help keep Uncle Sam away from your returns.

Picking The Right Kind Of Fund For Your Needs

Not all mutual funds or ETFs are created equal. Some focus on sectors known for high dividends – great for regular income but possibly increasing your ordinary income tax liability.

In contrast, growth-focused options usually pay little-to-no dividends – potentially offering greater potential for price appreciation while deferring most taxes until you sell shares later down the line.

Navigating Through Actively Managed And Index Funds

Beyond this dividend consideration lies another choice: actively managed vs index-based offerings. Active management involves frequent buying/selling activities by managers to beat the market, which could increase capital gains taxes.

On the other hand, index-based funds like most ETFs mimic a specific benchmark (like S&P 500) and typically make fewer trades. This often results in lower turnover of securities within them – thus potentially reducing your tax burden.

By carefully selecting mutual funds and ETFs that match your financial objectives, you can maximize after-tax returns. It’s all about making smarter decisions for better after-tax returns.

Key Takeaway:

Opting for tax-efficient investments like mutual funds and ETFs can boost your after-tax returns. Choose carefully, as actively managed funds may increase capital gains taxes due to frequent trades. Instead, consider stock index funds or ETFs with lower security turnover for potentially lesser taxes. And remember, growth-focused options could defer most taxes until you sell shares later.

FAQs in Relation to Tax-Efficient Investing Tips

What is the best way to invest to reduce taxes?

Tax-efficient investing includes choosing the right accounts, maximizing retirement contributions, and using strategies like tax-loss harvesting. Consider municipal bonds for tax-free income.

What is a tax-efficient way of investing?

Tax-efficient investing involves allocating assets strategically across different account types. Using investments that offer long-term capital gains can also enhance your after-tax returns.

Which investment is best for tax saving?

Municipal bonds, mutual funds, and ETFs are good choices for their potential in offering significant tax advantages or exemptions on earned interest.

What is a tax-efficient investment strategy?

A sound strategy focuses on selecting investments with low turnover rates like index funds or ETFs. Also beneficial: contributing maximally to retirement accounts and implementing asset allocation effectively.

Conclusion

Tax-efficient investing tips are your armor against the silent killer of investment returns – taxes.

Tax implications matter, and choosing wisely can give you more bang for your buck. The right account types, be it tax-advantaged or taxable accounts, can make a big difference in minimizing your tax burden.

Don’t forget about maximizing contributions to retirement accounts like IRAs and 401(k)s either. It’s a golden ticket towards significant tax benefits!

All these nuggets of wisdom add up! Use them wisely as you navigate through the world of investments. Your future self will thank you!